Money goes to money. The rich get richer. The odds certainly seemed stacked against you to achieve your ambitious financial goals. Particularly these days with ever increasing demands on your money just to get the bills paid, get food on the table and keep the roof over your head and still have some money left over to enjoy yourself.

Table of Contents

The first £100,000 seems so far away

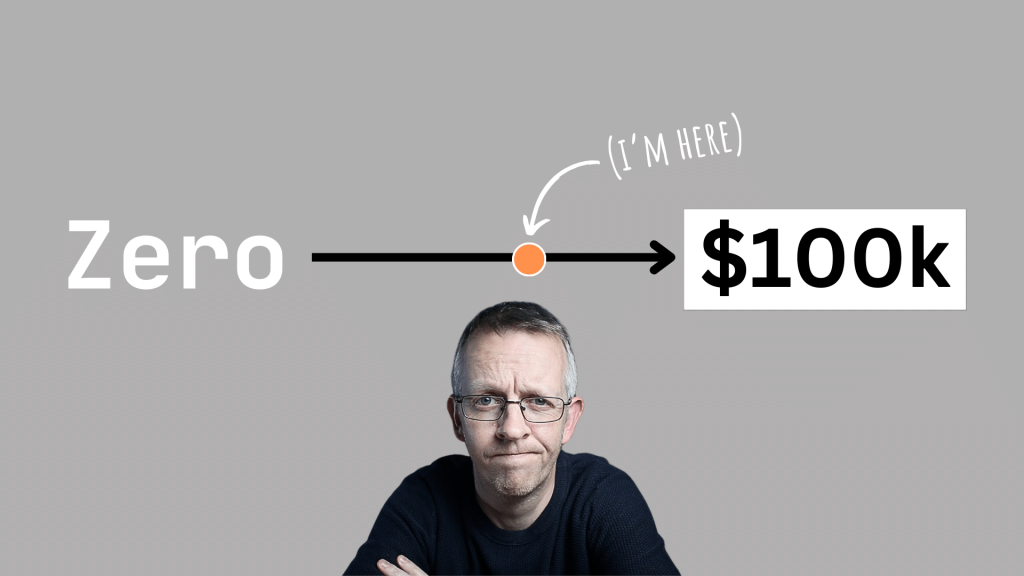

If you are thinking that wealth and financial freedom are just too far away to even be bothered attempting to build wealth, then in this blog I’m here to offer you encouragement to get that elusive first £100,000 in the bank and why it’s so important, even if I’m not there yet myself.

Today, I’m living the journey to my first £100,000 stocks and shares portfolio right now – in public on youtube… and I can tell you it’s sometimes hard to keep that grind up. At the last count we are over half-way there, chipping away and trying to to hit that 100k. But why £100,000? What’s so special about £100,000.

Let’s refer to one of the greatest investors of our time – Charlie Munger of Vanguard fame.

The first £100,000 is a b****

On getting to that milestone of $100,000 he said

It’s a b—-, but you gotta do it. I don’t care what you have to do — if it means walking everywhere and not eating anything that wasn’t purchased with a coupon, find a way to get your hands on $100,000.

Charlie Munger

Of course, it’s dollars in his quote, I just live in the land of the pound. Is £100,000 even that important… why not 90 or 95? I think that the £100k figure is a bit arbitrary. However, it is six figures instead of 5 and folks like round numbers! Once you hit a £10,000 marker you are into 5 figures and once you hit six figures, well that is a massive psychological boost.

Charlie Munger’s financial pedigree isn’t in doubt, but what he really understood was two things… what came after 100,000 and what had to come before it.

£100,000 – the endgame?

Let’s set this £100,000 right in the middle of our timeline.

Let’s look at the end goal first. With a stack of cash comes a stack of choices.

For sure, money can’t buy you happiness, but I very much believe it is a tool for opportunity. The more you have, the less effort you have to put in to get more of it and the more time you can spend doing what you want, rather than swapping your time for money. You might even imagine a scenario where you have so much money you can spend the day playing golf, taking a few more trips, or sitting on a beach with family.

When I think of having a good stash of money behind me, I immediately I think of things like compound interest and that particular route to passive income. More about that in a second.

But also, the more money you have the more choices you have of getting that money to work for you while you do something else.

It could be sitting in a bank earning interest, perhaps you could invest in stocks and shares, perhaps you could grow your own business, or outsource more of your work to buy back more time. These are generally things that’s aren’t feasible when you don’t have much money.

And that is why making enough money to hit £100,000 in the first place is so tough. You are starting from a position of nothing and from that point of view you typically have nothing to trade but your time for money. A job. You can’t have money in the bank to make you more money because you don’t have any. You can’t outsource bits of your business because the capital just isn’t there to support that move. You can’t play a tune on an air guitar.

With the cost of living the way it is these days, you can see why people never even get started in trying to grow their pot. Excuses are easily made when it just looks like too much. The finish line (if there even is one) is so far away, that people people just never get started.

It’s a issue of scaling

Take for example, someone has £1000 in the bank and they can earn 8% on that money. After a year they have made £80. Big whoop, eh? It’s not going to change your life.

But with £100,000 in the bank that same 8% is going to net you £8,000. If you are the sort to invest in an ISA, that’s tax free too.

Imagine hitting that £1,000,000 figure… that’s £80,000 a year. You’d never work again! But we are getting ahead of ourselves a bit here.

The point Mr Munger was making is that at £100,000 you hit your first milestone where the returns really start to make a difference. Nobody is saying hit £100,000 and stop, but rather it’s at this point where the scale of your operation can make a material difference on your life. Getting to that point is the tough part, but if you truly want to live a financially freer life, you’re going to have to do what’s necessary.

Make more money.

The first £100,000 is a brutal graft

The early days of investing are hard graft. You have to accept that for you to get to your first 100k, you are going to have to contribute the vast majority of that yourself. You just don’t have enough money to see significant investing returns in the early days. So you need to make more money. There are a few ways you might go about this. Changing job to get a pay increase is the obvious one. Start a side hustle is another popular shout.

Perhaps a youtube channel that in part talks about your journey with some helpful affiliate links for those thinking about investing?

It might just be you need to cut out your unnecessary expenses and lean towards a more frugal life-style. Likely your solution is going to be a mix of these things. Trim the less valuable aspects of your spending and invest as much as you can is the general idea.

Speed is essential for that first £100,000

The faster you can build your pot, the faster market forces can help you grow your wealth and the fewer contributions you will have to make yourself. Getting to that first £100,000 can be brutal and sacrificial and you should expect it to be so if you are serious about cracking this nut, but in the name of helping you see the big picture and the long term benefits lets looks at an example as to why the first £100,000 is the hardest and the next £100,000s get easier each time.

But the next £100,000 is easier

Imagine for a second you can invest £833 per month – that’s £10,000 a year. It’s not a small sum by any stretch but good for illustration with those nice round numbers again. Imagine a 7% return.

It’s going to take between 7 and 8 years to hit that first £100,000. The next £100k is going to arrive shortly after 12 cumulative years or just 5-6 years later. In fact it takes less time to go from 600k to £1M than it does to get to the the first £100,000.

This is assuming your rate stays the same and you don’t increase your own contributions.

And of that million, over 70% will come from accrued interest in the market, and less than 30% from your own pocket.

Staggering.

This is the power of compound interest.

| Year | Deposits & Withdrawals | Interest | Total Deposits & Withdrawals | Accrued Interest | Balance |

|---|---|---|---|---|---|

| 0 | $0.00 | – | $0.00 | – | $0.00 |

| 1 | $9,996.00 | $327.02 | $9,996.00 | $327.02 | $10,323.02 |

| 2 | $9,996.00 | $1,073.28 | $19,992.00 | $1,400.30 | $21,392.30 |

| 3 | $9,996.00 | $1,873.47 | $29,988.00 | $3,273.77 | $33,261.77 |

| 4 | $9,996.00 | $2,731.52 | $39,984.00 | $6,005.29 | $45,989.29 |

| 5 | $9,996.00 | $3,651.59 | $49,980.00 | $9,656.89 | $59,636.89 |

| 6 | $9,996.00 | $4,638.18 | $59,976.00 | $14,295.07 | $74,271.07 |

| 7 | $9,996.00 | $5,696.08 | $69,972.00 | $19,991.15 | $89,963.15 |

| 8 | $9,996.00 | $6,830.47 | $79,968.00 | $26,821.62 | $106,789.62 |

| 9 | $9,996.00 | $8,046.85 | $89,964.00 | $34,868.47 | $124,832.47 |

| 10 | $9,996.00 | $9,351.17 | $99,960.00 | $44,219.64 | $144,179.64 |

| 11 | $9,996.00 | $10,749.78 | $109,956.00 | $54,969.43 | $164,925.43 |

| 12 | $9,996.00 | $12,249.50 | $119,952.00 | $67,218.92 | $187,170.92 |

| 13 | $9,996.00 | $13,857.62 | $129,948.00 | $81,076.55 | $211,024.55 |

| 14 | $9,996.00 | $15,582.01 | $139,944.00 | $96,658.55 | $236,602.55 |

| 15 | $9,996.00 | $17,431.04 | $149,940.00 | $114,089.59 | $264,029.59 |

| 16 | $9,996.00 | $19,413.74 | $159,936.00 | $133,503.34 | $293,439.34 |

| 17 | $9,996.00 | $21,539.78 | $169,932.00 | $155,043.11 | $324,975.11 |

| 18 | $9,996.00 | $23,819.50 | $179,928.00 | $178,862.62 | $358,790.62 |

| 19 | $9,996.00 | $26,264.03 | $189,924.00 | $205,126.64 | $395,050.64 |

| 20 | $9,996.00 | $28,885.27 | $199,920.00 | $234,011.91 | $433,931.91 |

| 21 | $9,996.00 | $31,696.00 | $209,916.00 | $265,707.90 | $475,623.90 |

| 22 | $9,996.00 | $34,709.91 | $219,912.00 | $300,417.82 | $520,329.82 |

| 23 | $9,996.00 | $37,941.71 | $229,908.00 | $338,359.53 | $568,267.53 |

| 24 | $9,996.00 | $41,407.13 | $239,904.00 | $379,766.65 | $619,670.65 |

| 25 | $9,996.00 | $45,123.07 | $249,900.00 | $424,889.72 | $674,789.72 |

| 26 | $9,996.00 | $49,107.63 | $259,896.00 | $473,997.35 | $733,893.35 |

| 27 | $9,996.00 | $53,380.23 | $269,892.00 | $527,377.58 | $797,269.58 |

| 28 | $9,996.00 | $57,961.71 | $279,888.00 | $585,339.29 | $865,227.29 |

| 29 | $9,996.00 | $62,874.37 | $289,884.00 | $648,213.66 | $938,097.66 |

| 30 | $9,996.00 | $68,142.18 | $299,880.00 | $716,355.84 | $1,016,235.84 |

My route to £100,000

Personally I invest in low cost index funds and ETFs.

Stock picking isn’t for me.

I want something I can throw my money at come rain or shine and not have to think about it too much. Or at all, really. By investing this way, I free up my time to either put more effort into my side-hustles, learn new skills to try to increase my salary in the workplace or just spend my time doing what I want to do rather than sweating every investment decision.

I’m not there yet, but I will be soon.

If you want to see how I’m investing my money you need to watch this video next.