Trading212 or InvestEngine. Both platforms I love and I have been a customer of both Trading212 and InvestEngine for a long time. I have a stocks and shares ISA with both these companies and I could honestly recommend both these products out of all the platforms I have tried. So what follows is an honest review and comparison of Trading 212 vs Invest Engine.

Table of Contents

How to choose a platform to invest

Investing comes in all shapes and forms, from buying individual stocks to buying index funds and ETFs. From picking stocks yourself, to having a service do it for you. Costs, speed, ease of use – all these things contribute to helping you decide what platform is the best.

Are you thinking about the best stocks and shares ISA for you for 2023/24? You might want to check out my special feature post here to help you decide!

Whatever you choose, investing in the stock market puts your capital at risk. History shows buying and holding diversified assets has proven very fruitful over the long term, but past performance doesn’t guarantee future returns. You could get back less than you put in.

I suspect you know this, though, and that’s why you are comparing Trading212 and InvestEngine.

So why choose between Trading212 or InvestEngine?

There are lots of choices out there for UK investors and beyond. I’ve tried a good many of them. It’s all just opinion on which investing platform is the best, of course. In my opinion, Trading212 and InvestEngine are great.

(By the way, you will see folks refer to these platforms as 212 or Trading 212 or T212 or Invest Engine…. the list goes on. The correct names are Trading212 and InvestEngine, but it’s all the same thing)

Some are good, like Vanguard, or Lightyear and some, like Freetrade are poor by comparison. I’ve tried them, so I can talk about them. Like I say, I think Trading212 and InvestEngine are two great ones.

(… and no, this isn’t just about affiliate links! I have affiliate links for other providers that I have tried, but honestly I don’t think they are as good as these two, so I don’t promote them…)

Investing must haves

When choosing an investing platform I want something that

- must be properly regulated by the FCA and take part in the FSCS scheme

- offers a free ISA (or at least a very low cost one)

- is low cost in terms of any extra fees

- has plenty of choice for what I want to invest in

- easy to use

- good customer support

Depending on how you prioritise these things Trading212 or InvestEngine might be the best. Let’s consider how your investing style might help you decide which platform to choose between InvestEngine vs Trading212.

How to choose between Trading212 or InvestEngine

The ISA Issue

Investing in a stocks and shares ISA allows you to invest up to £20,000 per year tax free, currently. This means any gains, profits, dividends, and growth remain free from taxation. This is a massive deal, particularly if you begin to amass a sizeable portfolio.

Both Trading212 and InvestEngine currently offer a free ISA so both Trading212 and InvestEngine meet this very simple criterion.

Do you want to invest in individual stocks?

If you want to allocate you funds to individual stocks like Tesla or Lloyds, Amazon or Legal and General then you have to choose Trading212. InvestEngine only offers ETFs.

ETFs are baskets of stocks that are related in some way, like VUSA (Vanguard’s S&P 500 Index tracker) or INRG (iShares Global Clean Energy). The idea is you can buy lots of related companies and hold them in one entity. It’s instant diversification and what you invest in will dictate how your risk is spread. VWRL (Vanguard’s all world index) would be more diverse than the VUKE (FTSE 100) tracker because it includes stocks from all around the world rather than just the UK.

But if selecting particular companies is your thing, then it will have to be Trading212 and not InvestEngine.

Hargreaves Lansdown offer a free guide on some things to think about if you are considering investing in stocks. Click the image below to get it.

Decision made? Sign up here: https://www.trading212.com/invite/FMEuMwDP to get yourself up to £100 of free stocks when you deposit £1. (Pssst… don’t forget to check the code FMEuMwDP is there! If you have signed up in the past and didn’t get a free shares you could still get free shares by entering this code)

Not sure yet?

Read on!

I don’t know what to invest in!

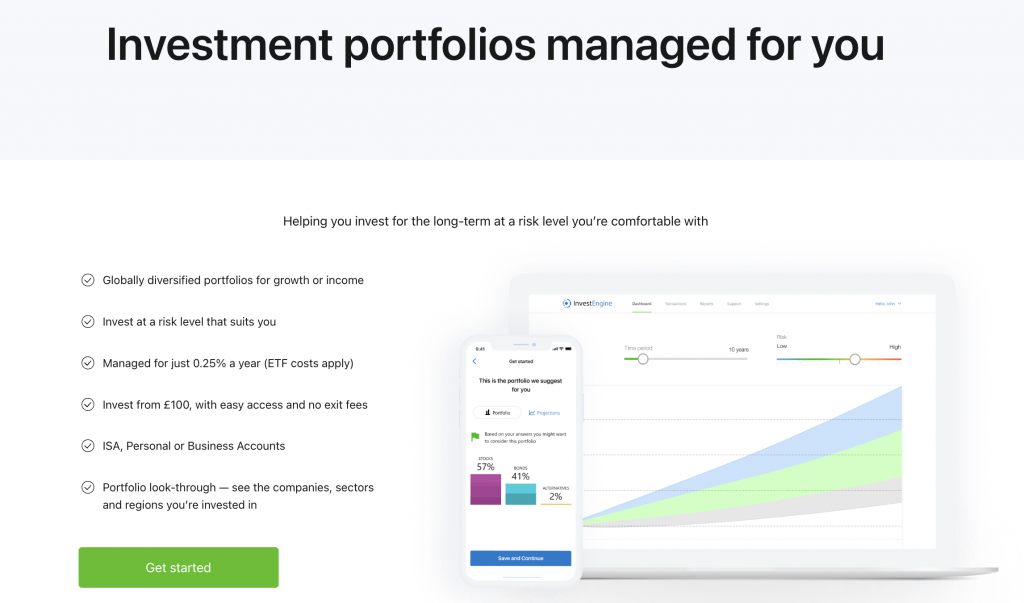

InvestEngine offer a managed portfolio service, so if you don’t know what you want to invest in, or are concerned about dipping your toes in the investing world, then this could be a good option. Simply, they ask a few questions about how your attitude to risk, your goals, timeframe, etc and then they suggest a pre-packed portfolio for you. They take care of the buying and selling and charge 0.25% of your investment for this service. That’s very competitive, to be honest.

Check out some of these articles if you are interested in hearing more about the managed service that InvestEngine offer.

Trading212 offer no help like this whatsoever. You are on your own, so if you want to invest, but not sure about how to go about it, Trading212 might not be the option for you.

Trading212 vs InvestEngine for cost?

InvestEngine carries no fees if you want to choose your own investments. There are no deposit fees, transaction fees, withdrawal fees, holding fees… none of that. The only charge InvestEngine has is the 0.25% management fee IF you want that service. Entirely free platform at the time of writing when you choose your own investments.

Trading212 can be entirely free, but you need to be careful about what you invest in and how you do it. Depositing by bank transfers is always free, but depositing by credit/debit card, ApplePay etc is only free for the first £2000. After that there is a 0.7% charge. Currency conversion is 0.15% which is still very competitive. No withdrawal fees at Trading212 so even with these few charges it is still an incredibly cheap option.

Trading212 vs InvestEngine apps

Both Trading212 and InvestEngine have a full website and a mobile app. Trading212 has a much more mature mobile app and it’s easy to buy/sell shares (and other things like CFDs) very quickly and pain free. The website is also great.

InvestEngine is newer, but the website is very user friendly. Investing in ETFs is my favourite way to get my money working so everything about the InvestEngine website pleases me immensely! I don’t use the mobile app much. I have little reason to check in on my investments daily, weekly, or even monthly so the fact the app isn’t so appealing doesn’t bother me.

Both are great products and I would urge you to try both if both satisfy your requirements. Don’t forget you can get an extra £25 bonus with InvestEngine when you sign up using my link, and deposit at least £100 for a year. This offer isn’t available on the site in general.

Want to compare another stock trading app – How about Lightyear vs Trading 212?

Pingback: BestInvest and InvestEngine - which is best for ISA? - Pretty Penny

Pingback: 5 things that make Lightyear Investing App great - Pretty Penny

Pingback: Is InvestEngine safe in 2023? - Pretty Penny

Pingback: Lightyear vs Trading 212 - easy comparison - Pretty Penny