It sounds obvious, but investing is pointless without money. You can’t invest fresh air and enjoy compounding fresh air. Investing is all about the bottom line and unless you are investing ‘decent’ money, there are probably better ways to make money rather than waiting for smaller sums to build up.

Table of Contents

In this article I’m going to talk about some of harsher truths of investing that people generally don’t want to talk about.

We are making a departure from the well trodden line that any kind of investing is good, and that future you will thank you.

The truth is, future you might hate you because you could be missing out on so much better.

Investing is pointless because the accepted wisdom isn’t always correct.

I’ve been a part of the investing and (dare I say it) FIRE community for a good long time now. However, there are occasions when I read something or hear something about investing being the key the building wealth and I wince. While in the main, investing is a fantastic way to make money over the long term, it’s not great advice for many people starting out on a journey to make more cash.

It’s fair to say over the last hundred years or so, the stock market has proven to be the best route to building wealth, with markets returning something between 8-10% – but percentages are relative terms and the bottom line is not the same to all people in all situations.

Let me explain…

We get bombarded on social media with wonderful stats like these:

There is a lot in here I don’t like.

- It’s a handy example and is a tasty sound-byte for an echo-chamber like Twitter. A sort of “faux-moment” of clarity – an false epiphany.

- I’ve heard this kind of thing so many times I really believe people think it’s a foregone conclusion.

- It’s an easy engagement tweet and belittles the effort involved to save and invest money.

- The assumption that double digit returns, on average, will last for another 50 years isn’t great. They might, they might not… who knows.

- $11 dollars a day is probably a lot of money to a lot of people.

But the very interesting part is that after 20 years 90% of the balance is coming from compounded interest. If you are skeptical, take a look at this chart.

| Year | Deposits & Withdrawals | Interest | Total Deposits & Withdrawals | Accrued Interest | Balance |

|---|---|---|---|---|---|

| 0 | $11.00 | – | $11.00 | – | $11.00 |

| 1 | $3,960.00 | $200.86 | $3,971.00 | $200.86 | $4,171.86 |

| 2 | $3,960.00 | $658.55 | $7,931.00 | $859.41 | $8,790.41 |

| 3 | $3,960.00 | $1,166.60 | $11,891.00 | $2,026.01 | $13,917.01 |

| 4 | $3,960.00 | $1,730.52 | $15,851.00 | $3,756.53 | $19,607.53 |

| 5 | $3,960.00 | $2,356.48 | $19,811.00 | $6,113.01 | $25,924.01 |

| 6 | $3,960.00 | $3,051.29 | $23,771.00 | $9,164.30 | $32,935.30 |

| 7 | $3,960.00 | $3,822.53 | $27,731.00 | $12,986.83 | $40,717.83 |

| 8 | $3,960.00 | $4,678.61 | $31,691.00 | $17,665.45 | $49,356.45 |

| 9 | $3,960.00 | $5,628.86 | $35,651.00 | $23,294.30 | $58,945.30 |

| 10 | $3,960.00 | $6,683.63 | $39,611.00 | $29,977.94 | $69,588.94 |

| 11 | $3,960.00 | $7,854.43 | $43,571.00 | $37,832.37 | $81,403.37 |

| 12 | $3,960.00 | $9,154.02 | $47,531.00 | $46,986.39 | $94,517.39 |

| 13 | $3,960.00 | $10,596.56 | $51,491.00 | $57,582.96 | $109,073.96 |

| 14 | $3,960.00 | $12,197.79 | $55,451.00 | $69,780.74 | $125,231.74 |

| 15 | $3,960.00 | $13,975.14 | $59,411.00 | $83,755.88 | $143,166.88 |

| 16 | $3,960.00 | $15,948.01 | $63,371.00 | $99,703.89 | $163,074.89 |

| 17 | $3,960.00 | $18,137.89 | $67,331.00 | $117,841.78 | $185,172.78 |

| 18 | $3,960.00 | $20,568.66 | $71,291.00 | $138,410.43 | $209,701.43 |

| 19 | $3,960.00 | $23,266.81 | $75,251.00 | $161,677.24 | $236,928.24 |

| 20 | $3,960.00 | $26,261.76 | $79,211.00 | $187,939.00 | $267,150.00 |

| 21 | $3,960.00 | $29,586.15 | $83,171.00 | $217,525.15 | $300,696.15 |

| 22 | $3,960.00 | $33,276.23 | $87,131.00 | $250,801.37 | $337,932.37 |

| 23 | $3,960.00 | $37,372.21 | $91,091.00 | $288,173.58 | $379,264.58 |

| 24 | $3,960.00 | $41,918.75 | $95,051.00 | $330,092.34 | $425,143.34 |

| 25 | $3,960.00 | $46,965.42 | $99,011.00 | $377,057.75 | $476,068.75 |

| 26 | $3,960.00 | $52,567.21 | $102,971.00 | $429,624.97 | $532,595.97 |

| 27 | $3,960.00 | $58,785.21 | $106,931.00 | $488,410.17 | $595,341.17 |

| 28 | $3,960.00 | $65,687.18 | $110,891.00 | $554,097.35 | $664,988.35 |

| 29 | $3,960.00 | $73,348.37 | $114,851.00 | $627,445.72 | $742,296.72 |

| 30 | $3,960.00 | $81,852.29 | $118,811.00 | $709,298.01 | $828,109.01 |

It’s hard to get the numbers exactly right due to the limitations of the compound interest calculator, but look at year 30.

After 30 years you will have contributed around $118,000 to a total pot of $828,000. That’s around $709,000 racked up in interest alone. By year 30, you are making over $81,000 a year on interest alone, with this projection.

The projection of 11% is generous. Personally, I think it’s unlikely we will see those returns over another thirty years, but it is headlines like this that perpetuate the narrative that you must invest at all costs.

This ideal is particularly prevalent on places like Twitter and in other online communities.

So how can it be that investing is pointless?

As I say, the numbers at year thirty are huge. You have a big deposit sitting in an account paying chunky interest.

Even at 5% this is paying out a sum approaching $40,000.

But what happens to this exciting investing path when the deposits we are looking at are much smaller.

The answer – investing becomes a huge slog – to the point where it feels like investing is pointless.

Right now, there is huge downward pressure on household and family budgets. Inflation still way above what we are used to (and the Bank of England target) and interest rates are rising. Pretty much all of us are seeing our disposable income shrinking like never before.

For many there is simply no money left over at the end of the month to save or invest. It all goes on essentials.

Let’s say you have $50 left at the end of the month. Should you be investing that?

I say no.

Hear me out.

Let’s consider a more sensible, sustainable projection of 6% returns per year. With regular savings accounts at the bank approaching similar rates, you even have option to go for cash or for stock market investments.

Let’s run the compound interest calculator again

| Year | Deposits & Withdrawals | Interest | Total Deposits & Withdrawals | Accrued Interest | Balance |

|---|---|---|---|---|---|

| 0 | $50.00 | – | $50.00 | – | $50.00 |

| 1 | $600.00 | $16.50 | $650.00 | $16.50 | $666.50 |

| 2 | $600.00 | $48.04 | $1,250.00 | $64.54 | $1,314.54 |

| 3 | $600.00 | $81.20 | $1,850.00 | $145.74 | $1,995.74 |

| 4 | $600.00 | $116.05 | $2,450.00 | $261.79 | $2,711.79 |

| 5 | $600.00 | $152.68 | $3,050.00 | $414.47 | $3,464.47 |

| 6 | $600.00 | $191.19 | $3,650.00 | $605.66 | $4,255.66 |

| 7 | $600.00 | $231.67 | $4,250.00 | $837.33 | $5,087.33 |

| 8 | $600.00 | $274.22 | $4,850.00 | $1,111.55 | $5,961.55 |

| 9 | $600.00 | $318.95 | $5,450.00 | $1,430.50 | $6,880.50 |

| 10 | $600.00 | $365.96 | $6,050.00 | $1,796.46 | $7,846.46 |

| 11 | $600.00 | $415.38 | $6,650.00 | $2,211.85 | $8,861.85 |

| 12 | $600.00 | $467.33 | $7,250.00 | $2,679.18 | $9,929.18 |

| 13 | $600.00 | $521.94 | $7,850.00 | $3,201.12 | $11,051.12 |

| 14 | $600.00 | $579.34 | $8,450.00 | $3,780.46 | $12,230.46 |

| 15 | $600.00 | $639.68 | $9,050.00 | $4,420.13 | $13,470.13 |

| 16 | $600.00 | $703.10 | $9,650.00 | $5,123.23 | $14,773.23 |

| 17 | $600.00 | $769.77 | $10,250.00 | $5,893.00 | $16,143.00 |

| 18 | $600.00 | $839.85 | $10,850.00 | $6,732.85 | $17,582.85 |

| 19 | $600.00 | $913.51 | $11,450.00 | $7,646.37 | $19,096.37 |

| 20 | $600.00 | $990.95 | $12,050.00 | $8,637.32 | $20,687.32 |

| 21 | $600.00 | $1,072.35 | $12,650.00 | $9,709.66 | $22,359.66 |

| 22 | $600.00 | $1,157.91 | $13,250.00 | $10,867.57 | $24,117.57 |

| 23 | $600.00 | $1,247.84 | $13,850.00 | $12,115.41 | $25,965.41 |

| 24 | $600.00 | $1,342.38 | $14,450.00 | $13,457.79 | $27,907.79 |

| 25 | $600.00 | $1,441.76 | $15,050.00 | $14,899.55 | $29,949.55 |

| 26 | $600.00 | $1,546.22 | $15,650.00 | $16,445.77 | $32,095.77 |

| 27 | $600.00 | $1,656.02 | $16,250.00 | $18,101.79 | $34,351.79 |

| 28 | $600.00 | $1,771.45 | $16,850.00 | $19,873.24 | $36,723.24 |

| 29 | $600.00 | $1,892.77 | $17,450.00 | $21,766.01 | $39,216.01 |

| 30 | $600.00 | $2,020.31 | $18,050.00 | $23,786.32 | $41,836.32 |

Is investing pointless if you make $2000/year?

After 30 years, you could be making around $2000 in interest alone. Not terrible, but it shows that those amazing figures from the previous example don’t really hit hard until either you have a significant pot built up.

Getting that pot is going to depend on either increasing your monthly contributions or a bigger starting deposit. Without being aggressive with your investments it’s all a bit pointless.

In our first year, in this example, considering the 6% annual interest is applied on a monthly basis we make just $16.50 on our investment of $600. Even less so if we apply the interest at the end of the year.

That’s not a good way to make money.

Admittedly it is a very hands off way to make money, and creating a habit where you try to save or invest some of your income each month is worthwhile. However, $16.50 for a return on $600 capital is below par and it’s why investing is pointless unless there is ‘decent’ money invested.

If the goal is to make money, then at these lower levels of savings you could be doing so much better than investing in the stock market or high interest accounts at the bank.

In my opinion investing is pointless until you hit the point where the size of the returns beats all other ways to make money. At high amounts investing scales incredibly well.

If the point of investing is to make money then one has to acknowledge that when dealing with smaller amounts of money, there are better ways to make money.

Oh yeah? What better ways are there to make money?

It’s likely you could double that $600 pretty quickly just by putting in a little more effort, rather than depositing your money in an investment account and then sitting passively. This is why investing is pointless at low levels.

Here are a couple of quick ideas.

Reselling and upcycling

A quick scan of Facebook marketplace, or the local listings is going to throw up loads of items that people are looking rid of very cheaply, or even free.

Many of these items are pieces of furniture for example.

With a bit of leg work, you can pick these items up locally, tidy them up, give them a lick of paint, perhaps and resell them.

If you are getting these items cheaply, even free, and sell them for, say, $30 then you have just made two years interest compare to investing. $30 is really cheap so there are going to be plenty of people to buy from you. You could probably sell them for much more if you have a good eye for design. You go go the whole hog and turn it into a side-hustle!

Low cost items like this have a huge pool of potential buyers so you should be able to turn over items easily and beat your investing rate.

Affiliate links

If, like me, you love to talk about investing and getting good value for your money then you could spend a few pounds to set up your own website (just like this one!) to talk about your passion and scatter affiliate links through your articles.

Take for example, Trading 212. It’s a great all round platform for investing. It offers an ISA account, general investing, and trading services. Each time someone uses my link to sign up and start investing I will get free shares, typically worth between ten and twenty pounds.

By offering useful content and answering questions, people can use my links to get a bonus for themselves and it’s an opportunity to say thanks for the info I’m putting out free of charge.

It’s a win, win.

Investing less than £50/year has given me a platform to funnel a series of one off payments from affiliate links that will dwarf the stock market returns on $600. Adding the free shares I have earned to an investing pot will really help get up to those higher amounts faster and make the investing process a whole lot more worthwhile.

Of course, you don’t have to stop at one affiliate partner, and you don’t have to talk about money either. Find something you are passionate about, some companies you would be proud to be associated with and get earning faster than what stock market investments can return.

Flipping items

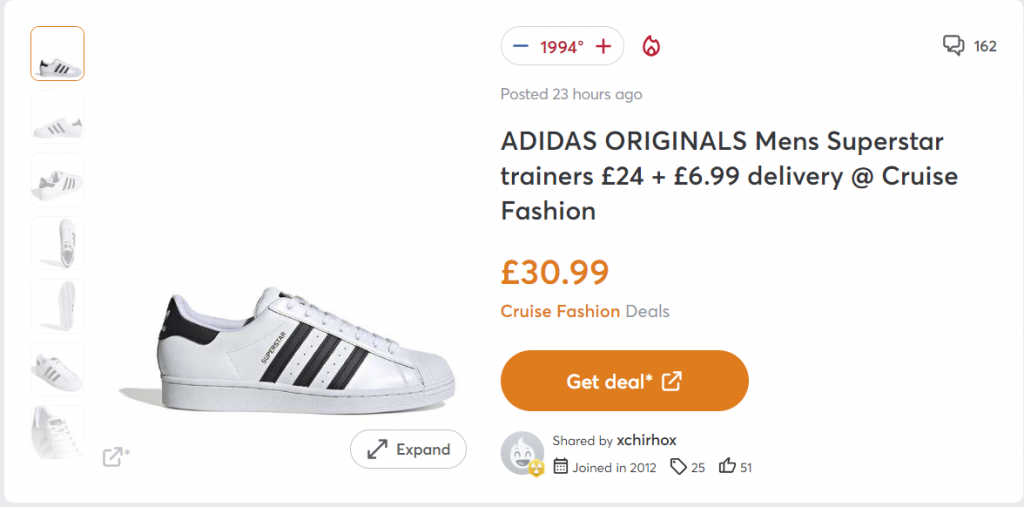

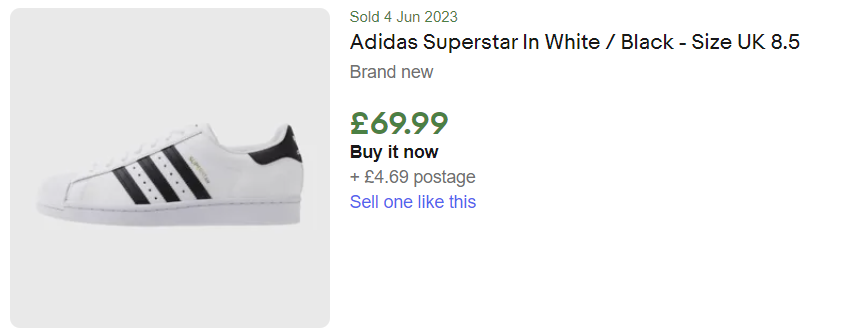

With a limited budget investing is pointless compare to flipping low value items. Again, a bit more effort required, but the returns are better. Here’s an example of a recent flip

Sold on Ebay for over double the sale price from the online vendor.

Hotukdeals is a great place to find possible bargains to flip.

It’s not guaranteed you will sell at a profit of course, but find the right product, do a quick check on ebay to see th going rate, and you should be able to be just about certain you are going to make some money.

It’s a huge return compared to what you could expect to make investing in those early years.

The tipping point

Piling all this extra money into your investments means the return from interest payments is eventually going out-pace any flipping, reselling or any other intensive money making plan. (Affiliate income is still an incredible opportunity because it scales so well)

Investing is pointless…. really?

To say investing is pointless is a bit strong.

After all, Rome wasn’t built in a day and investing is not about what you have today, but rather what your investments look like in thirty years time.

The habit of putting even a little bit away each month and having that money work for you passively is a super-power.

Over your lifetime, it’s probably going to be possible to increase your income, and instead of inflating your lifestyle, adding this extra disposable income to your regular investing is going to supercharge your future earnings.

If you are interested in getting started investing, I also have some great signup offers over here, to get you off to a good start.

Credits: