In this Shares review, I’ll be looking at this social investing app and explaining 3 things it must improve on and how it might fit in with your investing strategy. Competition is tough in this world of investing apps and in this Shares review I want to see if this one has a chance.

Table of Contents

An unbiased Shares review

When I look at a (new) investing app I’m interested in a few things.

- Fees

- Stocks are available

- If there is an ISA offered

- Customer service

Shares is still a very young app and has some ground to make in general if it is to catch up with it’s competitors, but it already has a few extra features that’s aren’t all that common in the more establish apps.

Furthermore, it’s only available in a few countries at the moment, of which the UK is one.

At the time of this Shares review there was a global waiting list available to sign up for, so I guess further expansion is planned.

Read on to find more about my time with Shares and don’t miss the three things it must improve on to have a chance of stealing you away from your investing app of choice.

First Impressions of Shares

After using the Shares app, for a few hours I decided to offer up my experience in this Shares review. I have to say from the off, I think there are better options available, particularly for UK investors but also for our European friends.

And here is why…

Shares fees

Fees are part and parcel of a sustainable business. I have no particular issue with fees as long as they represent good value and are justified. In researching this Shares review I found there are very few fees at all.

No fees for bank transfer deposits, no debit card deposits, and no fees for withdrawals via bank transfer. There is a 2% charge for fast withdrawals by debit card (with a minimum of £0.55 charged).

So what is charged? Any transaction, buy or sell will be charged at £1 per trade. So if you buy a position in any share you will be charged £1 and you will be charged again when you sell. Since all of the stocks available on Shares are US based (more on this a little later) then you will also have to consider the cost of foreign exchange fees, charged at the interbank rate when you buy stocks in a currency that isn’t sterling. Not a fee charged by Shares necessarily but a cost to investing on this platform.

When investing large sums with Shares, £1 per trade mightn’t be too bad, but if you only want to invest with smaller sums, maybe £10-£100 at a time, factoring a £2 cost to buy and then sell might start to look a bit expensive. Buying and selling £10 worth of shares would be a 20% hit to trade. Eeek…

This is the first thing that Shares needs to address. Either offer something cheaper for smaller investors or offer some sort of trading free of charge. Trading 212 do it, InvestEngine do it and they offer more perks too.

How Shares.io charges fees may have changed since I wrote this Shares review, so you can check out all the latest information on Shares fees on their website here: https://shares.io/trading-fees/

What can I buy on Shares?

Shares currently offer US stocks only. It’s a little limited in my opinion.

Sure, there is Tesla and Amazon and Microsoft and all the household names, but many UK and European investors will want to invest a little closer to home in stocks listed on UK indices.

Further, I’m a champion of diversified, long term investing and I was disappointed to see there are no ETF (Exchange Traded Funds) available to buy on Shares.

This is the second area I think Shares.io really needs to improve. Offering only US based stocks means UK investors have fewer options compared to the likes of Trading 212. European investors might find Lightyear to be a better option with a much greater offering of stocks to buy.

By the way, I have a full review of what Lightyear offers over here.

The third thing Shares need to improve on is a little later in this Shares review, but let’s have a look at what is good about Shares and what sets it apart next.

A review of customer service on Shares

Sign up was easy. The app is very smooth, and the onboarding process was painless. Some regulatory questions along with the usual name, address etc and I was using the app within about 5 minutes.

Customer services are available from within the app and I found them to be pretty responsive. There is a common questions and a FAQ section to get you moving on the common issues, but if this doesn’t resolve the issue you have then you have have a Shares representative answer your query via a messaging system.

Smooth enough and I was answered pretty promptly.

What makes Shares different?

Some time back I was asked to consider becoming an ambassador for Shares.io and part of the pitch was this statement

We’re a social media business doing finance, not the other way round

Shares.IO pitch

Social investing isn’t anything new particularly. eToro are one such company that pushes this idea, but it’s clear that to Shares.io are placing the idea of collaboration front and centre of their app.

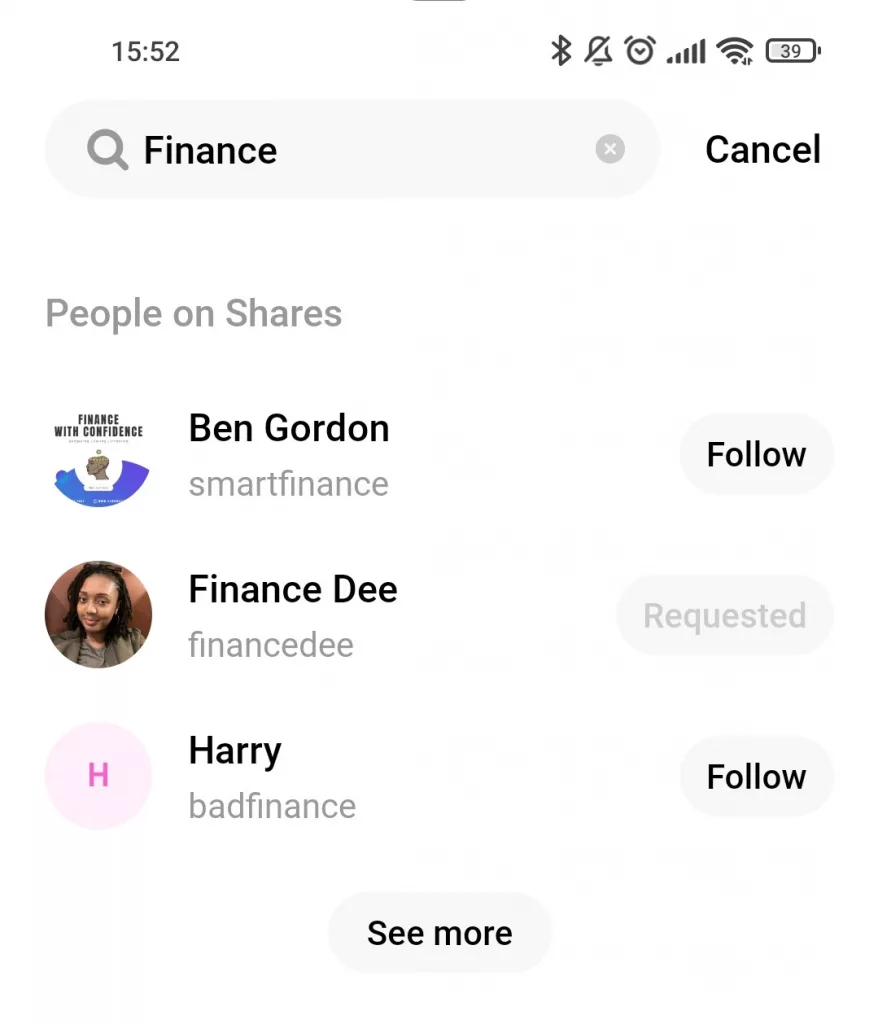

It’s cool, in the sense that if you have like-minded friends on the app, you have a place to chat about stocks and shares. You can have the app search for your contacts and add them, or you can follow other people you already know to be on the app.

I found that you had to know who you were looking for first. There wasn’t a list of popular investors like there would be a eToro for example. I couldn’t see a list of investors and their profiles and from there decide who to follow on Shares.

It made it a little cumbersome and difficult to get moving with this feature.

Shares Ambassadors

In the end I dropped in on their website and found a couple of their ambassadors to follow – that way I could search by name.

When you find someone you want to follow and hit that follow button, you have to wait to be approved. Why? Not sure yet. Privacy is important but when you push the idea of social trading why not immediately allow others to see what you are doing? Even two days I still hadn’t had my requests to follow accepted.

Feeling a bit… underwhelmed with Shares

It all seems a bit incomplete at this stage, if I’m honest.

Perhaps that’s understandable for a relatively new app. Get the main features out the door and build as you go. Onboarding new customers will be a gradual process as more and more features arrive.

However, I think they are missing one crucial element of attracting new UK customers. There is no ISA offering.

There is no ISA offering from Shares.io

It isn’t the end of the world there is no ISA. General investing platforms are fine. You might not even want an ISA from Shares. Maybe like me you have your ISA with a different provider and you just want to dip your toes trying out something else.

Perhaps you have already maxed your ISA allowance for this year and you have arrived at this Shares review, just looking to find out about some options for when you have maxed your allowance.

In any case, without an ISA offering, Shares are definitely putting themselves at an immediate disadvantage here in the UK. Considering a platform like Lightyear, you could say they don’t have an ISA offering either, but at least they offer things like a decent interest rate on uninvested cash and money market funds. Here on Shares, there isn’t anything like that… not yet, at least.

Summary of Shares.io review

When you roll all these factors together, I just can’t see enough in Shares.io to get me excited about investing with this app. I just feel there are better apps available to get your attention that offer more for less.

However, if you do want to try it out you can get yourself £5 free when you sign up and deposit £1 using this link. For disclosure, I might get a reward when you sign up for referring you, but it’s a great way to support the site at no cost to you.

Interested in seeing how I invest? Have a read at how I use InvestEngine for long term (cheap) investing.