Investing in the best ETFs on InvestEngine is key to maximising your investing returns. In this article I’ll look at what might be the best ETFs on InvestEngine for you.

Of course, everyone is different and each of us will have different investing goals. However, even if this article can help you understand what an ETF is made up of, how much it costs and the goals of each ETF we look at then you will be in a better position to judge other ETFs even if these ones don’t appeal to you.

I don’t invest in bonds at all (at the time of writing) so I’m only looking at stocks and shares ETFs. No ETFs of bonds here, for example.

As always, none of this is financial advice. It’s just my opinion. Investments can go up or down. Any time you invest you could get back less that you put in. Talk to a professional if you have any doubts about any kind of investment.

Further, at the time of writing I hold positions in VWRL, VUKE, VUSA and ICLN. Just disclosing that, in case anyone is concerned I’m trying to shill anything here!

Table of Contents

Best ETFs on InvestEngine for Global Investing

Vanguard FTSE All-World (VWRL)

One of the best ETFs available on InvestEngine for 2023 is VWRL. It is massively popular – maybe even the best all world ETF offered by one of the most trusted names in investing.

VWRL is a UK-listed passively managed fund that tracks the FTSE All-World Index, which includes companies from both developed and emerging markets.

Let’s un-pack that last sentence to help you understand what is going on with this ETF.

Understanding ETFs

First of all – an ETF is an Exchange Traded Fund. For the purpose of this article it’s ok to think of these as a basket of stocks, grouped together through some common theme. This group of stocks can then be considered, bought and sold as a single entity.

Secondly – a passively managed fund, is a type of investment fund that aims to track the performance of a specific market index rather than trying to beat it. This is different from an actively managed fund, where a fund manager takes control of the buying and selling of assets to try to outperform some sort of baseline metric.

Finally, an all world index is one that takes companies of all shapes and sizes from across the globe into consideration. When you buy an all world index you get diversification across many sectors and geographies – essentially getting a little piece of companies from all across the world.

A couple of other things from the screen shot above.

Distributing or Accumulating

A distributing ETF (‘Dist’) pays out the income from its underlying holdings. Dividends, for example, might be part of the payout of the stocks in this ETF. That means those dividends will be paid out, rather than automatically reinvested if the ETF was an accumulating ETF (‘Acc’).

TER

TER stands for Total Expense Ratio and is how much in percentage terms that the ETF charges for investment management and admin costs each year.

The TER is deducted directly from the ETF rather than being charged separately, and the value and performance of your investment is quoted after this deduction.

This charge will apply no matter where you buy your ETFs. It’s not a platform charge. Some platforms such as Vanguard will have a charge to use their platform on top of the costs of any ETFs. InvestEngine don’t charge anything when you want to pick your own investments.

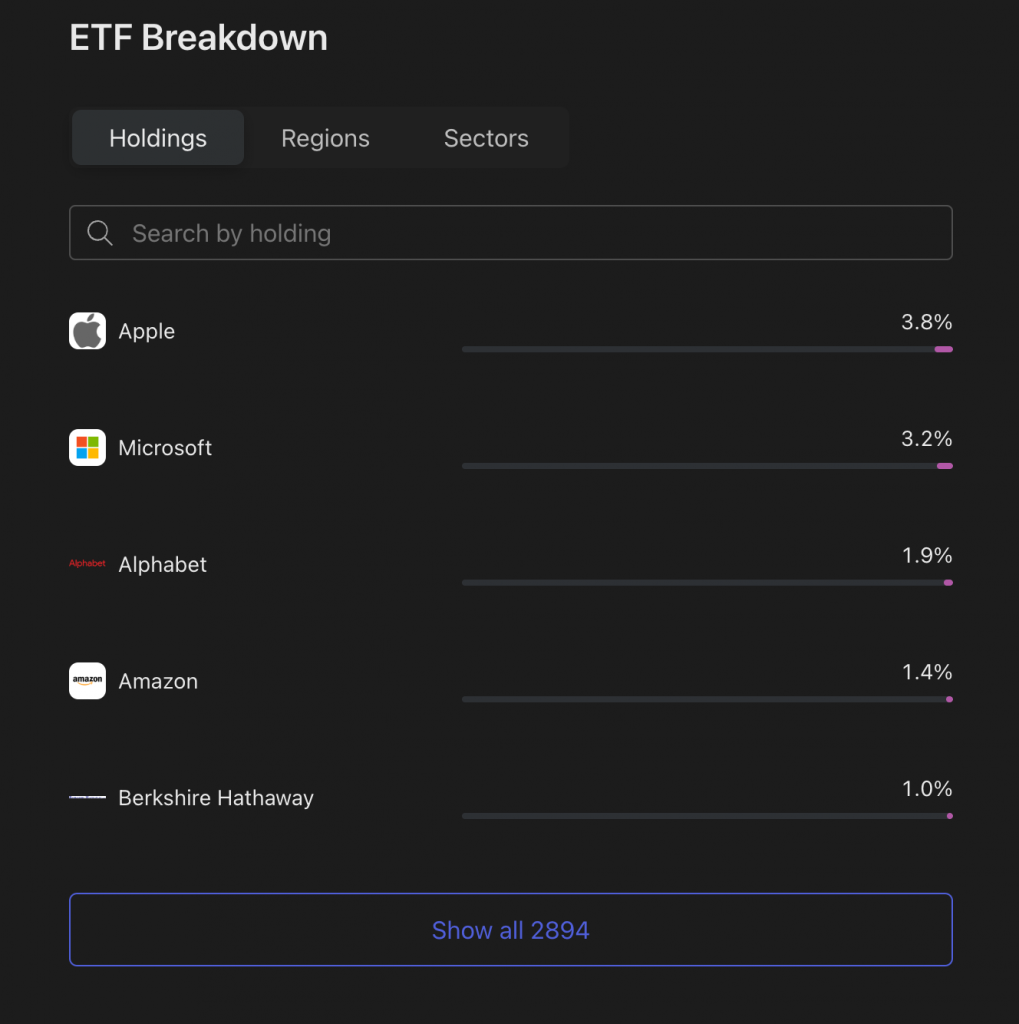

What is in the ETF?

Sticking with the VWRL example as one of the best ETFs to buy on InvestEngine, let’s look at what you are getting when you invest in VWRL.

There are over 2800 companies in this ETF from across the globe. The biggest holdings are shown above – Apple, Microsoft, Alphabet, Amazon and Berkshire Hathaway.

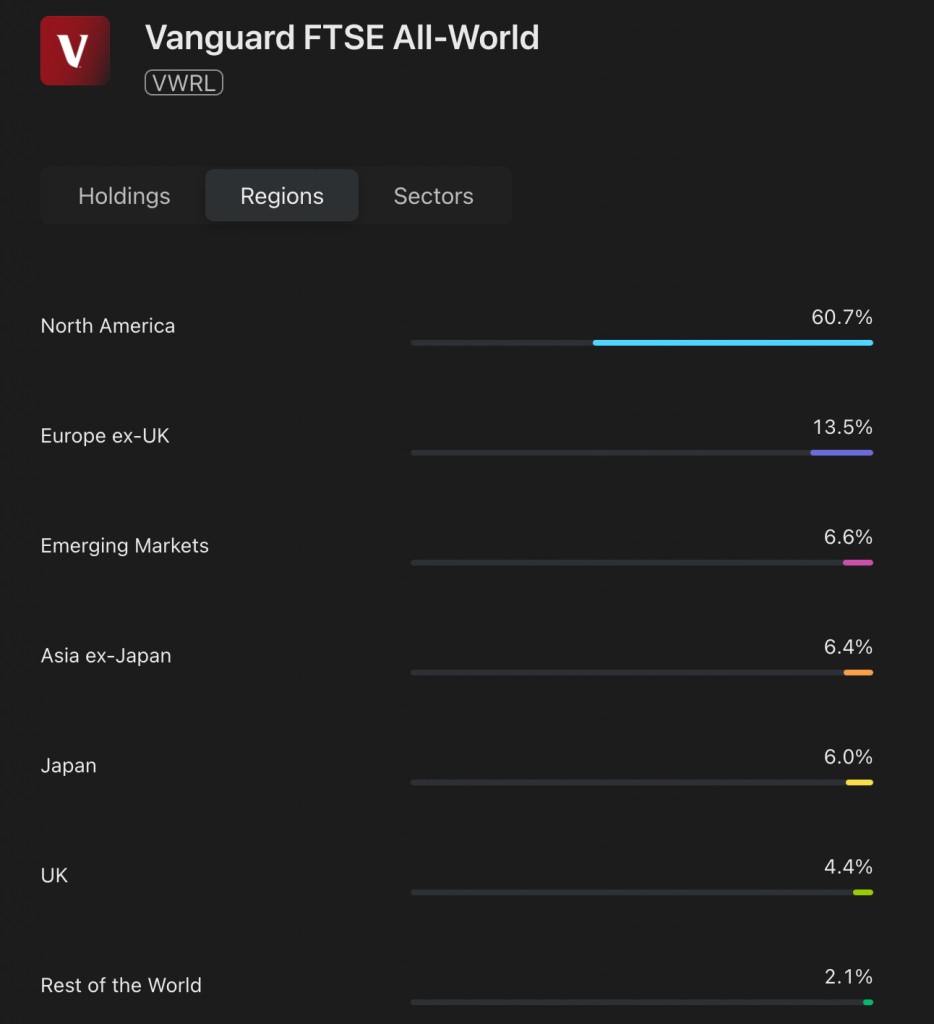

Regions

Looking at regions, you can see where the companies in the ETF are in terms of their geography.

Most of it is in North America. This makes sense as most of the big companies in the world are to be found in the United States and so the weighting of this ETF will reflect that.

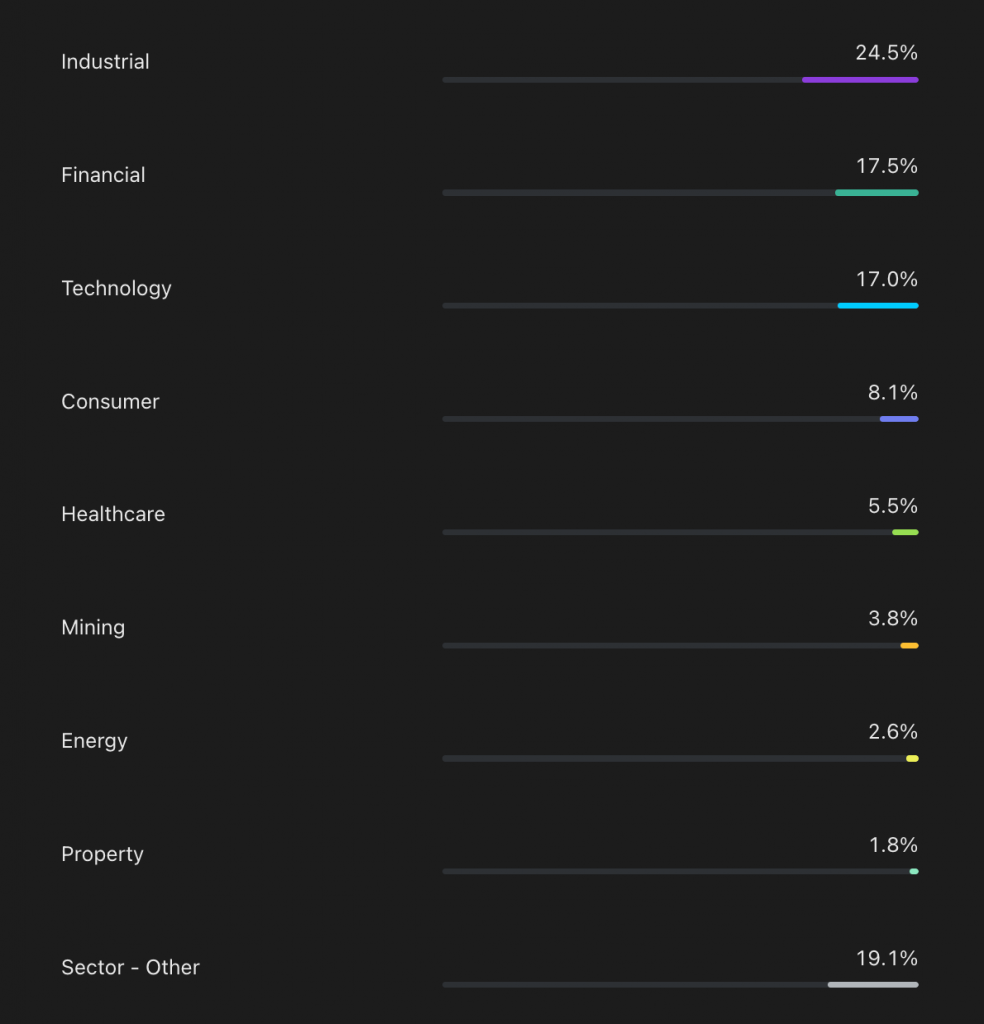

Sectors

Finally, looking at the Sectors, you can see in what industries this ETF is invested in.

These details are available on any ETF on InvestEngine (and other platforms too) and it is important to understand what you are investing in.

However, VWRL is not in my main ISA right now… maybe it should be!

So with this knowledge under your belt, let’s look at some more of the best ETFs on InvestEngine.

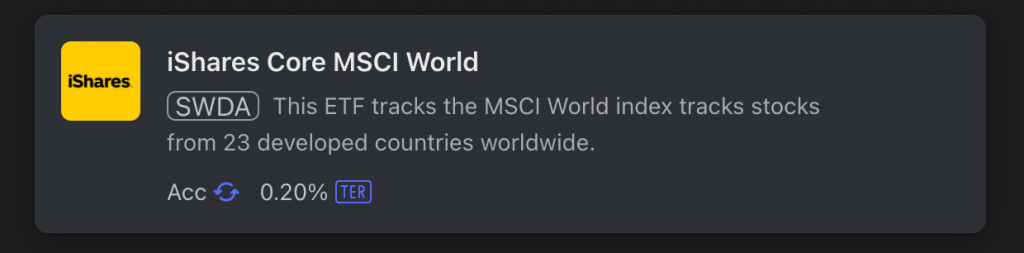

iShares Core MSCI World ETF (SWDA)

Another global option is iShares Core MSCI World ETF. This is global ETF but only looks at developed countries. The idea is that there should be less volatility because of the omission of developing nations.

However, this does mean you are invested in fewer companies around the world and it carries more concentrated holdings. In saying that there are still over 1400 holdings in this ETF, with some big names like Amazon, VISA and Coca-Cola.

The charge for this one, as per the screenshot, is 0.2% and it is an accumulating index, which means any income is automatically reinvested.

Best ETFs to Invest in the UK

Investing in the UK is starting to look very attractive again, and InvestEngine has plenty of UK ETFs to choose from. The UK can boast lots of strong companies, household names and improving dividends. Recently the FTSE 100 touched fresh all-time highs despite the global economic problems.

So with our leading stocks doing so well here in the UK, let’s see have a look at a couple of the best ETFs for investing in the UK on the InvestEngine platform.

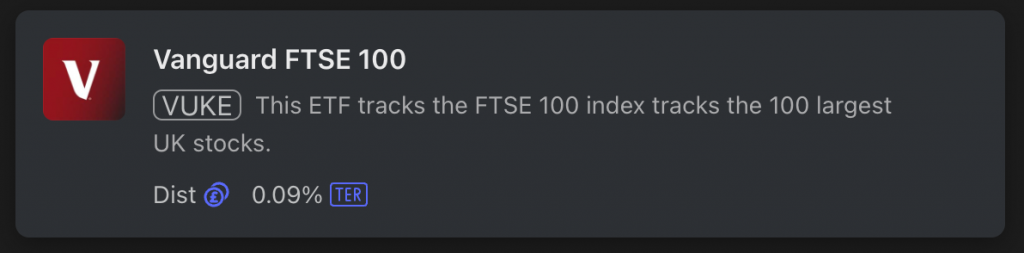

Vanguard FTSE 100 ETF (VUKE)

Vanguard FTSE 100 ETF (VUKE) is a UK equity ETF that tracks the performance of the FTSE 100 index. The FTSE 100 index is made up of the 100 largest companies listed on the London Stock Exchange and is generally acknowledged to be a good indicator of the UK stock market as a whole.

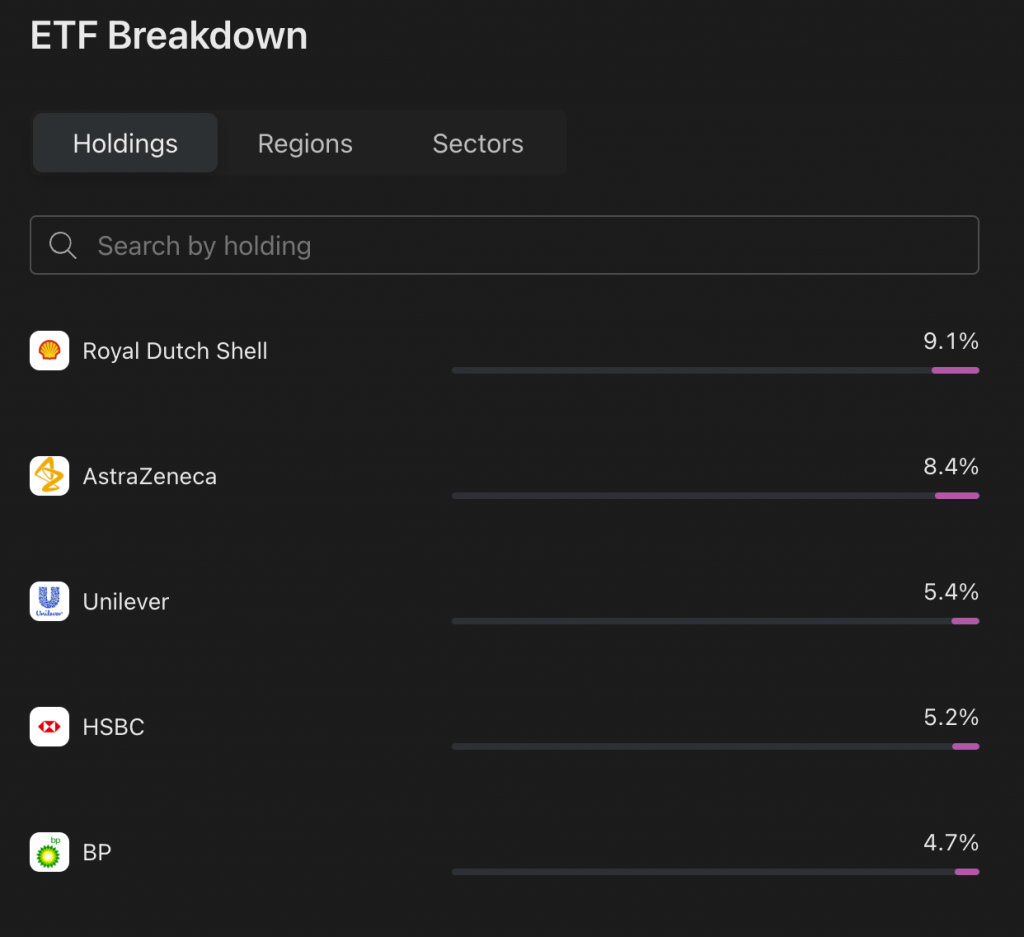

VUKE offers low-cost exposure to a broad range of large, well-established UK companies, including those in the financial, energy, and healthcare sectors. The ETF invests in the stocks included in the FTSE 100 index in proportion to their weighting in the index.

One of the key benefits of investing in VUKE is its low expense ratio, which is a measure of the annual fees charged by the fund. It’s a Vanguard ETF – I’m a huge fan of Vanguard products, known for their low-cost investment products.

VUKE is a cheap ETF to invest in with InvestEngine – an expense ratio of 0.09%, which is significantly lower than the average expense ratio of UK equity ETFs.

This means it only costs £0.90 per £1000 invested.

If you are a fan of UK stocks, this could be a great option for you.

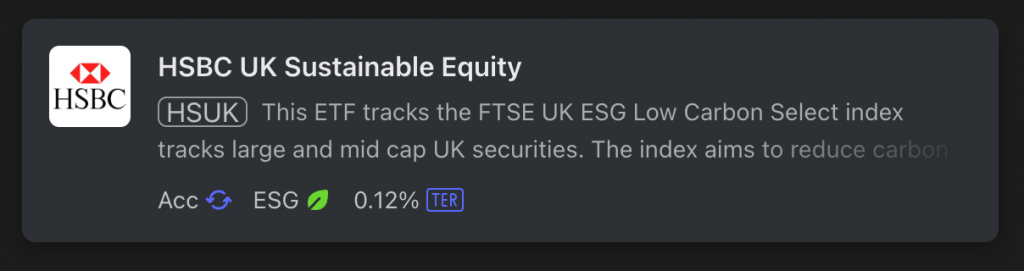

HSBC UK Sustainable Equity ETF (HSUK)

HSBC UK Sustainable Equity ETF is offered by HSBC Global Asset Management. The ETF aims to provide exposure to companies in the UK that are considered to have a positive impact on the environment and society, while also delivering competitive financial returns.

For many, investing should be about more than just making money. Many feel a moral or ethical responsibility to invest in companies trying to do some good. Or at least, no bad stuff!

The ETF invests in a diverse range of UK companies that meet certain sustainability criteria, such as companies that are reducing their carbon footprint, promoting diversity and equality in the workplace, and promoting good governance. The ETF may also exclude companies that have a negative impact on the environment and society, such as those involved in controversial weapons or fossil fuels.

By investing in companies that are considered to be more sustainable, the HSBC UK Sustainable Equity ETF aims to offer investors the opportunity to align their investments with their values and beliefs, while also potentially benefiting from long-term financial returns.

As ever, it’s not one-size fits all and what you deem unethical might be ok with me. As always, you should check exactly what you are investing in when it comes to picking ETFs.

Best ETFs for investing in USA on InvestEngine

Investing in US companies is very easy for us folks here in the UK. InvestEngine have lots of ways to invest in US stocks. Many of the big names that come to mind, such as Amazon, Google, Paypal, Mastercard, are all listed in the United States, so it makes sense to want to have some exposure in that area.

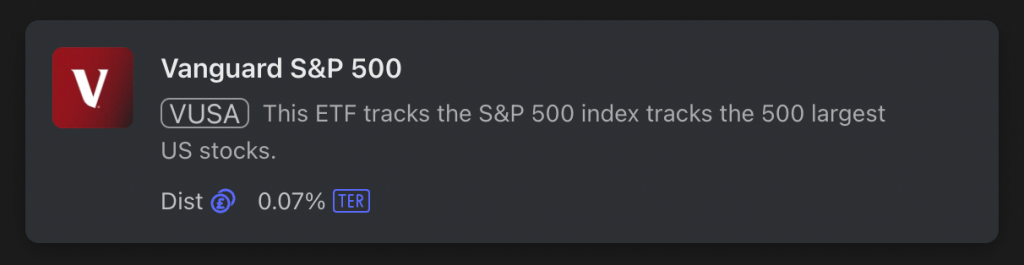

Vanguard S&P 500 (VUSA)

The Vanguard S&P 500 ETF tracks 500 largest US stocks. Pretty much every investor I know has some exposure to US stocks and, in my opinion, this is a great way to do it one swoop. It is an ETF I have invested heavily in, over the years.

Historically this ETF has performed very well.

It is very cheap at 0.07% offering exposure to a broad range of large, well-established companies across different sectors, including technology, financials, healthcare, and consumer goods.

There are tons of S&P 500 options on InvestEngine – a quick search on their ETF finder will show you a wide range of products that are similar to this one.

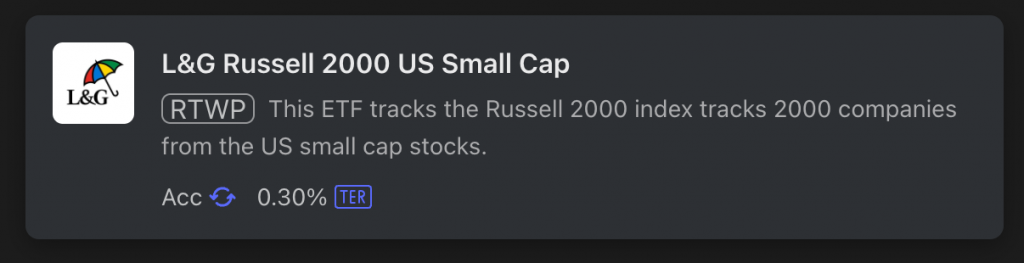

L&G Russell 2000 US Small Cap (RTWP)

The L&G Russell 2000 US Small Cap ETF is an alternative for people who want exposure to the smaller side of US equities.

The Russell 2000 is a stock market index that measures the performance of the small-cap segment of the U.S. equity market.

The index is composed of the 2,000 smallest companies in the Russell 3000 Index, which represents approximately 8% of the total market capitalisation of the U.S. stock market.

Investing in this ETF means you could potentially benefit from the growth potential of small-cap companies.

However, investing in small-cap companies also comes with higher risk.

Small-cap companies tend to be less established and may be more volatile than larger, more established companies. Further, stocks of smaller companies tend to be a lot less liquid – there is less money changing hands on these shares everyday – so price swings can be a bit more violent.

RTWP is a bit more expensive than other ETFs on this article, sitting at 0.3%. Costs should always be a factor when considering what to buy.

An ETF I love – but not for everyone

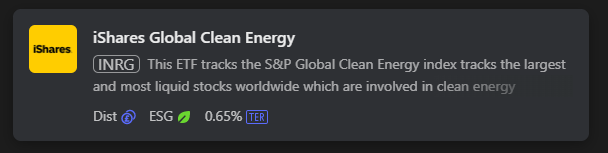

iShares Global Clean Energy UCITS ETF is aims to track the investment results of an index composed of global companies involved in clean energy and renewable energy production.

The fund holds a diversified portfolio of stocks in companies engaged in businesses such as solar, wind, hydro, and other renewable sources. INRG ETF is designed to offer investors exposure to the growing clean energy sector

The reason I say it isn’t for everyone is that is is based on a specific industry. You are certainly limiting the diversity available by zero-ing in on a particular area. That in itself makes this ETF more risky than other broader ETFs.

It’s also more expensive than broader index ETFs at 0.65%.

However, the reason I like this one is the potential. Clean energy is coming. It has to! The world is running out of options and I think it is a hugely exciting area to have an interest in. Electric cars, renewable energy, hydrogen… all kinds of cool stuff in the works.

Want to buy the best ETFs on InvestEngine?

I love my InvestEngine ISA as you can see in this review and I have an offer for you below:

If you are interested in trying InvestEngine, please consider using my link. For new accounts you can get a £25 bonus when you invest at least £100 for 12 months. This offer is not available through the general website.

http://investengine.pxf.io/PrettyPennyISA

InvestEngine UK Limited is authorised and regulated by the Financial Conduct Authority FRN: 801128. InvestEngine Accounts are FSCS protected up to £85,000. Capital at risk.