BestInvest and InvestEngine both offer solid options for your investing, but which one will suit your needs best? In this article I will compare the features of each investment platform in terms of their stocks and shares ISA options and help you decide which is the best option for you.

Table of Contents

How are BestInvest and InvestEngine the same?

Let’s get the similarities between BestInvest and InvestEngine out of the way nice and early!

Regulation

Both are regulated by the FCA here in the UK. What this mean is that both BestInvest and InvestEngine are required to comply with the FCA’s rules and regulations, which in turn are designed to protect consumers and promote fair and transparent financial practices

Both BestInvest and InvestEngine are covered by the Financial Services Compensation Scheme (FSCS). The FSCS is a UK government-backed compensation scheme that provides protection for consumers of financial services in the event that a financial services firm becomes insolvent or is unable to meet its obligations.

It’s important to note that the FSCS is a compensation scheme and is not a guarantee of the performance or security of any investment. It’s always a good idea to do your own research and carefully consider the investment options and services offered by any financial services company before making any investment decisions. It’s also a good idea to seek professional financial advice if you have any questions or are unsure about any aspect of your investments.

Investments can go up or down and you could get back less than you put in – don’t forget that!

Education

Investing can be a daunting idea to begin with. Both BestInvest and InvestEngine offer plenty of educational material on their websites. It’s worth saying that this isn’t sensationalised in any way – both platforms have a very sensible approach to investing. From explaining risk, to detailing the benefits of diversification, it’s all there.

Choose your own investments (if you want to)

Both BestInvest and InvestEngine allow you to build your own investment portfolio. These sorts of investments are called self-managed. You pick what goes into your portfolio and you are responsible for looking after that, including when to buy and sell assets, change what you are investing in and so on.

BestInvest offer over 3000 different funds and shares to invest in while InvestEngine offers over 500 ETFs to choose from. So while there is a better range of choice with BestInvest, you might not even want all those options.

So this leads us on to the next question when deciding between BestInvest and InvestEngine…

How do you want to invest?

Investing takes all shapes and forms. Many people like to pick and choose companies to buy into. Others prefers buying ETFs or index funds. Personally I am very much on the side of ETFs and index trackers, as this offers diversification in one simple basket. I can invest in one product and that product will have tiny pieces of many hundred of companies, thus offering me a nice broad base for my investing.

However, if you are interested in investing in individual companies then InvestEngine isn’t the product for you.

At the time of writing, you can only invest in ETFs. Single companies are not available on InvestEngine. So if you are deciding between BestInvest or InvestEngine, then BestInvest is the route to take on this one.

BestInvest and InvestEngine both offer managed solutions for your investing but with a few differences

When getting started with investing, many people are baffled by the terminology and the sheers number of options there are to get started.

InvestEngine and BestInvest both offer a managed solution for your money.

What this means is that the company you are investing with can invest your money on your behalf without you having to take an active role in how your money is put to work.

Many people know it is a good idea to invest, but they maybe don’t know how or don’t want to make decisions about how their funds are deployed. These managed services are a good to way to throw money at investing through these pre-packaged investment offerings.

What do BestInvest offer?

BestInvest offer a range of ready-made portfolios

Bestinvest’s Ready-made Portfolios are built from a range of funds selected by our investment teams at Evelyn Partners. We look after more than £50 billion of people’s money. These ‘off-the-shelf’-style portfolios come with a carefully selected collection of investments, so you don’t have to spend time choosing them yourself.

Bestinvest’s website

They offer two brands of ready-made portfolios. Expert and Smart.

Expert portfolios are built up with actively managed funds – that means there is someone actually making decisions on your portfolio on a regular basis – and the funds included are based upon the risk you are willing to take as an investor.

As an aside – risk is a very personal thing. Perhaps you just want an investment to protect your money against inflation. Perhaps you want to be a little more aggressive and go for maximum growth.

Smart portfolios are managed by the same people but because they are built up of ETFs and not actively managed funds, they are lower cost than the Expert offering.

More on charges a little later but worth noting, again, the make up of your portfolio will be reflective of the amount of risk you were ready to take on.

What do InvestEngine offer?

InvestEngine also offer a range of ready-made portfolios, with different flavours geared towards growth or income – different options that might suit depending where you are in your investing journey.

It’s why with our Managed investment service we start by asking you to complete a straightforward questionnaire that assesses your aspirations and needs. Based on your answers, we then suggest a suitable investment portfolio.

Investengine website

Depending on all your answers when you are setting up a portfolio, InvestEngine will offer you something based on those answers. It’s a ready-made portfolio, fully functional and ready to go. It’s just a suggestion though, and when all is said and done, if you don’t like it, you can still make changes.

How do BestInvest and InvestEngine help you get the right product?

As mentioned before, there is lots of information on both sites regarding all things investing. Customer service is excellent on both platforms, with queries answered quickly and always to the point. It’s worth saying that InvestEngine have an entirely free self-managed option at the time of writing, but whether my query was about the free version or the paid for managed service, I found customer support to be courteous and very helpful in both cases.

What are the differences in costs and fees between BestInvest and InvestEngine?

Fees. Argh! Nobody likes fees. Quite often they can be complicated and difficult to work out what exactly you are paying.

With InvestEngine, their managed service is a flat 0.25% plus whatever the ongoing charges of the ETFs are. Ongoing charges for the ETFs are not exclusive to InvestEngine. Whenever you buy an ETF on any platform there is an associated ongoing charge. It’s just the price of business and since this is rolled up in the current cost of buying into that ETF people rarely notice it. It’s worth paying attention to however – always be aware of what you are paying.

BestInvest’s fees are somewhat more convoluted.

When dealing with individual shares it’s £4.95 per trade. This isn’t so bad if you are buying £1000’s of shares in one go, but if each purchase you make is £100 then that’s nearly 5% of your capital going in fees alone – this would be very expensive! Same with ETFs, it’s a £4.95 charge whatever you do.

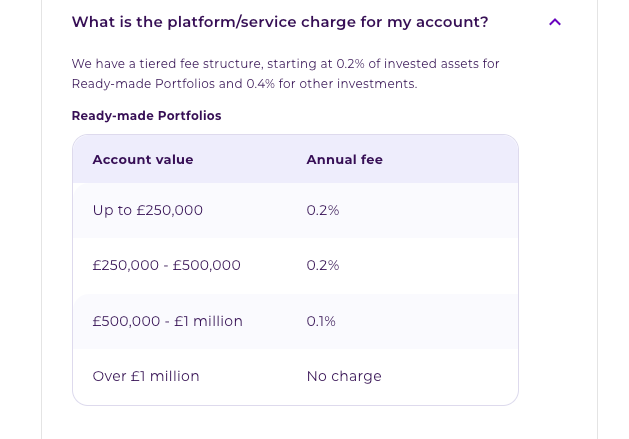

Platform fees start at 0.2% for ready made portfolios on BestInvest and get cheaper the more that is invested. It’s more expensive for self-managed portfolio starting at 0.4%

So when you combine, share dealing charges along with platform charges and ongoing fund charges, they do start to rack up a little bit on BestInvest.

Fees will always be a massive consideration for investors. At the moment (though it could easily change in the future) InvestEngine is a long way cheaper than BestInvest, and even entirely free of all platform charges if you go self-managed.

When it comes to investing there are other options too. Trading 212, for example, offers a really low cost way to invest in shares and ETFs. However, there are no managed offering with Trading 212. You are entirely on your own with this one… Check out the full comparison between Trading 212 and InvestEngine.

Pingback: Trading 212 ISA 2023 - 5 Reasons to get one now - Pretty Penny