On the face of it, Etoro copy trading is a great feature for new traders. However, scratch the surface and there is a huge problem with this.

Copy Trading does not amount to investment advice. The value of your investments may go up or down. Your capital is at risk.

Inexperienced traders or investors that aren’t completely confident can jump on board with someone else and copy their trades. It sounds wonderful. Just copy someone who knows what they are doing.

Table of Contents

Copy trading promoted all over the internet and TV

Etoro love to promote their copy trading feature of their platform.

Some time ago, I wrote this article discussing the opportunity that Etoro copy trading offers. Mostly, I dealt with how to pick someone to copy. However, as I have grown in experience and knowledge, I realise that may have been naïve.

Etoro copy trading to start trading

If you want to copy the trades of someone who has proven their investing nous to Etoro, then all you need to do is go and find a popular investor on the Etoro platform that catches your eye and simply copy what it is they are doing.

Etoro will help you out, it’s really easy to get started with etoro copy trading.

The folks you copy, Etoro calls these guys “Popular Investors”.

Once you are copying your investor of choice, then essentially every time this popular investor makes a trade, you also make it.

Etoro does this for you automatically and proportionally to the amount you have invested.

So if the popular investor uses 5% of their portfolio to buy Facebook shares, then Etoro will place the same trade for you. It pretty smart, actually. I can see the appeal for folks who want to get started investing but maybe don’t know where to begin.

However the whole process is fraught with problems and they start with the popular investors themselves.

Past performance is not an indication of future results.

How to become a popular investor on Etoro for copy trading

To be an popular investor on Etoro (someone who can be copied) you need to meet a few criteria.

I don’t think the criteria are that demanding to be honest…

- You have to avoid a monthly loss of 30% in a month in the last 6 months. I imagine in normal circumstances, a reasonably level of diversity would keep that losses like that at bay. You aren’t allowed to have a single holding of more than 20% so this goes hand in hand with that.

- Two months of trading history – no big deal. Just be a reasonably active for a couple of months.

- Average equity of $1000. Again – easy solved by having $1000 invested. Not a huge sum. It might rule out a few but over time, I can see this figure being raised by most in an investing enterprise.

- At least one verified copier for the last month – you could get a mate to copy you if you really had to force the issue.

One follower is small potatoes if you are actively trying to grow your following. I imagine you could get one follow quite quickly.

Spreading the word on social media, particularly if you have a following there already, could get you what you need here. - Average AUC of $500 dollars for the last month. This is Assets Under Copy. It’s how much copying money is following your trades. For example, two copiers each with $250 would be the $500 required for this stipulation.

This is probably the most difficult part to achieve, because people have to be invested in you and your skills to actually put their money into you for copy trading.

Once you manage that you are at the Cadet level. Big whoop.

Popular investors are on thin ice

Once you meet these feeble requirements, then you are open to literally anyone entrusting their life-savings to your stock market acumen.

Do you see the issue here?

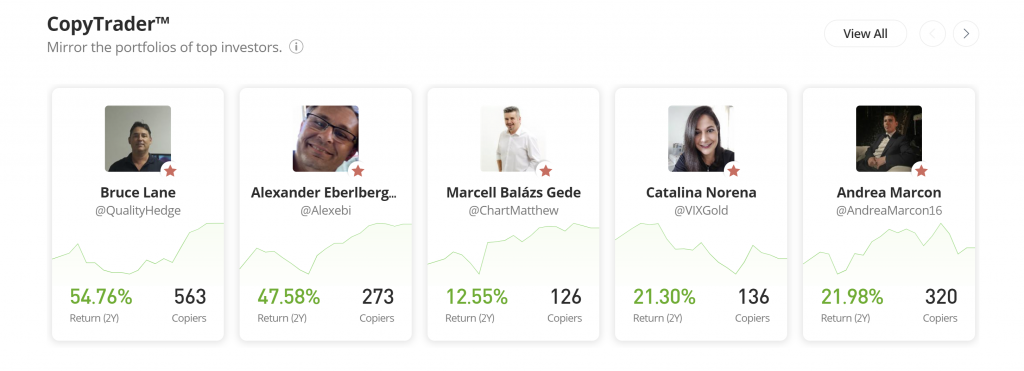

You could have a wonderful few months in the market, fluked a few amazing choices and you look like a world beater. You tell people on social media how well you are doing.. hell, even Etoro promote the biggest winners on their own website for copy trading, and very quickly a popular investor is going to become a very popular investor!

What’s in it for me to become a popular investor and be copy traded?

Money. That’s the long and short of it.

As a popular investor, Etoro are going to reward me – pretty handsomely too – for having a ton of followers.

Why would Etoro do that?

Well, money again.

Follow the money.

It’s always about the money.

Follow the money

Let’s rewind a little bit to see how Etoro make their money. They make money from charging deposit and withdrawal fees, overnight and weekend fees on CFDs, inactivity fees, foreign exchange fees, crypto dealing charges and, most importantly for this conversation, the spread in the different assets it offers – that’s the difference between the buy and the sell price.

Look at this information from Investingoal.com

Every time someone makes a trade on Etoro, Etoro get a little slice. How big a slice depends on the asset.

It’s not a secret. Not really.

Etoro talk about having no commission charges but the spread will contain their profit margin and it is very much a real thing.

I’m not saying this is the worst thing in the world to ever happen. Every business needs to make money but understanding that this is how Etoro makes a 87% of their income, then the idea of copy trading starts to look a lot less noble.

Etoro copy trading feeds the Etoro profits

Etoro are clearly incentivised to have their customers trade and place orders as often as possible. They make money every time it happens.

Consequently, it’s very clear why they promote their popular investor scheme and copy trading as aggressively as they do. (The idea appeal massively to people who are seeing their salaries slowly eroded by high inflation and their debts going up with rising interest rates)

A popular investor with 50 copiers will trigger 51 profit making actions for Etoro when they place a trade because those 50 copiers are all going to have the same trade placed automatically.

Imagine that same popular investor makes even just 5 trades a month. That’s 255 profit making actions for Etoro from just one popular investor.

But an investor with 50 copiers isn’t even a particularly popular one.

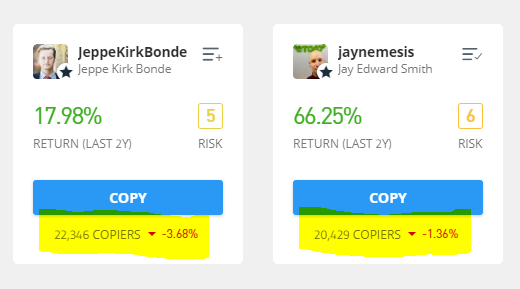

Some of the biggest popular investors have upwards of 20,000 copiers…

20,001 profit making events happening every time one of these guys makes a trade and you can see Etoro are going to be making serious bank from this program. The trades don’t even have to be good ones. Etoro makes it money regardless of whether one of these traders have turned a profit or a loss.

It’s very easy to see how more trades and more copiers are going to pull big numbers for Etoro and that’s why Etoro are prepared to invest so heavily in copy trading. Here’s how they go about that.

Paying the popular investors

With the potential to rake in big money, Etoro want to reward people who are successful on their platform, because these are the guys that are going to attract a following to generate the trades and generate the revenue. Follow the money and all that.

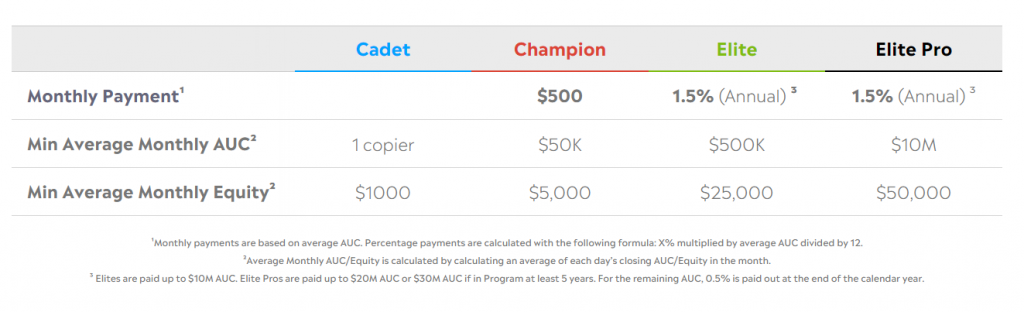

Once a player on the popular investing platform achieves a portfolio of $5000 and has assets AUC of of $50,000 then the popular investor will get a payment of $500 per month from Etoro.

I can imagine someone doing pretty well will attract a lot of copiers and that figure of $50,000 could be achieved pretty quickly.

As you go up the tiers, popular investors can then make up to 1.5% of AUC annually.

Win or lose, these popular investors will continue to be paid by Etoro, as long as they are maintaining the right numbers of copiers and hitting the right notes in terms of AUC.

Etoro copy trading is turning regular people into fund managers

Like it or not Etoro and their copy trading programme is facilitating the metamorphosis of regular people to fund managers.

In some cases, completely unqualified people are being entrusted with other people’s money. How much money is down to the copier.

Check this out…

This popular investor’s full time job is a social media marketer and recommends a 50% stop loss to over 800 copiers and over 32,000 followers. To me that’s just plain irresponsible and the career background doesn’t suggest this is necessarily the person you should entrust your money to.

Getting off topic slightly, but I’m just trying to show you how normal folks are suddenly becoming unlicensed fund managers, controlling potentially huge sums of investor money and making suggestions on investing strategy.

Now you might suggest that it’s up to the copiers how they deploy their money, and to an extent that is true. What is also true though is how powerful advertising is and how much influence anyone talking about this sort of stuff in the investing space actually has. It varies but people out there are looking for guidance and it’s important that everyone involved is up front and honest about what’s going on.

However, the whole feel of Etoro and copy trading is the sensational numbers, social investing and the requirement to actively trade to show you are staying ahead of the curve.

Regular folks aren’t equipped for that sort of responsibility. They aren’t. The best and brightest can’t beat the market 85% of the time over the long term.

Etoro copy trading is just a numbers game

Not everyone is going to do well – in fact it’s displayed clearly most people lose money on Etoro.

Some will win in the short term at least, and as a result these are the ones promoted by Etoro to copy trade.

As soon as things go south for the leading guys, then someone else will replace them in the recommendations.

There will always be people winning, somewhere, just not the same people all the time probably, and so long as there are successful people to parade, copy trading will continue.

It’s very difficult to beat the market. Even harder when so much capital is being siphoned off with each trade.

Etoro copy trading churn

The constant churn of promoting different popular investors and the short-termism of the whole operation smacks of a platform that isn’t actually that interested in the longevity and well being of it’s customer base.

So long as Etoro can draw new investors to it’s platform it will continue to remain a prominent player in the investing space.

There are so many other reasons not to use Etoro and copy trading in general. A couple spring to mind – there is no ISA wrapper to protect gains from tax. Another downer is that every time you crystallize a profit, whether through your own trades or copies, that is a taxable event and may not be advantageous to your tax position. Not sure how that is reported or if it is included in these stellar gains often advertised.

Anyway, there are better options for long term investors out there. Cheaper options offering more diverse assets for a buy and hold strategy. Vanguard and InvestEngine spring to mind.

At the end of all that, however, I’m not saying never try copy trading, just do so knowing what it is and who is really winning.

eToro is a multi-asset platform which offers both investing in stocks and cryptoassets, as well as trading CFDs.

Please note that CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 74% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money.

Past performance is not an indication of future results. Trading history presented is less than 5 complete years and may not suffice as basis for investment decision.

Copy Trading does not amount to investment advice. The value of your investments may go up or down. Your capital is at risk.

Cryptoassets are highly volatile and unregulated in the UK. No consumer protection. Tax on profits may apply.

eToro USA LLC does not offer CFDs and makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication, which has been prepared by our partner utilizing publicly available non-entity specific information about eToro.

Pingback: Honest InvestEngine ISA Review - 1 year later - Pretty Penny

Pingback: Etoro vs Trading 212 - Choose your perfect platform - Pretty Penny