In this Lightyear Investing App review I’ll look at 5 things that make Lightyear great, and a couple of downsides that don’t help at all.

Table of Contents

Today we are talking about Lightyear investing app – one of the newest of the seemingly ever expanding list of investing apps available here in the UK.

I have been using the Lightyear investing app since about May of 2022 and so I want to offer you my Lightyear investing app review. In particular I want to talk about 5 of the features that make this Lightyear investing app great… and a few that make it not so great… yet…

Of course, just before we get started, this is not a sponsored post. However, I do have an affiliate code you can use if you want to get yourself $10 worth of free shares when you sign up using the code PPC10. I will also get a bonus for recommending a new customer to Lightyear.

Remember, you investments can go up or down and like with any investing product, returns are not guaranteed and you could get back less than you put in.

It’s important to carefully consider your investment goals and risk tolerance before deciding whether an investment product is right for you.

1. Lightyear investing app is incredibly easy to use

On opening the Lightyear investing app, you are presented with your portfolio. It’s really clear how much your portfolio is worth and how it has performed over different timescales.

It also shows at a glance how much of your money is invested in stocks and how much cash you have. Very nice.

Keep the cash figure in mind, because I have two very interesting things to tell you about cash in the Lightyear investing app a little bit later.

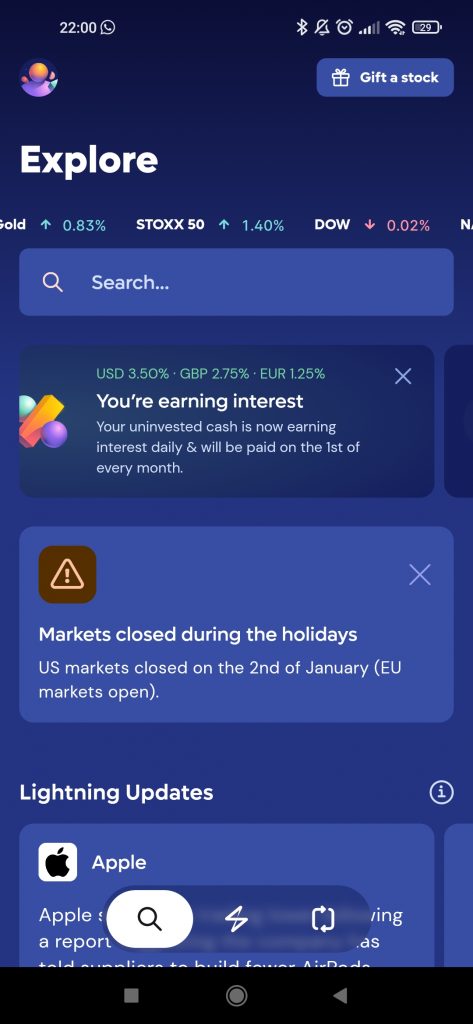

On clicking the magnifying glass icon to the left, you are taken to the Explore section. This is where all the searching, buying and selling of stocks takes place.

It is very well laid out, with a news ticker along the top, a prominent search bar to let you search for assets in the US, EU and UK (more on this later) and various informative panels with Lightyear service announcements, updates on stocks, discovery section to browse assets and so on.

Transitions between sections are smooth, and lag-free on the Lightyear investing app and this reviewer thinks it’s a breeze to use.

2. Lightyear investing app is very quick to buy and sell

Without doubt the slickest and fastest investing app I have used, it is a wonderful interface to use. Not only does it look great, Lightyear makes it very easy to find what you are looking for with the intuitive Explore section, as I’ve already mentioned.

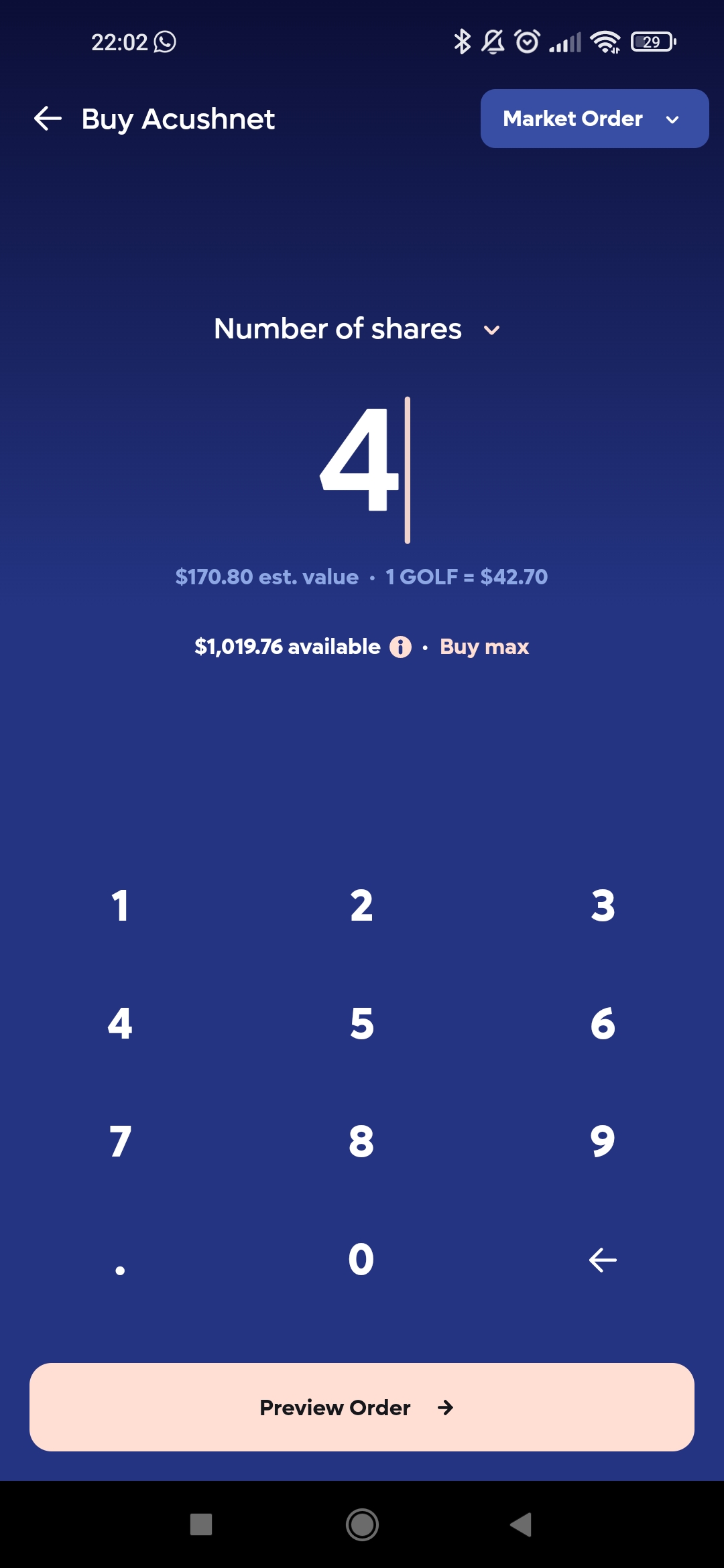

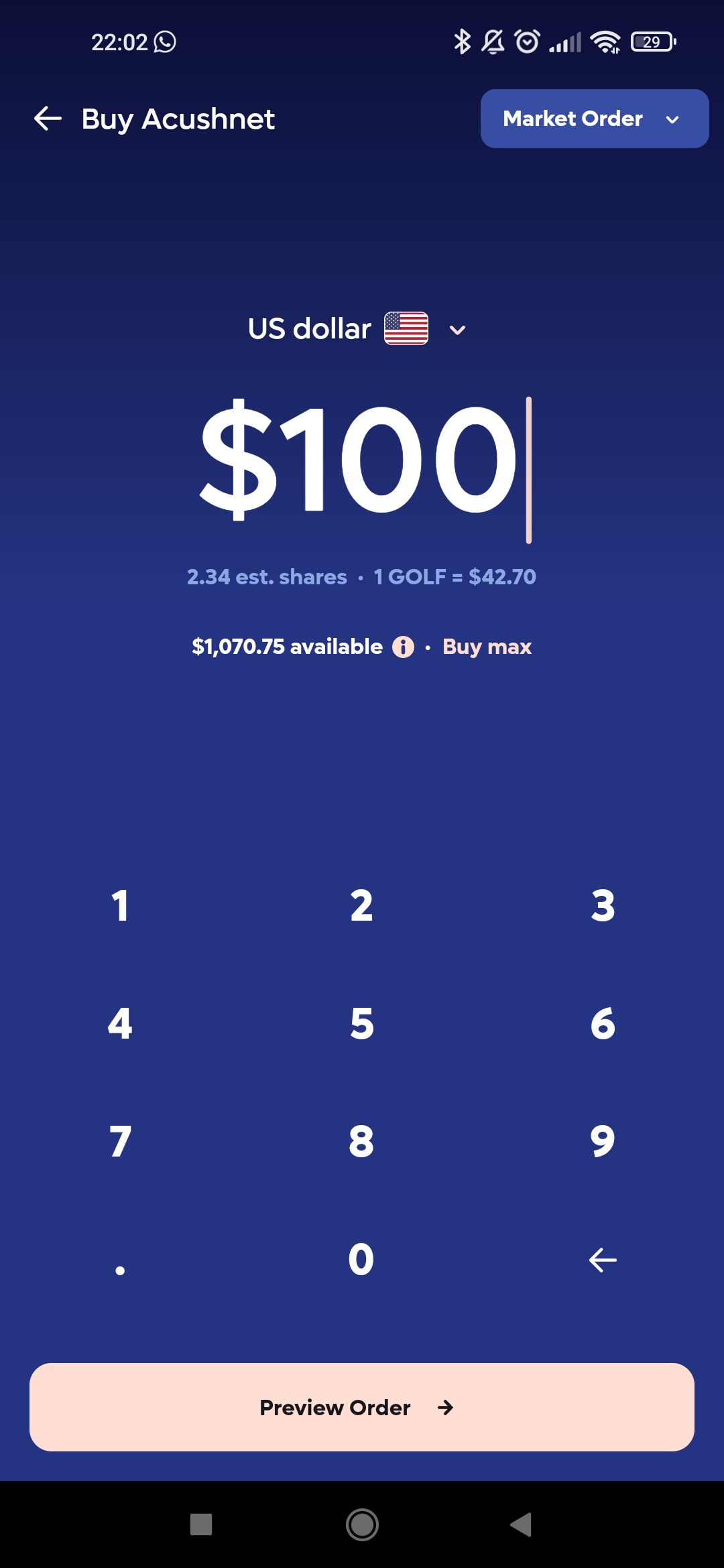

Once you find a stock or share to trade on the Lightyear app, then you can buy a particular number of shares, or a particular value. That is to say, for example, $100 worth.

We can also see that lightyear offer fractional shares so virtually every penny you want to invest gets invested and you don’t have to have the right amount of money to buy whole shares.

That’s a pretty common feature now, but very handy nonetheless.

The orders go though very promptly and confirmation of your trades are served up to you very quickly.

3. The range of assets on the Lightyear investing app is expanding

Single shares aren’t for me, but that’s ok!

As anyone who follows this channel will know, I don’t often buy individual stocks and shares, which until recently was the main offering on the Lightyear investing app.

Initially I bought single shares and shared my findings on my Youtube channel to document my experience of the early days on the Lightyear app (some things have changed since – particularly around fees and what stocks are available. For example, since this video was posted Lightyear’s pricing structure has changed such that now, all users pay a 0.35% currency conversion fee when converting between USD, GBP and EUR. At the time of writing, this is the only fee users have to pay).

At the outset, you could only trade US stocks, but now, there are more and more European stocks and ETFs coming online and they are just as quick to trade as their US counterparts.

ETFs are great

I love ETFs because of the instant diversification they offer and it’s good to see Lightyear adding these assets on top of their initial offerings.

Of course, Lightyear is still a very young investing app, so I would expect more assets to roll out in future (though I have no inside knowledge of when this might be!)

Invest in your favourite ETFs from as little as £1. It’s a very cheap way to get started investing, and of course, you can yourself $10 of free shares when you sign up with the code PPC10

Just remember! Investments can go up or down, returns are not guaranteed and you could get back less than you put in. Capital at risk.

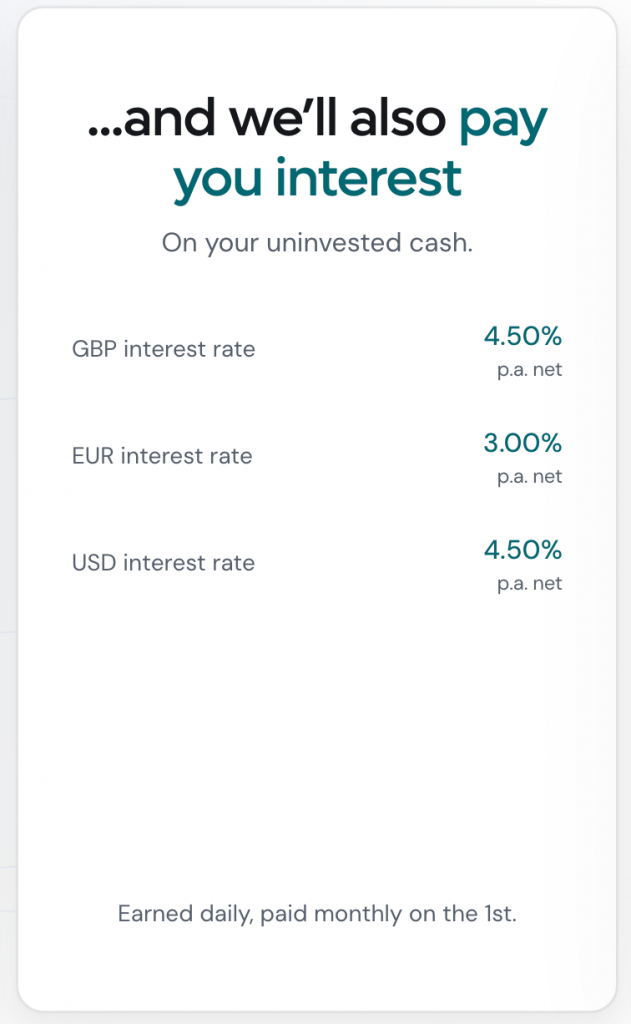

4. Lightyear pays interest on uninvested cash

Very few investing apps do this, but Lightyear will pay you interest every month on any uninvested cash you have in your account. This is great news for those who want to keep some capital on the sidelines, but still in their investing app ready to deploy.

On 16th August 2023 the rates are 4.5% on USD, 4.5% on sterling and 3.00% on euros. This is uncapped. Up to date rates can be found at https://lightyear.com/gb/pricing.

Of course, Lightyear is not in anyway a bank, but it is beneficial to have your money working for you even when it isn’t invested.

5. Lightyear investing app fees are extremely competitive

Lightyear are totally transparent about fees, and it’s good to see.

At the time of writing, the only charges you have to pay are conversion fees between currencies and that is set at 0.35%. There are free deposit, and withdrawal methods that don’t cost a penny, but if you want the convenience of other methods (like ApplePay, for example) then there might be charges associated with that.

As I say, no fees if you don’t want them, except for currency exchange.

Update: On 16th August 2023, investing in ETFs is free, but there are some charges for buying individual stocks. Check out the website for the latest pricing.

There will be taxes to pay in some cases, but those are to do with local tax laws and not the charges being levied by Lightyear.

6. Multi-currency account

A great feature of Lightyear and one I was really pleased to see when doing my initial Lightyear investing app review, is being able to have balances in different currencies.

This is really useful, because it means if you are in the UK for example, you can buy your US dollars and then buy or sell US stocks in dollars rather than losing out to currency conversions fees each time you buy or sell.

So where does Lightyear come up short

Lightyear is a very new investing app, but at the time of my initial review

No ISA product

Unfortunately, Lightyear have no ISA product right now. A stocks and shares ISA (Individual Savings Account) is a type of tax-efficient investment account available to UK residents, where any gains are free from tax.

I understand Lightyear are working towards this offering but it’s not here yet. Still, if you have already have an ISA account somewhere else (perhaps even maxed out) you can still open a general investing account with Lightyear and try out the app.

Don’t forget code PPC10 for $10 of free shares when you invest £1.

Just remember! Investments can go up or down, returns are not guaranteed and you could get back less than you put in. Capital at risk.

Interested in an ISA product, offering tax-free investing? Check out this article where I compare the very popular Trading 212 and InvestEngine

Regulation of Lightyear

In my opinion the regulation around Lightyear here in the UK is a bit more complex than say an InvestEngine or Vanguard. Ultimately I think it’s ok, but let’s see what Lightyear has to say about it and we will try to pick the bones out of it from there.

Lightyear Financial Ltd is an appointed representative of RiskSave Technologies Ltd, which is authorised and regulated by the Financial Conduct Authority (FRN 775330). Lightyear Financial Ltd is a company registered in England and Wales with company number 12925823. Registered office 42-46 Princelet St, London E1 5LP, United Kingdom. Lightyear Financial Ltd can be found in Financial Conduct Authority Financial Services register under FRN 955739.

Lightyear website

So RiskSave have appointed Lightyear to act responsibly and in accordance with their obligations.

This is where it gets different from the likes of InvestEngine or Vanguard for example. Lightyear are not directly regulated by the FCA so as such you are not protected by FSCS, but rather

Should Lightyear Europe default, all our customers have their assets covered up to the amount of 20,000 EUR by the Estonian Investor Protection Sectoral Fund. Your US securities are held with our partner Alpaca, who is FINRA regulated and a registered member of the SIPC. This means your US securities are protected up to the value of $500,000 should Alpaca fail. You can read more about this directly on the SIPC website.

LIGHTYear website

Lightyear are very honest about this and aren’t trying to hide. They just don’t have that direct authorisation here in the UK just yet.

So it looks like your investments are still protected.

If Lightyear were to go bust – cash is still safely with the bank and assets are still safely with ABN/Alpaca. Accessing those may be difficult if the Lightyear app was to be no longer available.

If Lightyear was still solvent, but the bank was to fail, then the EU 20k protection scheme would be applicable.

If Lightyear was fine, is fine and the bank is fine but ABN or Alpaca goes bust the you would be into the processes of EU protection/US SEPA protection schemes respectively.

Legislation isn’t specific to Lightyear as such. Every app or product is going to have their own fine print. At any rate – it’s important to go in with your eyes open with any investment product. Decide if it is right for you.

Pingback: Lightyear vs Trading 212 - easy comparison - Pretty Penny

Pingback: A brand new Lightyear web application - Pretty Penny