InvestEngine Savings Plans is the latest new feature InvestEngine has released onto it’s platform. In this article I’m going to explain what to expect if you are thinking about using an InvestEngine Savings Plan and the three things you must know if you want to make the most of InvestEngine’s latest offering

Table of Contents

InvestEngine are helping you be consistent

If you are a long term investor in stocks and shares, you likely have a plan to invest on a regular basis. You might be investing monthly, you might be investing weekly, perhaps it’s whenever and however you earn an extra few pounds/euros/dollars.

InvestEngine have brought Savings Plans to users of their DIY and managed offerings. This is going to help all my fellow InvestEngine investors to get completely onto autopilot and automate their investing.

Automated investing means you can take all the emotion out of your long term plan, it lets you be as hands-off as possible and you aren’t going to get caught up in silly nonsense like trying to time the market or guessing when you invest based on market movement.

1. InvestEngine Savings Plans are flexible for scheduling deposits

I think most people would be aware of automated monthly deposits for investing, whether that be with InvestEngine, other platforms or with their bank for example. You set up your direct debits or standing orders, however you do it and then on the first of the month you move some money automatically to your investing account.

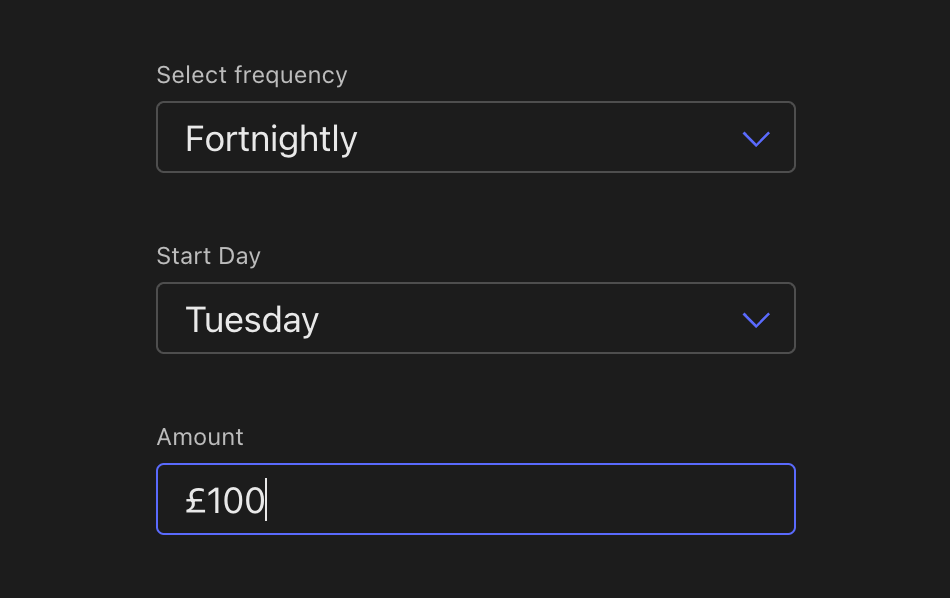

InvestEngine has gone one step further with their Savings Plans. When using an InvestEngine Savings Plan you get to choose when you want to make your regular deposit – either weekly, fortnightly or monthly. InvestEngine have tapped into the latest Open Banking technology called Variable Reccurring Payments (or VRPs). It’s completely up to you when you invest and how much. You can even choose which day of the week you want your regular payments to be made.

With this added flexibility offered by InvestEngine Savings Plans you can get another great benefit that aims to help long term investors.

Pound cost averaging

InvestEngine Savings Plans offer investors a convenient means to capitalise on the widely-recognised risk management technique known as pound cost averaging (also referred to as dollar cost averaging). This approach, first coined by an economist by the name of Benjamin Graham in 1949, involves spreading investments over time with the aim of offsetting any crazy market swings. The idea is that through spreading your investment over time consistently you are investing in the highs and the lows… essentially it’s the opposite of trying to time to the market!

By the way, he also wrote a book, that Warren Buffet calls “the best book about investing ever written” called The Intelligent Investor. I highly recommend you check it out.

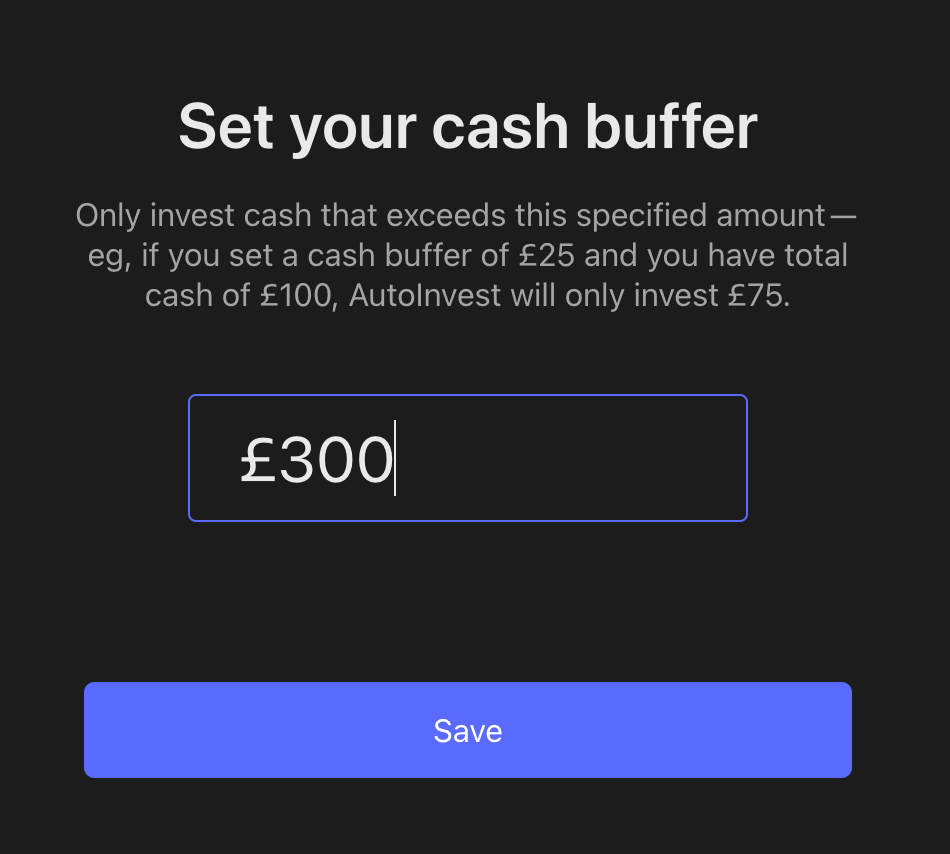

2. Cash buffers on InvestEngine Savings Plans

When using AutoInvest as part of your saving plan, you can also set a cash buffer. So for example, if you start with a cash balance of zero, you can set a cash buffer of £100 and if you deposit £200, then only £100 of that deposit will be invested.

Amount AutoInvested = Deposit + Starting Cash Balance – Cash Buffer.

It would be good if you could set this cash buffer as a percentage of your portfolio. For example 10% of the value of your portfolio. The reason being as your portfolio grows (hopefully) through consistent investing, that you may want to keep your cash buffer at a level consistent with the size of your portfolio.

It’s a small gripe at this stage but something that I think would really add to the feature.

3. Limitations of InvestEngine Savings Plans

InvestEngine Savings Plans have a couple of limitations to be aware of.

InvestEngine say that you can start from as little as £10 for your recurring payment, but in practice, it is worth noting that certain banks might not offer the option of Variable Recurring Payments (VRP) and instead establish a higher threshold of £50 for recurring payments.

Further when I tried setting up a Savings Plan on a portfolio with less that £100 already in it, I was prevented from doing so. It seems that a portfolio has to have a minimum of £100 already deposited before you can take advantage of this facility.

If you want to try InvestEngine, please consider using my link to sign up. You will get a £25 bonus when you invest at least £100 for twelve months on their platform. Just remember, any investments can go up or down and you could get back less than you put in – capital at risk!

Despite these tiny impediments, Savings Plans provide flexibility and accommodate various budget levels, allowing individuals to tailor their investment strategy according to their financial capabilities. By offering accessible entry points, I think InvestEngine Savings Plans aim to make investing more inclusive and achievable for a wider range of people.

After all, it’s through small and consistent contributions that we hope to be financially free.

Let me know what you think of InvestEngine Savings Plans in the comments!