A week ago, I had never heard of money market funds. It’s true! This money blogger needed a beginner’s guide to money market funds! So I wrote one.

In this article I’m cutting through the fluff to offer this beginner’s guide to money market funds through the eyes of a beginner. I’ll talk about what a money market fund is, why you might like to invest some money here, where you can do that, and some of the pros and cons of getting involved with money market funds.

Plus! I’m going to do this in a jargon-free way, so you can decide easily if money market funds are a good investment option for you.

Of course, nothing in this article is investing advice. It’s for information and entertainment only. Please consult a professional if you need real advice!

Table of Contents

A beginner’s guide to money market funds by a beginner

The first thing I do these days, is ask ChatGPT a question. What is a money market fund?

A money market fund is a type of mutual fund that invests in short-term, low-risk, and highly liquid securities. These funds are designed to provide investors with a safe place to park their cash and earn a modest return while preserving capital and maintaining liquidity. Money market funds are often considered a suitable option for investors seeking a stable and conservative investment vehicle.

ChatGPT

More questions than answers in there, maybe!

So let’s break this down.

A money market fund is a type of mutual fund that invests in short-term, low-risk, and highly liquid securities

What is a mutual fund?

A mutual fund is a kind of investment offered by a management company, that pools the money from multiple investors into one big pot. This big pot is then invested in a range of things like stocks, bonds, money markets or other assets like these.

There are quite a number of advantages that a mutual fund can offer.

Diversity is one – not keeping all your eggs in one basket.

Another is through pooling all the resources. Access to some instruments, (things to invest in) can be quite expensive on an individual basis so by pooling all the resources, potentially, more options open up to the managers of the mutual fund. Economies of scale come into play.

It’s also true that mutual funds are usually highly liquid, which means individuals can usually buy and sell their positions very quickly.

So a money market fund is one that invests in products that are low risk and low return and invest in things called “cash equivalents”. Investments are not made into cash, but things that are very close to it – a variety of short-term, highly liquid, and low-risk financial instruments.

What exactly is in a money market fund?

As with most funds, what’s in it depends on the goal of the fund.

However, from a ‘beginner’s guide to money market funds’ point of view, let’s look at a couple of examples.

One instrument might be Treasury Bills – considered one of the most cash-like instruments due to their high credit quality and very short maturities. Issued by governments and backed by government they are considered a very safe choice.

Another might be Repurchase Agreements – these are short-term agreements where one party sells securities to another with a promise to repurchase them at a slightly higher price on a specified future date.

While money market funds invest in instruments that are similar to cash in terms of liquidity and stability, it’s important to note that there is always some level of risk involved.

While these investments are extremely low risk, they are subject to fluctuations in interest rates, credit risk, and market conditions.

Why would you choose to invest in a money market fund?

The appeal of money market funds are three fold:

- Liquid – you can turn your investment into cash again very quickly

- It’s short term – so you are never locked into a particular rate of return for very long

- It’s very safe (but not infallible) due to the high credit rating of the investments. This means the folks who have borrowed are very unlikely to fail to pay that money back to the lender.

With all these things in mind, you might choose to use a money market fund if you are parking cash for whatever reason, and want to try to get a better return than an easy access bank account.

Another reason to consider money market funds is if you are seeking to diversify a portfolio of investments. Money market funds aim to provide capital preservation – to keep your initial investment safe – while offering relatively low gains.

Finally another good reason to consider investing in money market funds is if you are looking for an interim investment while you consider your next move. The liquid nature means you can quickly pivot out of money market funds for something else, relatively easily.

You could reasonably expect that you would at least get back your capital when exiting your money market fund position. So for every pound or dollar you put into that money market fund, you should be able to withdraw at least that again.

This sounds a lot like a saving account, no?

It does a bit! While you aren’t exactly taking a position in cash like you would with a bank, you are buying cash-like instruments. From that point of view you have to decide if you would be better off just having an easy access account with your bank.

That’s fine. The issue is that the returns on easy access bank accounts are likely to be lower than the returns that a money market fund aims to make. You can usually expect smaller returns with an easy access account than you would would expect with a money market fund.

If you are prepared to lock up your cash in a bond or a fixed term deposit account with a bank you may find a fixed rate of return for a fixed amount of money to be more beneficial in your circumstances. Banks also offer FSCS protection on your investment as standard.

So should a beginner invest into money market funds?

Really, there is no “better” option here when choosing between money market funds or traditional bank accounts, or even investing in other stocks and shares – the more advantageous option for you really depends on your circumstances and this beginner’s guide to money market funds is not about to tell you which you should go for!

A beginner’s guide to money market funds – an example

No beginner’s guide to money market funds would be complete without an example. So here goes! Lightyear are one of the platforms that I use that offer money market funds – they have partnered with Blackrock here to offer three money market funds.

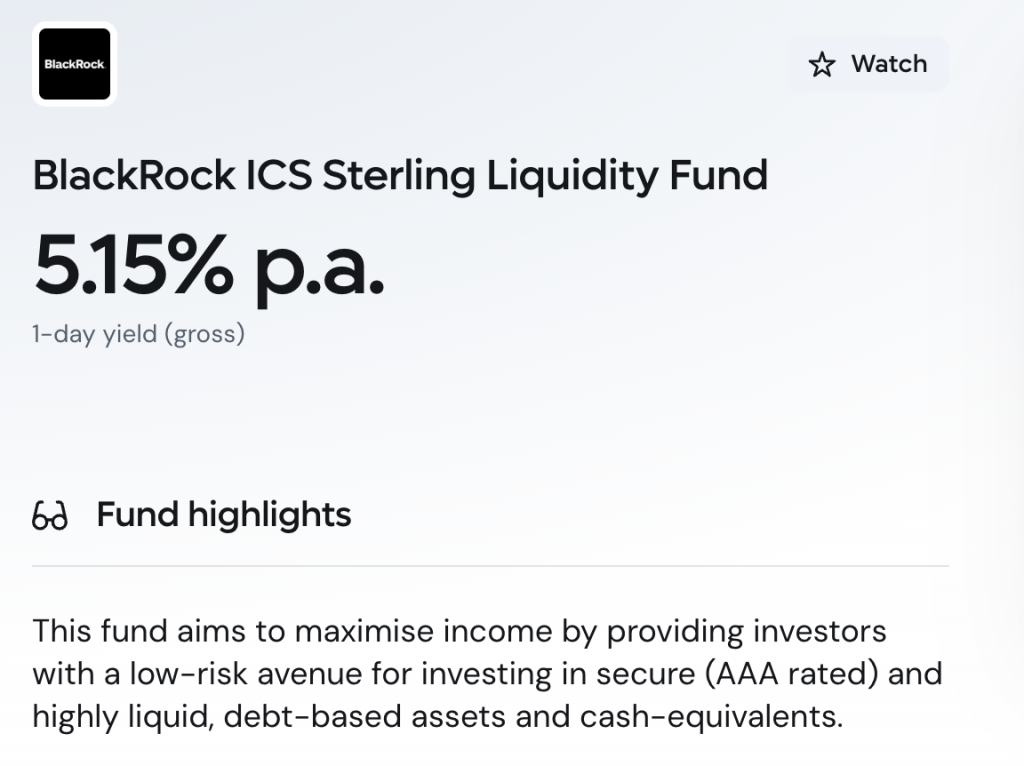

Let’s take a look at BlackRock ICS Sterling Liquidity Fund for our example.

Please note that the figures in this screenshot are accurate at the time of the creation of this blog post. Things may have changed since (and most likely have since these funds are heavily dependant on current interest rates and are very short in their duration) so please make sure you check the up to the minute info available on the Lightyear app or simply search for the fund to get all the information you need. Your capital is at risk when you invest.

The BlackRock ICS Sterling Liquidity Fund

Every investment has a purpose; a goal if you like. What is the point of this money market fund.

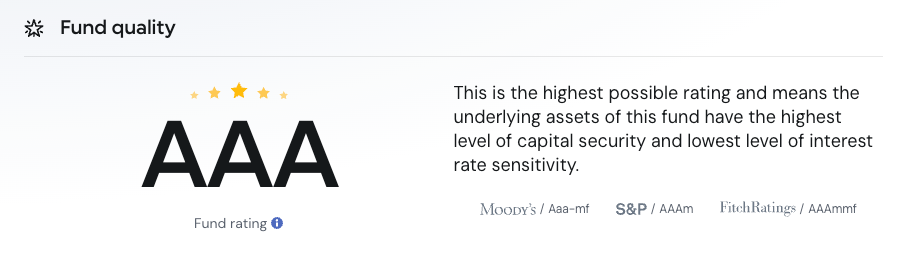

This fund aims to maximise income by providing investors with a low-risk avenue for investing in secure (AAA rated) and highly liquid, debt-based assets and cash-equivalents.

Triple A rated is the highest rating you can have for an investment in terms of how safe your capital is. According to Standard and Poor the definition is “Extremely strong capacity to meet its financial commitments”.

What returns can I expect as a beginner to money market funds with the BlackRock ICS Sterling Liquidity Fund?

The headline figure is 5.15% gross per annum. However, this is based on a one day yield and you will very likely see fluctuations in this return on a frequent basis. This rate will be particularly impacted by Bank of England interest rate changes.

(Capital at risk. Gross yield shown as of 18/08/2023, subject to daily fluctuation and fees)

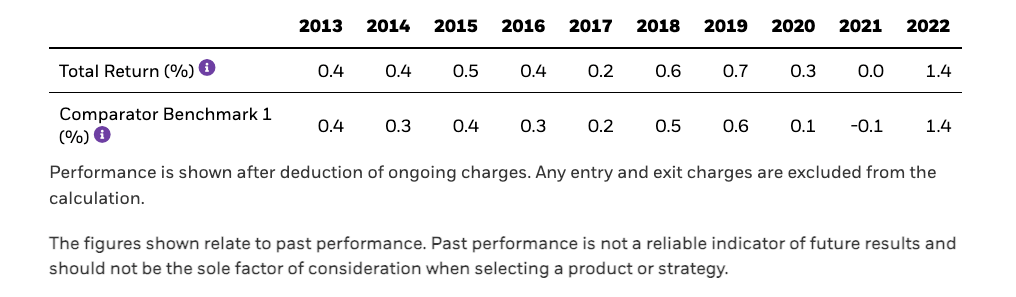

Consider the past decade – interest rates were at all time lows with the Bank of England and so the returns from this money market fund were very low also. As we see the rate rises over the last year or so, we see a rise in the returns of this money market fund.

Interest rate rises aren’t the only thing to contribute to changes in the returns of money market funds, but they are huge factor.

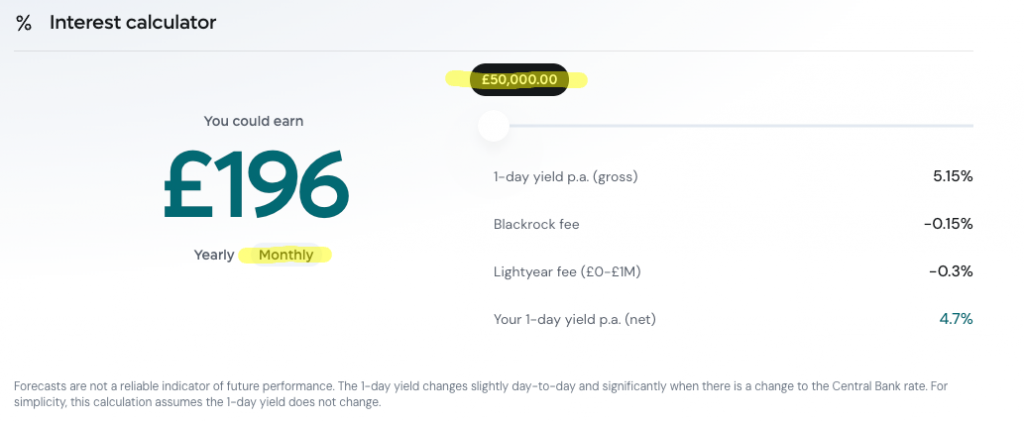

There are associated fees with investing in this fund and I will address those a little later, but having this figure of 5.15% allows us to make some projections about what this fund could return you, if it were to stay the same.

For example…

Investing in this Blackrock money market fund with Lightyear would look like this:

How will fees affect my investment?

Fees are always a factor, so take into account the provider fee, which is Blackrock in this case, and any platform fees (with Lightyear in this example) before you come up with any final figure. £196 is the monthly return on a £50k investment at 4.7%. If you invest in money market funds outside of an ISA then you may be subject to tax on your gains also.

In this screen capture from Interactive Investor, you can see that annual charges vary from 0.1% to 0.5%. The most expensive on this list is five times that of the cheapest! This aren’t necessarily the worst culprits either. Just be sure that you are getting value for whatever fees you pay.

It is worth noting that Lightyear currently pay 4.5% on uninvested cash. You can find out more about that here on their pricing page or in this article so investing in money market funds will bump that return slightly.

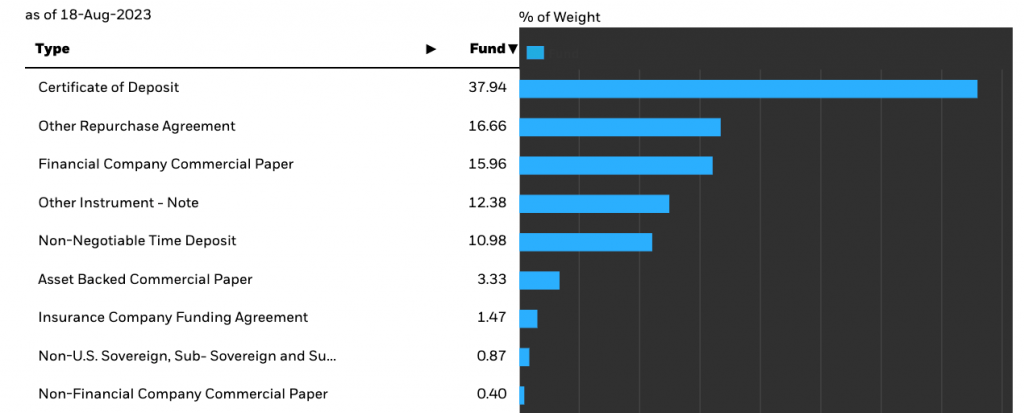

What does this fund invest in?

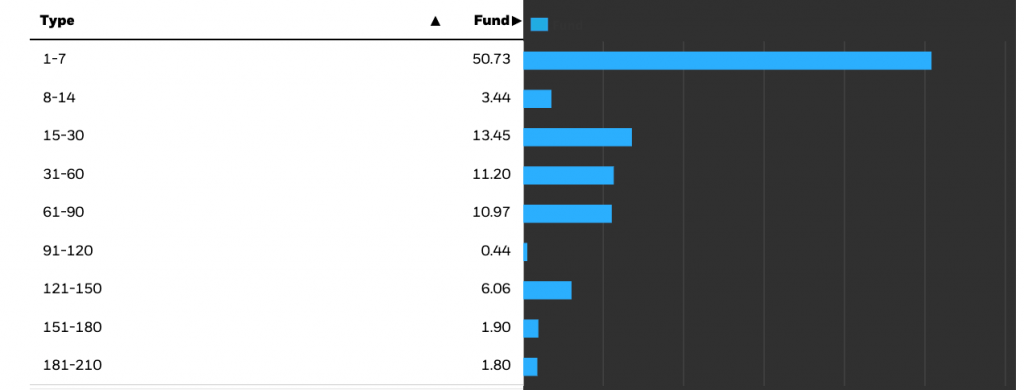

The majority of the make up of this fund is in Certificate of Deposits which is very low credit risk and very little interest risk because of the short duration. Indeed most of the holdings will mature in 1-7 days!

How quickly can you get your money back from a money market fund?

The fund currently stands at over £34 billion, trades once per business day and has daily liquidity. This means that if you need your money quickly, you can get it back to cash very quickly.

As I said, there will be moderate changes to the yield on a daily basis but your capital is considered very safe. Overall it’s a very straightforward product and you shouldn’t worry about the pace at which you can exit a position.

Remember, when you invest, your capital is at risk.

(Capital at risk. Gross yield shown as of 18/08/2023, subject to daily fluctuation and fees.)

Find out more about Lightyear in this article, next.