Etoro vs Trading 212 – both huge platforms with exciting features, but which one is right for you? In this comparison I will look at the key features of each trading platform and help you make the right decision on whether to sign up with Etoro or Trading 212 when thinking about your investing or trading preferences.

None of this information constitutes financial advice. This information illustrated in this article comparing Etoro vs Trading 212 may be out of date, or changed since last published, so please check the fine print of both platforms when considering Etoro vs Trading 212.

Some of the links in this article are affiliate links. If you register for services through them, I may receive a benefit from the platform. This will not detract from any offer you might have otherwise received.

Table of Contents

Risk on Etoro vs Trading 212

Etoro have the following warning on their site:

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 74% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money.

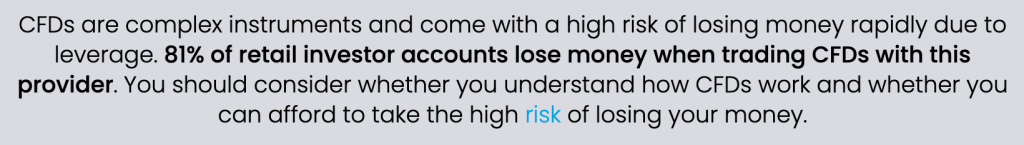

Trading 212 have this one:

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 81% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Trading CFDs is not the same as long term investing, but in any case, understand there is no silver bullet to making money. With that out of the way – let’s get into the juicy content!

Etoro vs Trading 212 Regulation

Let’s get the boring (but important) stuff out of the way! Trading 212 is regulated in various jurisdictions but most importantly for UK users, by the FCA. In the unlikely event of default, the FSCS compensation is up to GBP 85,000 per account. More regulatory information is available on their ‘About Us‘ page.

Etoro is similar with regulation happening with the appropriate bodies in the UK, USA, Europe and beyond. Again, here in the UK the FCA is involved and UK users can enjoy proper regulation and are protected by the FSCS. More information is available here.

Trading 212 vs Etoro for different styles of investing

Investing long term usually mean drip feeding money on a regular basis into assets and holding for a long period of time, hoping that these assets will grow as the years go by.

Trading is a much more active way of trying to take money where you will buy or sell assets on a much more regular basis compared to investing. It’s much higher risk but the rewards can potentially be much higher.

In terms of a long term investment, both platforms offer the facility to buy and hold assets for the long term and both platforms have ample facilities for quick-fire trading too.

Both platforms offer CFD’s for the short term traders among you where you can put your money where your mouth is and bet on companies to do well or do perform poorly. This is not an area I’m interested in, but both platforms offer this. In terms of Etoro vs Trading 212 for short term trading, I’d probably call this one a tie.

Personally, I’m more interested in long term buy and hold and with that in mind there is one thing Trading 212 offers that Etoro doesn’t not. An ISA.

Etoro vs Trading 212 ISA

An ISA is a tax-free wrapper that allows everyone in the UK to invest a certain amount of money (currently £20,000 for adults) without being liable for any tax on any profits. Lovely.

All profits whether they are from the rising value of shares or dividends or whatever are tax free forever.

Etoro do not offer an ISA due to some of the investments they offer. However, they have partnered with Moneyfarm and offer an ISA product by proxy. This is not the same as Etoro actually offering an ISA account for investing.

Etoro vs Trading 212 Long term stability

For anyone looking for a long term home for their investing both these platforms are safe choices. Etoro has been around for ages and the platform continues to grow and evolve.

Trading 212 is a relative newcomer but at the same time is a very mature application, adding new features all the time and growing at a rapid pace.

Both platforms are profit making and while that continues there is no reason to think either platform will be going anywhere any time soon. I have used both platforms and while I think both have their merits, when considering Etoro vs Trading 212 in terms of long term investing, Trading 212 edges this one because of the provision of an ISA.

What assets can you invest in with Etoro and Trading 212

In a Trading 212 ISA or general investing account you can invest in a huge range of stocks and ETFs (baskets of stocks lumped together with something in common… e.g. S&P 500). In their CFD section you can trade long or short with leverage on stocks, ETFs, indices and currencies. That’s quite comprehensive for whatever you are interested in.

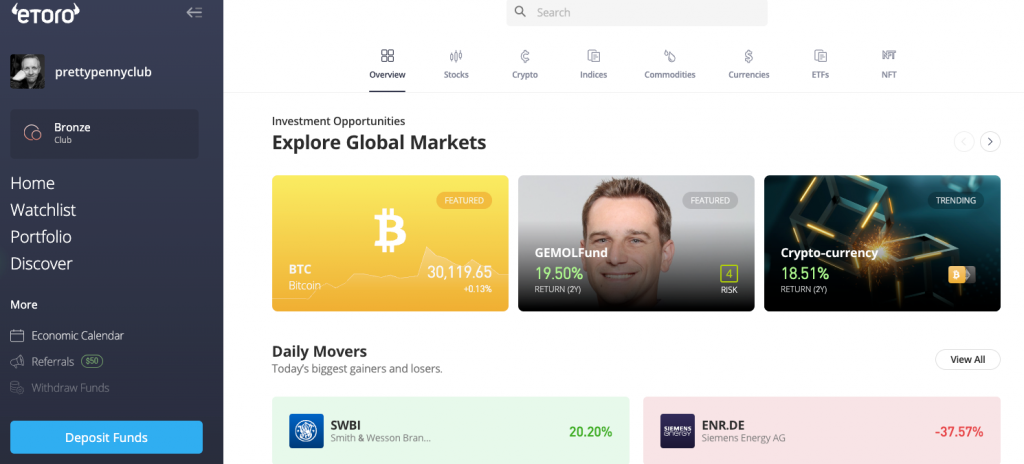

When comparing Trading 212 vs Etoro then the latter goes a step further and offers trading on a wide range of popular (and not so popular) crypto-currencies. You can really diversify your portfolio with Etoro as a one-stop shop for all things trading/investing in a huge range of assets.

So if getting an ISA isn’t a big thing for you, it might just be the flexibility and the range of options that would sway you to open an account with Etoro.

But what about fees?

Trading 212 is cheaper than Etoro.

Looking at the fees for Trading 212 compared to Etoro, then it is plain to see that Trading 212 is much cheaper that Etoro when it comes to fees both up-front and hidden.

Fees are part and parcel of running a business and fees are ok so long as they represent fair value for you. It’s up to you to decide if you are getting the service and facilities from your platform that justify the fees you pay.

Perhaps you enjoy and are more efficient with a particular look and feel? Maybe you like the brand or reputation? Maybe what you want to trade or invest in is on one platform rather than another? There are many reasons to be in a state where you are prepared to pay a particular fee.

With that in mind, let’s take a look at what the fees are like.

CFDs are complicated and different instruments will attract different spread costs. This is the difference between buy price and sell price of the instrument.

It’s difficult to compare these fairly and succinctly because the spreads will be different across different instrument on different platforms. It’s worth examining Trading 212’s CFD spread fees herehttps://www.trading212.com/trading-instruments/cfd and Etoro’s corresponding fees here.

Looking at long term investing fees is much simpler!

| Item | Trading 212 | Etoro |

| Bank Deposit Fee | None | Variable based on currency |

| Card Deposit Fee | 0.7% (first £2000 free) | Variable based on currency |

| Withdrawal Fee | None | $5 (min $30 withdrawal) |

| Inactivity Fee | None | $10/month (after 12 months of inactivity) |

| Account Fee | None | None |

| Forex Fee | 0.15% | Variable based on currency |

The fees are wide and varied with Etoro and whether Etoro suits you or not will depend very much how you like to invest. Do you like to invest across a range or crypto assets as well as regular stocks and shares? Do you prefer simple low cost investments like index trackers? If you prefer the latter the Trading 212 might be a better options.

But then, you’d be missing out on two things that Trading 212 don’t offer, but Etoro do.

Etoro vs Trading 212 for social investing

Etoro and Trading 212 both offer social features, but Etoro definitely place a greater emphasis on their social offerings compared to Trading 212. Let’s examine Etoro first.

Etoro CopyTrading

Etoro is well-known for its CopyTrading feature, which allows users to automatically replicate the trades of successful traders on the platform.

Customers can browse and evaluate the performance and strategies of different traders over different time periods, and choose to allocate funds to copy their trades. You can look at the risk these investors and traders are taking too, to find something that suits your profile.

This feature enables users to benefit from the expertise of others and potentially replicate their success. However, it’s not without risk and shouldn’t be seen as an easy way to get rich. You are placing your faith in these folks to get it right!

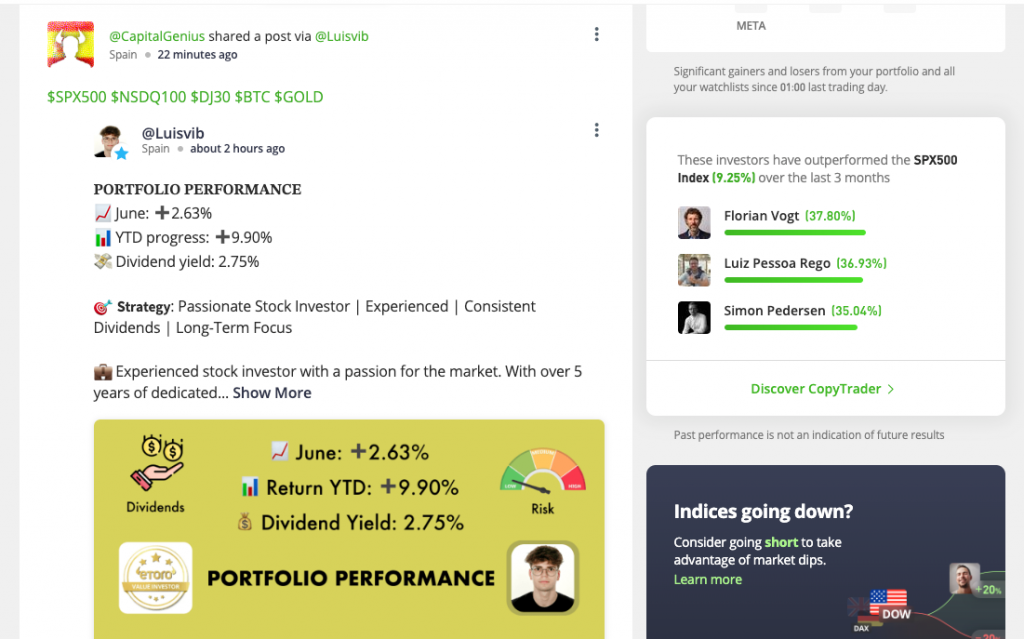

Etoro Social News Feed

Etoro provides a social news feed where users can interact and share insights and their ideas with fellow traders on the Etoro platform. Users can follow other customers, comment on posts, and engage in discussions.

This really helps foster a collaborative environment for learning and exchanging ideas. Watch out for the trolls!

Let’s see what Trading 212 are offering…

Trading 212 Community Insights

Trading 212 has a community-driven aspect where users can share their trading insights, strategies, and analysis.

The platform allows users to publish and browse market insights in a kind of forum like set-up.

You can ask people to comment on your posts and you too can engage in discussions with other investors on Trading 212. This way everyone gets to see what others think of their investments in real time.

Trading 212 offer ‘pies’ also to help group your investments together where each stock is a slice of your pie. You can share these with the community and other people can copy them too.

Watchlists

Trading 212 allows users to create and share watchlists of stocks, ETFs, and other assets.

Customers can discover popular or curated watchlists created by other traders, enabling them to explore new investment opportunities and gain insights from other Trading 212 users’ strategies.

Etoro vs Trading 212 Customer service

In my opinion this isn’t even close.

Personally, I find Trading 212’s customer service far superior than eToro’s for several reasons.

Firstly, and most importantly, I appreciate the prompt and efficient responses I receive from their customer support team. Typically, in the past when I have needed help I’ve received responses in less than a minute through the app.

Etoro largely deal in email support for run-of-the-mill queries and support tickets aiming to respond within 48 hours. In my experience it was always longer than that.

If you don’t need much help, then great, no issues for you, but when you do need them it can be frustrating to wait so long for a reply.

With Trading 212 whenever I reach out with an inquiry or concern, they are quick to address it and provide me with clear and concise answers. Generally speaking when the responses come from Etoro, they are good, but it just takes so long to get there!

When customer service can respond quickly, it make you feel more valued as a customer and helps you build confidence in your investing platform. When it isn’t so good, then bad customer service can really put you off the company as a whole.

I want my investing platform to be quick, reliable and offer help when I need it so comparing Etoro’s customer service to Trading 212’s means that Etoro fall a long way short of it’s competitors.

Education at Etoro and Trading 212

Etoro and Trading 212 both offer learning resources to help you understand the nature of investing and the jargon used in the industry. Etoro do this very well with a “course” containing ten modules that have a focused learning objective like “Why should I consider investing?” or “A Guide to Investing vs. Trading” and the massively important thing to think about “How to Manage Risk as a Stock Trader or Investor“

They are useful guides but shouldn’t be your only source of information.

Trading 212 is similar with a dedicated section on their website and app for learning about investing. They offer information on all aspects of investing but more focus on the long term nature of investing – things like dollar cost averaging, understanding financial statements or dividend investing.

Both are good and it would do no harm to cover all the information offered by both sites when it come to boning up on some investing knowledge.

It’s worth noting that Etoro will give you a practice account with a virtual $100,000 in it to get used to the platform and try out some strategies. This is really useful to help you get used to buying/selling and working with your platform before you get stuck in with your hard earned cash.

Summary

Overall, both these services offer interesting features that set them apart from each other. What is important is that you find something that suits your style. Of course if you try and platform and don’t like it, there is no reason you can’t quickly move on.

If you have found this information useful, I would hugely appreciate you using my links to sign up for these platforms. More information can be found on my offers page!

Up next – Lightyear vs Trading 212 – easy comparison

eToro is a multi-asset platform which offers both investing in stocks and cryptoassets, as well as trading CFDs.

Please note that CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 74% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money.

Past performance is not an indication of future results. Trading history presented is less than 5 complete years and may not suffice as basis for investment decision.

Copy Trading does not amount to investment advice. The value of your investments may go up or down. Your capital is at risk.

Cryptoassets are highly volatile and unregulated in the UK. No consumer protection. Tax on profits may apply.

eToro USA LLC does not offer CFDs and makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication, which has been prepared by our partner utilizing publicly available non-entity specific information about eToro.