In this Lightyear vs Trading 212 comparison, I’ll take a look at two of the competing investing apps here in the UK. What can you invest in? Fees? Special features? Interest on your uninvested cash? It’s all in here, and it’s not as simple a choice as you might think.

Table of Contents

I am a user of both apps. Trading 212 since early 2020 and Lightyear since Spring of 2022, so I’m well placed to offer this article on Lightyear vs Trading 212. Please bear in mind, information in this article is correct at the time of writing and may have changed since. You can check out the most up to date info on both the Lightyear and Trading 212 websites. None of this is financial advice, and remember your investments can go up or down.

Finally, I have written plenty of content on both Lightyear and Trading 212 on this very blog. Make sure to check them out after you have finished here.

Let’s begin with Lightyear vs Trading 212.

Fees on Lightyear vs Trading 212

Fees are often the first thing investors will look for. The impact of fees cannot be underestimated, especially over the long term. Paying fees that are too high is going to seriously eat into your profits over the years.

Lightyear are very up front about their fees, as are Trading 212 in that respect. I will say that much! Everything is very transparent with them. As we all know there are lots of ways fees can occur, so let’s step through it and see how Lightyear vs Trading 212 looks when comparing fees between the two platforms.

Deposits and withdrawals

Getting money onto the platform will cost nothing with Lightyear nor Trading 212 when you use bank transfers. Unlimited bank transfers are possible, but using any debit or card facilities incur fees after certain thresholds are hit.

After the first £500 with Lightyear, you will be charged 0.5% for card-type deposits. With Trading 212 after the first £2000, you will be charged 0.7%. So it’s a higher threshold of convenience with Trading 212 but a higher fee once you go beyond that. For me, a little bit of planning with bank transfers is fine. This way you eliminate all manner of depositing fees.

Withdrawals are non-existent on both Trading 212 and Lightyear.

Foreign exchange fees

Foreign exchange (ForEx) fees are part and parcel of most platforms where you either want to buy foreign currency, or buy foreign shares directly. At Trading 212 you are going to pay 0.15% for transactions that aren’t in your local currency. So if, for example, you are buying some Amazon stock as a UK investor, it will cost you an extra 0.15% to do so and the same again when you sell.

With Lightyear, you will pay 0.35%. It’s a little bit more, but Lightyear offers something interesting here that Trading 212 doesn’t, and that is a multi-currency account.

It is possible to hold balances in sterling, euros and US dollars all at the same time. This means if you are a frequent trader of US stocks for example you can buy dollars once with this 0.35% charge and then move in and out of positions in the US market without incurring fees each time you transact.

For those folks who buy and sell frequently this may well work out to be less expensive than paying 0.15% each time with Trading 212. For buy and hold folks, who have little intention of selling, it could be it’s cheaper to take Trading 212’s offering. Everyone’s circumstances will be different so consider what fees are appropriate for your needs.

There are other charges to take into consideration when buying stocks with Lightyear and here they are…

Fees for buying stocks on Lightyear vs Trading 212

Lightyear will charge for buying stocks on the platform. For US stocks that’s 0.1% up to a maximum of $1.00. For UK stocks it’s a flat rate of £1 and for European stocks it’s a flat rate of 1 Euro.

It’s interesting there is no charge to buy ETFs on Lightyear.

So if you are someone like me, who prefers to invest in ETFs (baskets of stocks and shares in one convenient holding) then the charges for buying individual stocks and shares ain’t going to matter!

The fees for buying individual stocks on Lightyear aren’t horrific, but when Trading 212 charges no fees for buying and selling stocks you would wonder why you would bother with Lightyear.

More on what you get for your extra fees in a little bit.

Other fees

There will likely be other fees based on local laws or regulation, such as stamp duty. These are not specifically related to Lightyear vs Trading 212 so aren’t considered here.

What can you buy on Lightyear vs Trading 212?

The range of instruments you can invest in is going to be important as an investor. You want to make sure you can find something on the platform to suit your investing style.

Lightyear have been increasing their choices over time, starting out with just US stocks but now offering over 3000 stocks and ETFs from across the globe. Trading 212 offer over 12,000 instruments to invest in. It’s fair to say that Trading 212 is a more mature platform as well – another comparison which will get into in just a little bit.

Comparing the choice, I found everything I would want is on both platforms. I don’t stray too far from the beaten track. The S&P500 ETFs are well covered, Tesla, Amazon, Microsoft and all the bigger hitters are on both platforms, but if you like some of the less well known companies or ETFs, it could be that Lightyear won’t have you covered here.

Uninvested cash on Lightyear vs Trading 212

What happens with uninvested cash on Lightyear and Trading 212. With Trading 212, it just sits there, gathering dust. Waiting to be used to buy shares. With Lightyear, you will earn uncapped interest on your uninvested cash.

In a nutshell Lightyear will pay the base rate of your currency, less 0.75%. So if the base interest rate in the UK is 4%, then Lightyear will pay 3.25% of uninvested pounds sterling. The same deal applies across any money held in your other currencies on Lightyear. The current rates on offer are available here.

This is pretty handy. Be aware Lightyear are not a bank and while customer funds are held in segregated accounts, in the unlikely event all safeguards fail, funds are ultimately protected by the Investor Protection Sectoral Fund only for amounts up to 20,000 EUR in total across all your multi-currency account balances.

It’s a pretty good perk, if you are of the mind to have uninvested cash on standby.

If this sounds like something you want from your platform, I do have an affiliate code you can use if you want to get yourself $10 worth of free shares when you sign up using the code PPC10. I will also get a bonus for recommending a new customer to Lightyear.

Remember, you investments can go up or down and like with any investing product, returns are not guaranteed and you could get back less than you put in.

It’s important to carefully consider your investment goals and risk tolerance before deciding whether an investment product is right for you.

User experience on Lightyear vs Trading 212

What about using the Lightyear app vs Trading 212.

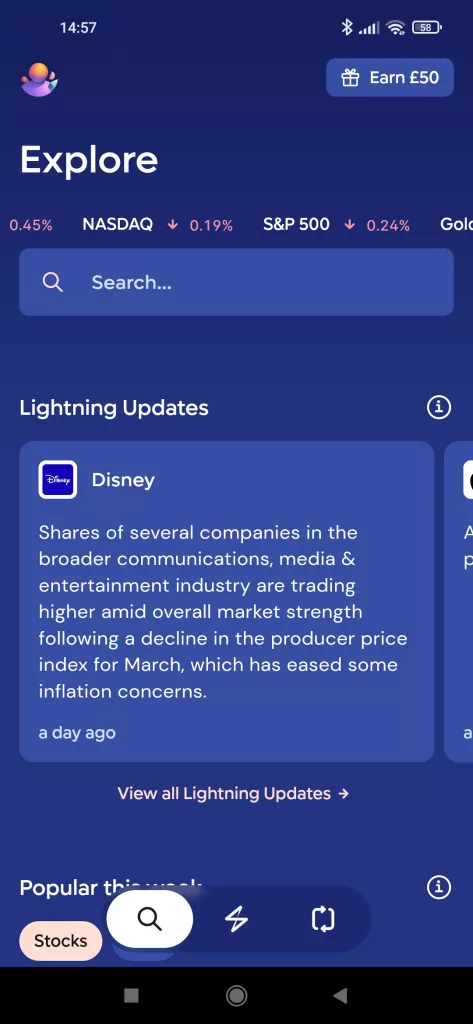

Lightyear is very slick, maybe the quickest app I have used, both in terms of navigation and placing orders. I cover this whole experience in the YouTube video below. There is a ton of helpful information, such as updates on the stocks you might be watching, a ticker along the top of the interface and other highlights front and centre.

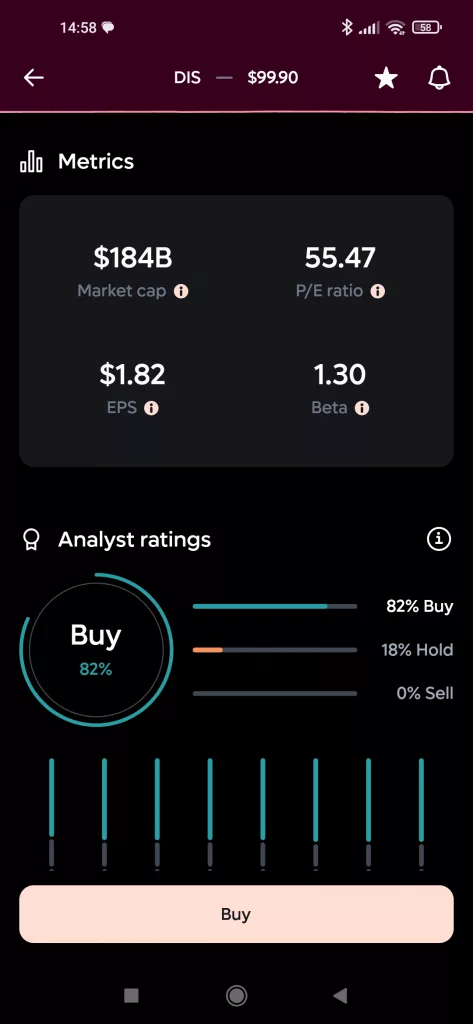

Looking at particular stocks, you get a summary of various analysts to help you gauge where a company is heading, as well as news on earnings, performance, market cap, P/E ratio and so on. Tons of info.

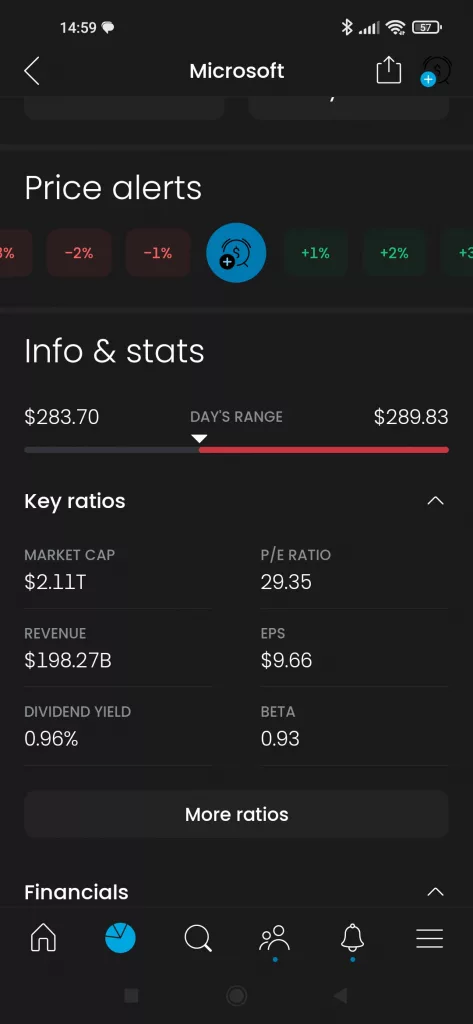

Trading 212 offers similar facts about a company, but isn’t as well laid out or palatable as Lightyear. I don’t think the information is as friendly on Lightyear. The facts are present on Trading 212, but it just isn’t as presentable and easy to digest, and there isn’t the same emphasis on news or updates on Trading 212. Whether that’s good or bad might depend on your tastes.

Lightyear is app only, whereas Trading 212 has a very mature app and desktop site. Most are using mobiles these days, but having a full view of your investments on a large screen is certainly helpful. Trading 212 offers price alerts, limit and stop orders and so forth – things that Lightyear don’t currently offer. Finally CFD’s are an option on Trading 212 if that’s your thing. It isn’t mine so I don’t cover it at all. Lightyear doesn’t offer this.

Customer service I found to be excellent on both platforms. I was responded to in a timely manner by competent staff. Very refreshing, especially if you have ever had to deal with Etoro!

Longevity of Lightyear vs Trading 212

Lightyear is a relatively new investing app on the UK investing scene and as such doesn’t have a particularly long history to look back on. In the short time I’ve been with Lightyear, I’ve seen various changes in the platform as they move from trying to grab some market share with no charges and limited markets available to gradually introducing charges and moving towards profitability.

It’s this move to profitability that can make or break a platforms. We have already seen in recent times Orca collapse. The fees weren’t extortionate there by any means, similar in fact to what Lightyear are charging – it just goes to show how hard it can be to break into this space.

As far as Trading 212 goes, it’s hardly an old timer! Been around a good number of years now, but not as long as Vanguard for example.

It does, however, boast a large user base and a lot of customer money moving through it’s halls. They had a weird period of about a year when there weren’t accepting new sign-ups but that all seems to have passed and they are moving on pretty swiftly.

It looks like Trading 212 is here to stay. If you are interested in trying out Trading 212, using my link/code (FMEuMwDP) you will get a free share up to the value of £100 when you open an account and deposit £1. As before though, remember that your investments can go up or down and with any investment, your capital is at risk.

Regulation of Lightyear vs Trading 212

In terms of regulation, Lightyear are an appointed representative of RiskSave, an entity regulated by the FCA. This means that Lightyear are not directly authorised by the FCA but rather RiskSave are responsible for Lightyear’s activities and it is RiskSave who are authorised by the FCA.

I go into all this in a bit more depth in this article. When all is said and done, I think the regulation in the UK is sufficient but not as comprehensive as Trading 212 or other institutions directly regulated by the FCA.

Being directly regulated by the FCA means being part of the FSCS scheme which will guarantee deposits of up to £85,000 per account here in the UK. Lightyear can’t do this but up to 20,000 EUR as described earlier.

ISAs

Much of the appeal of investing in stocks and shares is to do with the annual tax free individual savings allowance of £20,000. Over the years this allowance could really become quite a sum if invested with in stocks and shares.

Lightyear do not offer an ISA and that is a real downside when comparing Lightyear vs Trading 212.

Trading 212 offer a general investing account, similar to what Lightyear offer, but also offer that ISA product, where all gains will be free from any kind of tax.

Most investors will be looking for that ISA and without that offering I can see Lightyear falling behind in the pecking order.

So which product wins?

At first glance I was finding it hard to see why Lightyear would be a better proposition that Trading 212 in a straight up comparison of Lightyear vs Trading 212. It costs more to use (in most circumstances), there is no ISA product on offer and there are less instruments to choose from.

However, it does offer better information in-app than Trading 212 in my opinion. I think it is quicker, but I don’t really have any metrics to prove that… more a feeling. It also offers interest on cash balances that Trading 212 doesn’t. This might be worth the fees it charges if it lines up with what you are looking for.

For me, an ISA trumps everything, and the lack of one for Lightyear is a real downer when comparing Lightyear vs Trading 212.

However! There is also the possibility that your ISA is already committed somewhere else, or maybe you have already maxed your ISA at Trading 212 and looking for another provider to continue your investing. Lightyear might be a contender for you here. Don’t forget my links if you are opening an account. Affiliate links are a great way to support the site and using them lets me know you are finding this information useful.

Read this article next to see how I am investing my ISA allowance.

Pingback: Trading 212 vs Vanguard - Battle of the best! - Pretty Penny

Pingback: Etoro vs Trading 212 - Choose your perfect platform - Pretty Penny

Pingback: Trading212 vs InvestEngine - Get it right! - Pretty Penny