In this InvestEngine managed portfolio review, I’m going to look at how one of myInvestEngine managed portfolios has performed and if it has been worthwhile in terms of making money.

Is it better to leave the management of your investments to someone else, or do you simply not trust anyone else to look after it? I’ll try to answer these questions in this InvestEngine managed portfolio review.

A recent twitter poll I fired out recently voted overwhelmingly that managed portfolios cannot be more effective than looking after your own investments. Hold on to that thought as we move forward.

InvestEngine managed portfolio review

InvestEngine has been rightly lauded for their completely free platform which allows you to build your own portfolio from over 500 ETFs with absolutely no fees.

Nothing to pay in terms of deposit, withdrawals, or transactions. Quite brilliant really. How long this can last is an entirely different conversation, but right now, it’s entirely free and it’s where I have my ISA to boot. The other service they offer is a managed portfolio.

In a nutshell, a managed portfolio is where InvestEngine makes the investing decisions for you.

Kind of.

For their trouble they take a fee of 0.25%. Not free, but still very competitive.

So if you have to pay for it, and since InvestEngine already offer a free pathway to investing why you would even want a managed portfolio at all!

Why bother with an InvestEngine managed portfolio?

Well, it’s to take all the mental load away from your long term investing. InvestEngine’s managed portfolio is a way you can simply just deposit your money into your account and let InvestEngine look after you via some ready made portfolios.

Now I made a video some time back about what is involved in getting all this – and to save me from repeating myself – I’ll just leave a link to that video where I talk about what’s involved in setting up a managed portfolio that might suit you – you can check that out when you are done here.

Once you are ready, InvestEngine will carry out the plan, hopefully in a way that will be beneficial. In terms of costs it’s 0.25% of your investment value. The idea is that you are paying someone that should have more savvy than you, to make good decisions on your behalf. No hands on required from you, no charts, no jargon and that’s just for starters.

Of course, anytime you want to change your plan you can do that. You aren’t tied into anything and there are no contracts or anything like that.

On top of that, InvestEngine will diversify your investment for you appropriately, spreading your risk. Hopefully taking away some of the wild swings we have seen lately and all being well, send you on a nice gradual upswing over the long term.

The InvestEngine managed portfolio experiment is set

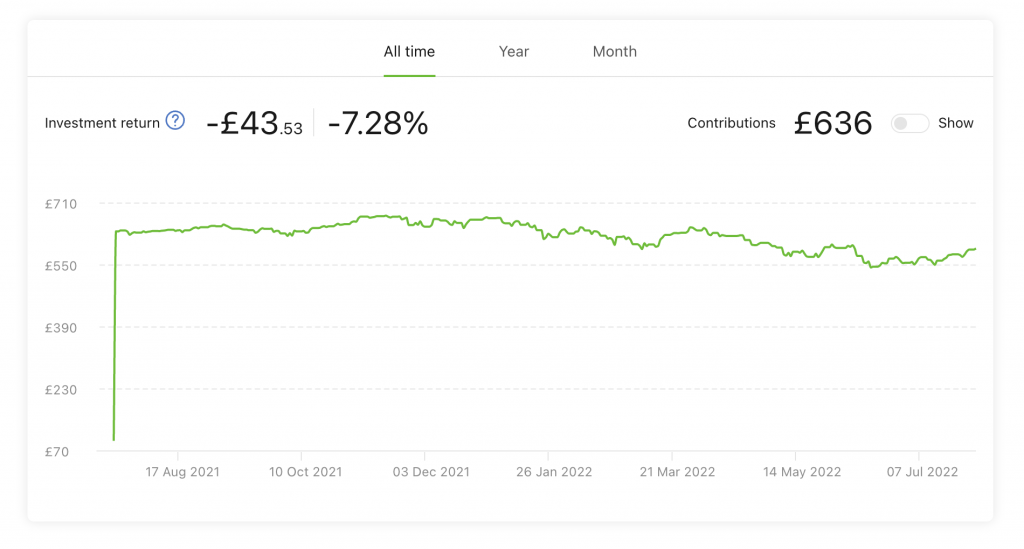

So to set the scene and explain what’s going on, I have two managed portfolios from the 21st July 2021 to the present day. To see how they have performed over the first year, I have added nothing to these since they were opened.

I have my ISA with InvestEngine, as I mentioned, but that is self managed, entirely separate and we aren’t talking about that today.

Regular visitors to my blog and my Youtube channel will know I’m a long term investor, so today we are looking at my Growth 10 portfolio. It’s about 89% stocks, 5% bonds and 5% in gold and a little bit of leftovers. This is pretty close to investing fully in the stock market.

On 21st July 2021 I dropped £636.35 into this managed account. And on the 21st July 2022 it now sits at £577.63 – overall, a loss of -9.22%. The screen capture is actually from a few days after this!

Tragic

At first glance it’s not great, but we need to remind ourselves that the world has been struggling since the turn of the year, so it’s worth seeing how this result holds up vs a couple of the larger index trackers out there.

But! Just before we go any further it’s important to note, that whoever is doing the investing there is not a silver bullet for success. Investments of any description can go up and down. It’s important to understand that any investment carries risk. However, while InvestEngine are both regulated by the FCA and take part in the FSCS scheme, they do not have a crystal ball. Nobody knows for sure where stock markets are going and InvestEngine are no different. Anyone who claims they do, is bluffing.

That’s a fact.

Compare and contrast

Right, so I had to eat a 9.22% loss for that 12 months. But what would investing in the S&P 500 have done? That’s the top 500 or so companies in the US. On 21st July VUSA – which is vanguard’s S&P 500 tracker was valued at £60.14 and one year later was £62.88 – a gain of about 4.05%.

So at a first glance it doesn’t look like InvestEngine’s managed offering is really cutting it.

But there is always more to this sort of stuff than meets the eye.

Cast your mind back to 4th January. VUSA had touched over £67 a share. Life was good, the moon boys were having a great time. Investors could do no wrong. Enjoying a run when you could nearly throw a dart at a board of assets and come up with a winner.

Unfortunately the next day started a decline that would see the S&P lose about 21% over the next 6 months.

By contrast, my managed portfolio fell from £670.0 to £543.68 in the same period up to 21st June – a loss of only -18.9%.

Only.

Ha!

Defeat wasn’t quite so brutal doing it this way! The point I’m really trying to make is that you could look at any particular time period and spin things however you want.

No InvestEngine managed portfolio history

And that brings us on to something these managed portfolios really don’t have – a history. They haven’t really been going long enough just yet to get any real long term results. There’s no real performance history to speak of. That said, no two investments are the same and different assets will be affected in different ways by different things, and so you need to be careful not to compare apples with oranges.

The S&P is, of course, US focused and glancing down what is actually in my InvestEngine managed portfolio, I see that only about 30% of this portfolio is in the S&P500 in the form of this Xtrackers S&P 500 product.

Let’s try something else

So what else is in here. A European tracker. Interesting.

How has InvestEngine Growth 10 compared against that. Well VERX – Vanguard’s offering for Europe excluding the UK decreased in value by just a shade over 11%. That’s a worse than our managed portfolio. Yikes.

But It reinforces what I said, about no two investments being the same.

I think most investors would agree that diversification is important. It stops you from being overexposed to any one singular asset or geography and should, in theory at least, be a smoother ride as one invests for the long term.

The world as a whole has struggled particularly the last six months and I think our portfolio reflects that. In some ways that could be interpreted as being ok! I would expect when the prosperity of this rock we live on turns around, so too will this particular managed portfolio. It’s hard to say though. again nobody knows for sure.

The results for the first year investing with InvestEngine’s Growth 10 aren’t great. You can’t sugar coat that. But only hindsight is 20/20 and nobody knows what’s coming. When it comes to your investing, all you can do is make the best decision you can with the information in front of you, hold on to your knickers, and if in doubt, zoom out.

Alternative?

If you don’t fancy managed portfolios, InvestEngine is currently the cheapest way to invest in ETFs. It’s how I am using my stocks and shares ISA allowance for this tax year. A totally free platform and a free £25 for you when you invest at least £100 for twelve months when you use my link to sign up. And if you are interested in seeing exactly how I have set up my ISA, you need to check out this video right here.

Pingback: Trading212 vs InvestEngine - Get it right! - Pretty Penny