An InvestEngine ISA for 2023 could be a great choice for you. In this article I offer 5 reasons why an InvestEngine ISA might well suit you and your investing style.

Before we go any further, nothing in this article should be considered financial advice! I am not a financial advisor, nor qualified to talk about it in any way. When you invest, your capital is at risk and you may end up getting back less that you put in.

Also, this is not a sponsored post! I just really love InvestEngine. It’s where I have my ISA.

For all the folks who are interested in long term, inexpensive investing, this one is for you.

Table of Contents

InvestEngine has got some slick new branding for 2023 so it’s about time to find out exactly what InvestEngine has to offer for your ISA in 2023. So here are the 5 reasons you choose InvestEngine for your ISA in 2023.

1. An InvestEngine ISA does investing right

An InvestEngine ISA means long term thinking

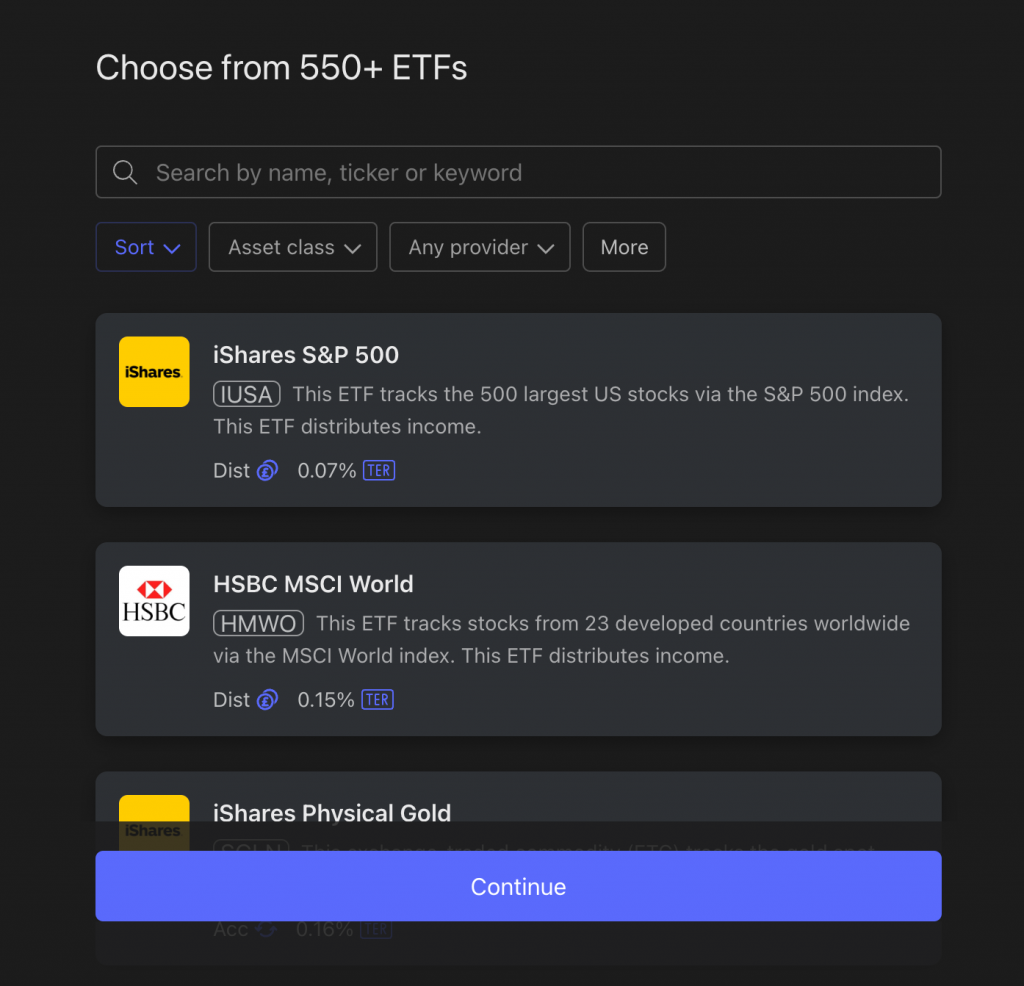

Let me explain. InvestEngine is all about long term diversified investing. The best kind of investing, in my view. They market their platform as the ETF investing platform and what they offer is a huge range of ETFs from all over the world in all manner of sectors to make sure every investment you make is diversified in some kind of way.

From the very popular S&P 500, to something a little different like a video gaming and eSports ETF, every investment available on their platform is a diversified basket of stocks.

An ETF is an Exchange Traded Fund – for now think of it as a collection of stocks all lumped together for some reason. It might be a particular index, like the top 100 companies in the UK, or they could be grouped by a sector like property or clean energy. An ETF is then bought and sold as a single entity. Investopedia has a nice article explaining this is more detail.

So rather than trying to pick individual stocks, which can be incredibly volatile, InvestEngine encourages broad investing through it’s options available to you in their InvestEngine ISA product.

Fractional Shares for your InvestEngine ISA

InvestEngine offers fractional shares. What this means is you don’t have to have enough money to buy a full share of something in order to invest. Let me demonstrate by example.

Imagine one unit of VUSA (Vanguard’s offering for the S&P 500) costs £100. It doesn’t, by the way, but it makes for a simple example!

One unit costs £100, but you only have £50. In this case, you can buy 0.5 shares of VUSA with InvestEngine.

This makes investing with an InvestEngine ISA very flexible as you can invest as little or as much as you want to in order to to maximize your funds.

Curiously, Vanguard do not offer fractional shares on their platform, so if you wanted to buy Vanguard products on Vanguard’s platform you have to buy in full units. That means, in this example, you couldn’t invest in VUSA unless you had at least £100. It’s restrictive, but InvestEngine have taken away the problem by allowing fractional investing.

Proper regulation here in the UK

InvestEngine regulated by the FCA here in the UK. What this mean is that InvestEngine is required to comply with the FCA’s rules and regulations, which in turn are designed to protect consumers and promote fair and transparent financial practices.

Accounts with InvestEngine are covered by the Financial Services Compensation Scheme (FSCS). The FSCS is a UK government-backed compensation scheme that provides protection for consumers of financial services in the event that a financial services firm becomes insolvent or is unable to meet its obligations.

It’s important to note that the FSCS is a compensation scheme and is not a guarantee of the performance or security of any investment. It’s always a good idea to do your own research and carefully consider the investment options and services offered by any financial services company before making any investment decisions. It’s also a good idea to seek professional financial advice if you have any questions or are unsure about any aspect of your investments.

Investments can go up or down and you could get back less than you put in – don’t forget that!

2. An InvestEngine ISA lets you keep more money and pay less tax

Investing within an InvestEngine ISA allows you to invest up to £20,000 for 2023/24 and while it remains invested, any profits remain free from tax here in the UK. So whether that’s from dividends or just plain old growth through your investments going up in value, you won’t have to pay a penny in tax.

When you consider consistent investments with InvestEngine in sensible ETFs and how these investments could compound over time, then these tax free benefits are really quite significant.

If you invest outside an ISA then every penny you make from your investing could be liable for tax depending on how much you make and under what category that profit comes under. Simplify the whole investing game by maximising your ISA allowance.

3. An ISA with InvestEngine is incredibly cheap

InvestEngine platform offers two broad ways to invest. A Do-It-Yourself option called DIY Portfolios and a Managed Portfolio option.

DIY Portfolio for InvestEngine ISA

With a DIY InvestEngine ISA, you will incur absolutely zero fees with InvestEngine.

- no deposit fees

- no transaction fees

- no monthly fee for an ISA

More money in your pocket for investing and less of your hard earned money handed over to needless fees.

This is in contrast to some other providers like FreeTrade or Vanguard where there is an associated cost of using their platform – there is nothing to pay for DIY portfolios on InvestEngine.

Simply deposit your money without paying any fees, choose your ETFs and away you go. Simple investing in an InvestEngine ISA.

It is right to point out, that investing in any ETF comes with a cost. You might not even realise it, but the cost of your ETF’s charges are wrapped up in the share price. No matter what platform you use it is kind of a ‘hidden’ charge – at least it’s not immediately obvious. Think of it as the cost for someone packaging this nicely diversified basket and looking after it for you.

It’s also worth pointing out that InvestEngine tries to educate it’s users in this regard showing how these charges will affect your investing and teaching you about it in their educational material (more on this, a bit later)

Managed Portfolio

InvestEngine also offer a managed option for their ISA. This means InvestEngine will take control of your portfolio, offering some ready-made portfolios that they will suggest for you after you have answered a few questions on your investing goals, what risk you can tolerate etc.

If you do want InvestEngine to manage a portfolio for you the fee is a flat 0.25% of the money invested. This is incredibly competitive, and like the the DIY portfolio, you will benefit from paying zero fees for anything else. 0.25% is all you will pay for a managed portfolio from InvestEngine.

You can focus on Income or Growth, depending on your goals. Again, the questions InvestEngine ask will help shape what it is you are looking for.

4. InvestEngine offer lots of education material

InvestEngine are keen to educate their customers on what’s going on with the platform and investing in general. They have a nice blog which is updated with commentary on what’s going on in the world of finance and they have material on their main website on how to move around the platform and get the best out of the information on offer.

However, if they have a category of “Education” on their blog and clicking on that (at the time of writing, at least) you get nothing but crickets! It’s empty.

It’s a bit of a shame, though not a big deal. They have so much information in other places… it just seems a bit of an own goal that the very section entitled education is so devoid of content.

Also, InvestEngine are very upfront about what their products cost. Of course the only thing to pay InvestEngine is the 0.25% if you go the managed route, but InvestEngine also make the costs of each ETF plain as you move to invest.

5. InvestEngine offer excellent customer experience

InvestEngine offer a full desktop app along with a mobile app. The fresh new branding is in place and it looks good. The app does feel a little clunky compared to something light Lightyear, but it’s functional and it does the job.

To be honest, long term investing means you don’t have to be checking your portfolio every few minutes on your phone, so it’s not a huge problem for me.

Customer service is very responsive. The few times I had questions or needed an explanation for something, the customer service agent who responded was polite, knowledgable and succinct.

One criticism levelled at InvestEngine is that they are very young. A relatively new platform and trust has to be earned. However, with all the right regulation in place and my personal experience being very good over the last two years or so, I’m happy with everything InvestEngine has to offer new and existing customers.

Bonus Reasons!

InvestEngine has a very low barrier to entry. You can get started with just £100 and top up any amount after that. Commission-free investing whether you want to contribute regularly or just add more to your investments as and when it suits.

Pingback: Best ETFs on InvestEngine for 2023 - Pretty Penny

Pingback: Best stocks and shares ISA for 2023/24 - Pretty Penny