In this post I perform an InvestEngine ISA review, nearly one year on from opening. ISA time is quickly coming around an it’s time to start thinking about this incoming year.

Of course, nothing in this article constitutes investing advice. These are my experiences. Investments can go up or down and you may get back than you put in. Please consult a professional before you take on any investment. And there’s more – this is not a sponsored post or anything like that. These views are my own! I’m just putting this content together to help out anyone researching an InvestEngine ISA or looking for an InvestEngine ISA review.

Table of Contents

2022 was rough… and it still is now in 2023

2022 was a tough year and 2023 so far has been a tough year for pretty much everyone. Inflation up, interest rates up, three prime ministers here in the UK and all sorts of mayhem around the world. You would be forgiven for thinking that it’s a terrible time to be an investor in anything.

Still… this channel talks about investing consistently for the long term, through thick and thin, whatever the weather, so I continued to try to make some extra money and continued to invest in what I believed to be right – long term index tracking ETFs… and, for 2022/23, with a DIY InvestEngine ISA.

InvestEngine ISA in review

So, in this post I’m going to take a look back at my InvestEngine ISA investment for the past year. Of course, I’ll be looking at returns on my money and how my choices have performed but also, my experiences of the platform itself. I’ll talk a little bit about what has changed over at InvestEngine since I decided to have my stocks and shares ISA with them and have a think about whether InvestEngine is still the platform for me.

Let’s go!

So for a little context, InvestEngine… a relatively new platform to the investing scene caught my eye back in 2021 with their no nonsense, sensible take on long term investing. Around the time they were brought to my attention I had already decided that I was going to move most of my investing to simple index tracking ETFs – nice baskets of stocks that would give me diversified investing in a convenient package, rather that trying to pick and choose individual holdings.

This time last year my ISA was with Trading 212 (another excellent low cost investing platform) but it had closed it’s doors to new customers. There was a lot of hype and question marks over what was happening at Trading 212 towers so I was ready to move away from their ISA product to try something new.

Ultimately, that was InvestEngine – I’ll get into my ISA in just a minute, but here’s how I came to that conclusion.

InvestEngine ticking all the right boxes for me

Part of this channel’s goal is to talk about investing platforms and investing and while Trading 212 weren’t taking on new customers, there didn’t seem to be much point in chatting about that when folks new to the scene couldn’t try it out.

FreeTrade was pretty close to what Trading 212 were offering but costs on FreeTrade were creeping up. Some investments were being placed behind paywalls and honestly, I don’t like it very much. There were cheaper and better options out there for my ETF based approach.

Hargreaves Lansdowne is a big name, lots of flexibility and has proper regulation and all that stuff, like you would expect. There seemed be more charges that I wanted to pay however. It varies of course, depending on what you are looking for but I quickly decided on this occasion it wasn’t for me. They do however have a nice little guide to investing that is free to download.

Interactive Investors – again, fees I didn’t want to pay!

Etoro – no ISA, but was never on the radar anyway…

Stake – no ISA.

Anyway, things moved on and after doing a straight up comparison of InvestEngine and Vanguard – the grand-daddy of all investing platforms, I made the jump to InvestEngine. Check out the comparison video out after this one if you want to see InvestEngine go head to head with Vanguard.

Especially if you are a footie fan. It’s a bit of a weird metaphor, but, ack… go watch it!

Right, let’s jump into my InvestEngine ISA and have a look around what it’s there.

InvestEngine ISA review in numbers

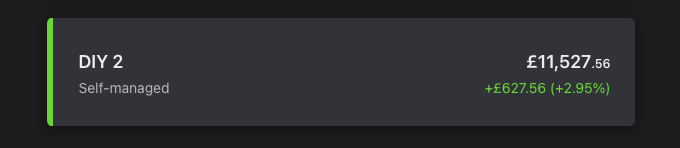

Here’s a summary:

£627. It’s not amazing, but then it’s been a pretty grim 12-16 month across the board. Sure there have been some individual stocks and shares that have done very well, but in general terms it’s been a bit rubbish for all things financial growth.

That’s the way of it. I’m not surprised to see it. I’m just glad I was able to keep contributing over the last year so when that inevitable upswing comes again (in my opinion anyway) I’ll be loaded up to take advantage.

Let’s dive into that DIY Portfolio

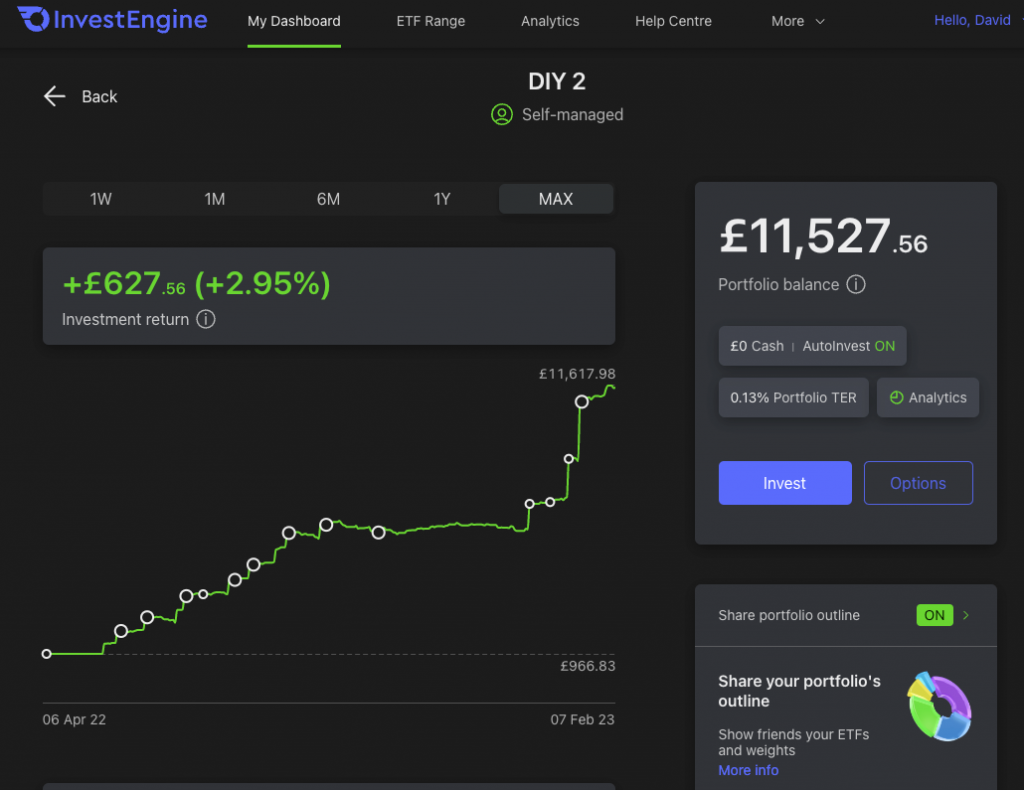

All the little white circles you can see are points at which I invested. There was a period between September and December when I didn’t invest very much at all. Only the auto-investment of my income from existing holdings was put into the ISA. At this point, interest rates had really started to climb higher and I opted to pay down some debt on the mortgage instead.

You can see I made up for it recently though, with some chunky deposits, taking me up to a balance of around £11.5k.

InvestEngine ISA Review – What’s in the bag?

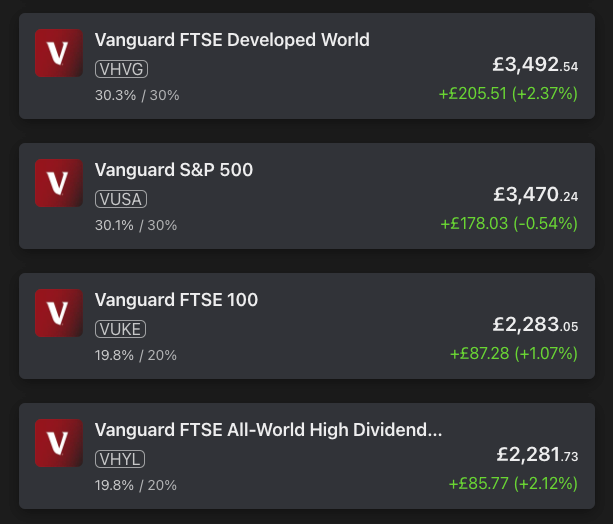

My InvestEngine ISA is made up of just four ETFs.

- Vanguard FTSE Developed World (VHVG)

- Vanguard S&P 500 (VUSA)

- Vanguard FTSE 100 (VUKE)

- Vanguard FTSE All-World High Dividend Yield

Each one is in the positive at least!

I chose these ETFs back in April 2022 because I felt they gave me a nice broad level of diversification. With what was going on in eastern Europe and Asia at the time, I didn’t want to go for much in the way of emerging markets. I realise that this combination is pretty heavily weighted towards the USA but I’m happy with that over the long term.

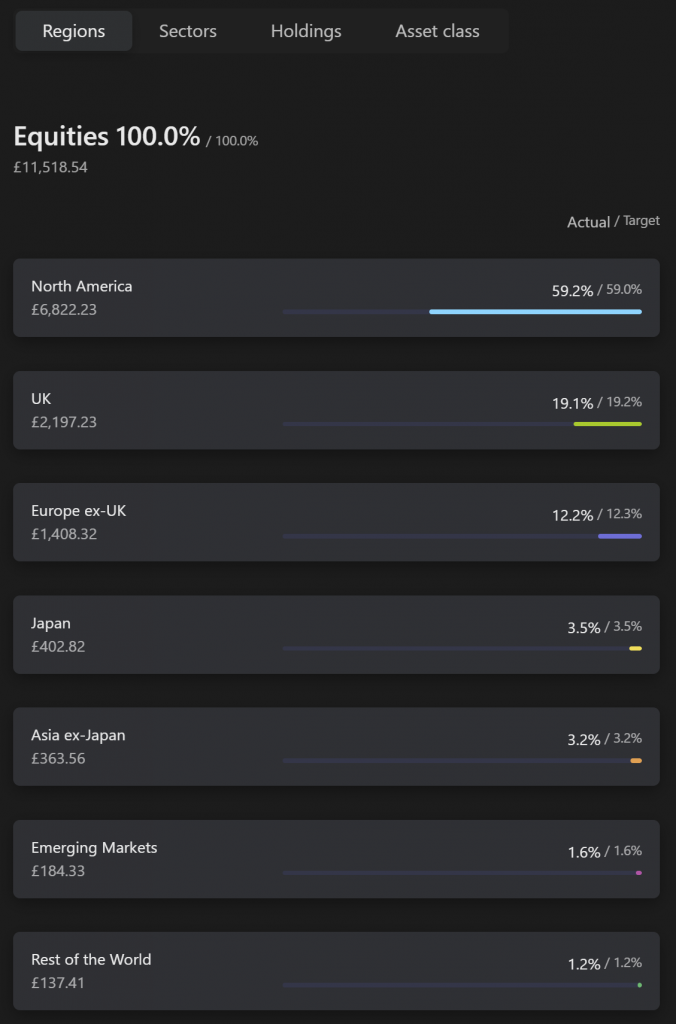

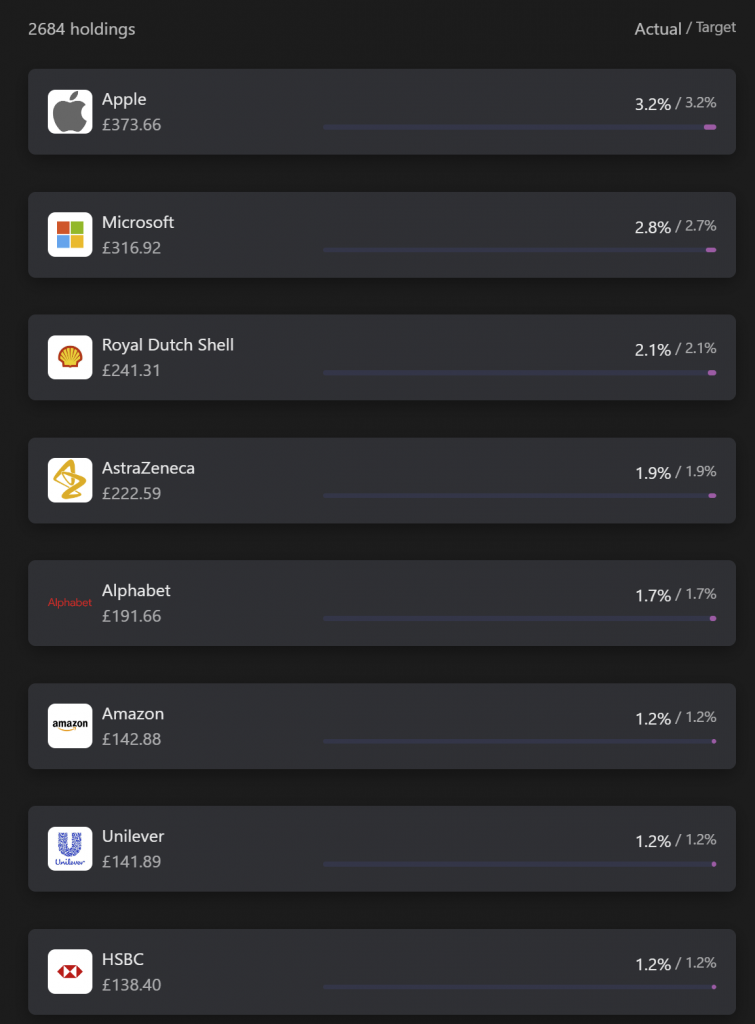

A nice feature of InvestEngine is that it can look at all your holdings, smash them all together and give you summary data on everything you hold.

The same can be said for Sectors, Holdings, and Asset class.

Holdings is perhaps the most interesting because it looks into all you ETFs and pulls out what percentage of what stocks you have.

Will this InvestEngine ISA Review bring and changes?

Maybe.

There are a few other ETFs I’ve been looking at on this platform. One or two of those might get a look in for the next tax year when the ISA allowance kicks in again with another £20,000 tax free investing opportunity.

For now, I’m going to stick with these.

For a more in depth look at how I came up with these, take a look at this video

What’s next for InvestEngine?

Still a free platform

I had the opportunity to speak to the InvestEngine team and I’m assured that DIY portfolios will continue to be entirely free of platform fees for this next tax year of 2023/24 . That makes it the cheapest platform anywhere to invest in ETFs.

It weirdly creates the scenario where it is cheaper to invest in Vanguard products on InvestEngine than it is to use Vanguard’s own platform.

Of course, InvestEngine is properly regulated and takes part in the FSCS scheme just like any ISA provider should!

If you are interested in trying InvestEngine, please consider using my link. For new accounts you can get a £25 bonus when you invest at least £100 for 12 months. This offer is not available through the general website.

http://investengine.pxf.io/PrettyPennyISA

InvestEngine UK Limited is authorised and regulated by the Financial Conduct Authority FRN: 801128. InvestEngine Accounts are FSCS protected up to £85,000. Capital at risk.

InvestEngine have a rebrand

They have a fresh new look and feel on both their website and their app. A nice new logo and so forth. It doesn’t really change much from the point of view of investing but I think it’s a bright change that hopefully will encourage more people to get investing.

A successful crowd-fund

Back in June InvestEngine successfully crowdfunded £1.5M from around 1200 investors on Crowdcube, more than doubling the target of £700,000. I think this goes to show there is a lot of good feeling and interest in what InvestEngine are doing and I hope that bodes well for the future.

Anything else?

Perhaps if you are more interested in picking stocks and shares rather than investing in ETFs, then the very flexible Trading 212 might be more your speed.

Pingback: Best ETFs on InvestEngine for 2023 - Pretty Penny

Pingback: 3 Essential Money Tips for 2023 - Pretty Penny

Pingback: Lightyear vs Trading 212 - easy comparison - Pretty Penny