InvestEngine is a new investing option to me. I hadn’t heard of these guys until a few weeks ago, so I thought I’d sign up, have a look around and put together a quick review of their services and see if they are worth your time and energy… spoiler alert.. I think they are!

I’m going to go through a little bit about what they offer, a couple of the key sign up points, services they are offering that other investing apps perhaps aren’t and a couple of thoughts on where they might be coming up short depending on what it is you are looking for from your investing.

Not Sponsored!

Right away, I want to let you know this is not a sponsored video. I have a link below can use to sign up to get yourself £25, when you invest £100 of your own money which is pretty darn good compared to some of it’s competitors so if you get some value from what you read here or if you would like to support the creation of more content, I would very much appreciate that click

So landing on their website we see that InvestEngine are proclaiming “More power to your money, Smart investment portfolios that cost you less and give you more”.

For too long, the investment scene has been blighted by high fees, and complicated charges, tempered somewhat by the new breed of trading apps like T212 or FreeTrade, so any services that profess low costs to keep more of your own money in your pocket has got my attention.

We will come to fees in a minute, but let’s just see what they offer.

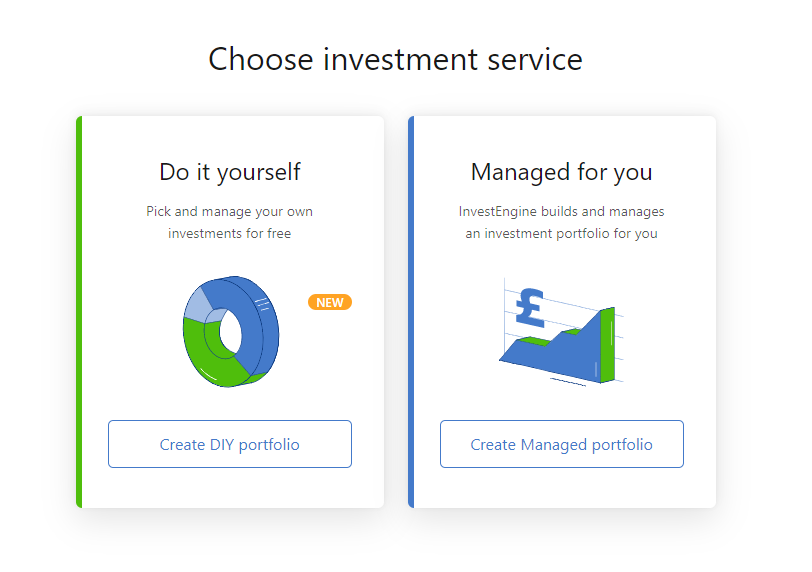

Two options in the main, build your own portfolio out from a choice of over 150 ETFs covering a range of stock markets, bonds, commodities and including ESG (very popular these days) and thematic choices and it won’t cost you a penny other than associated charges with the ETFs – not specific to Invest Engine’s platform, ETFs carry charges everywhere. Very cool. Going with this DIY option allows you to set your own weights – a bit like T212’s pies and comes with a nice one click rebalancing and other features to help you stay on top of your own investments.

Or you can have your portfolio managed for you, where you answer a few questions about what risk you want to take, and the nice people at IE will build a portfolio for you and look after the day to day running for just 0.25% per year.

By comparison, Vanguard’s very popular lifestrategy funds are around this sort of cost too at 0.22% or a little bit more. So the fees for the convenience of IE looking after your investments are very low. Lower fees, means more money in your pocket. Good stuff.

So we choose which we want. I had an explore with the self managing options and all the usual characters one might expect were in there. S&P 500 options from ishares. Vanguard ETFs and to be fair, lots of others I wasn’t really that familiar with. Someone who has a strong grasp of what they are looking for could play around in here for ages and have a great time.

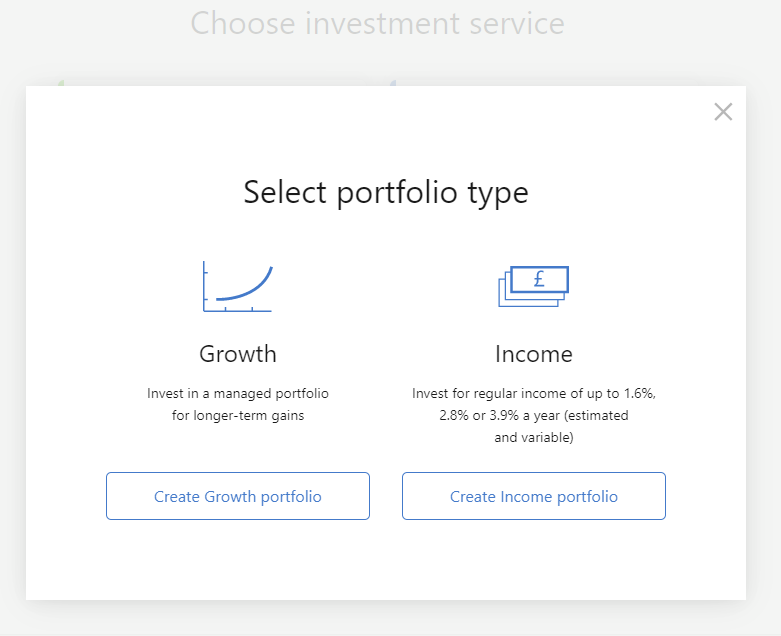

InvestEngine are professing easy managed accounts for a low cost, so that’s what I want to see. On choosing the managed option you can choose between two broad strokes of growth or income.

I understand what they are getting at here – their growth option is typically more volatile but with potential for higher returns over the long term, and they aim to have their income portfolios a bit more reliable and indeed offering fairly regular income paid to you directly.

So what do the portfolios look like?

I was interested in seeing what they were both like so I created two portfolios, one for growth and one for income. You can create as many portfolios as you want it seems although I haven’t been able to figure out how to remove any I don’t want. It’s not a big deal really, you aren’t obliged to fund them so you can play around with answering the discovery questions and see what kind of portfolios are created for you.

And that’s how IE tailor your portfolio for you… through a little questionnaire with various different questions about you as an investor. You can answer these how you like and I’ll come back to the kind of thing they are, but to be honest though, it’s best to answer the questions honestly I’d imagine – that way, you can help IE to help you by allowing them to match a portfolio to your risk and appetite for investing because remember when investing, nothing is guaranteed, you can make money and lose money, markets go up and down, so go in with your eyes open and understand your capital is at risk and if in doubt speak to a professional.

Like I say, give yourself the best chance for your investment to be successful by helping IE to set you up with a plan that suits your needs and investing personality.

So the questions were similar to what I have seen before, how much you plan to invest and how much of your income that is. What age you are, how long you want to invest and so on. They ask how you would feel about investing if the market dips and generally they are getting a feel for what your risk appetite is in a simple way, without all the jargon that is sometimes in abundance in this field.

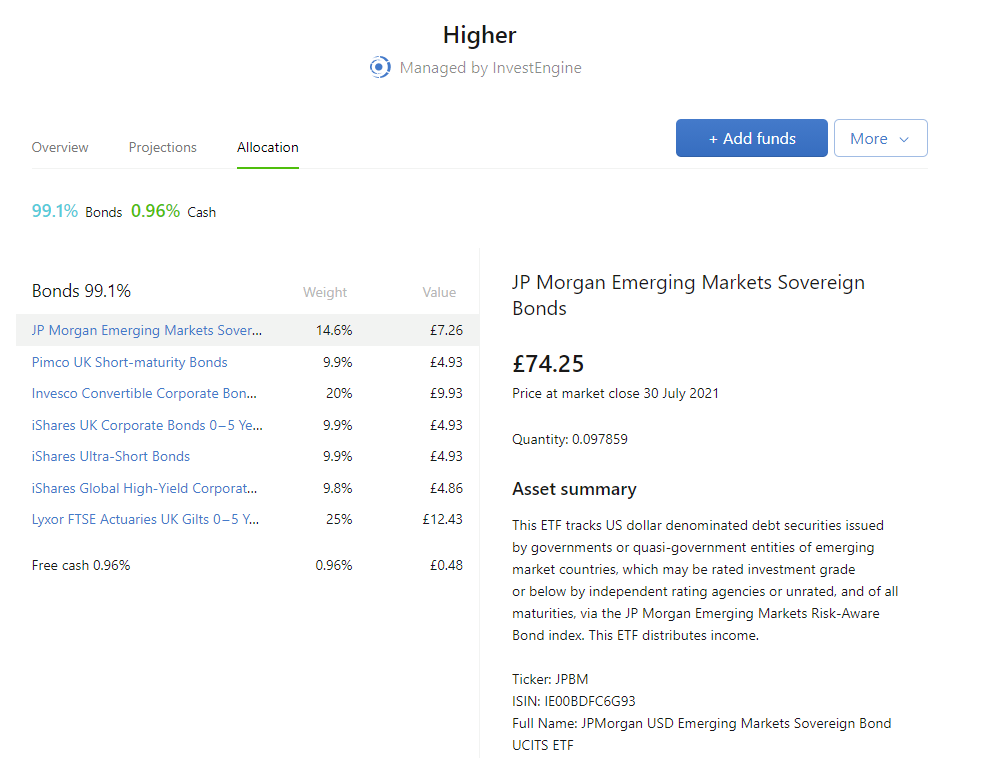

Income Portfolio

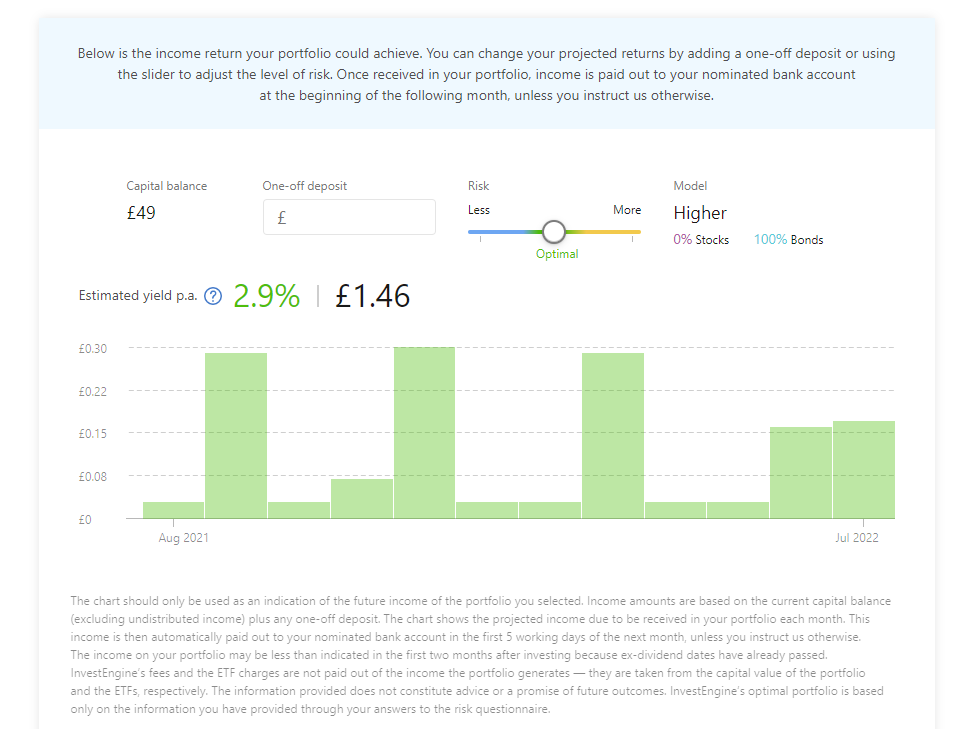

After choosing an income portfolio, at the end of the discovery (it only took a couple of minutes), and going through the questionnaire in just a minute or two, I was presented with this portfolio.

So it was entirely bonds, which I though was interesting returning an estimated 2.9% per year. It doesn’t seem particularly high, but then this is supposed to be a fairly stable option and to be honest, we are comfortably beating the high street savings rates here for a return.

Looking at the projections tab IE are giving you a best estimate as to how much money will be returned to you and when, so if you are the sort to enjoy planning and budgeting, (and let’s face it, who isn’t?!) then this will likely appeal to you.

Still in the projections tab you can change this recommendation by experimenting with the slider. Shifting it to the right for more risk, introduces 25% of stocks, which would hopefully yield a better return but as I say, carries more associated risk. If you decide you want to amend your risk at any time during your investing life you can just click that Apply button and your portfolio will be updated to reflect your new choice. It’s pretty cool that it’s so easy and yet the warning are still prominent. I really feel IE have hit a great balance here between usability and protecting people from getting carried away. It’s not often you see an investing/trading platform offer words of caution and it’s refreshing to see.

Growth Portfolio

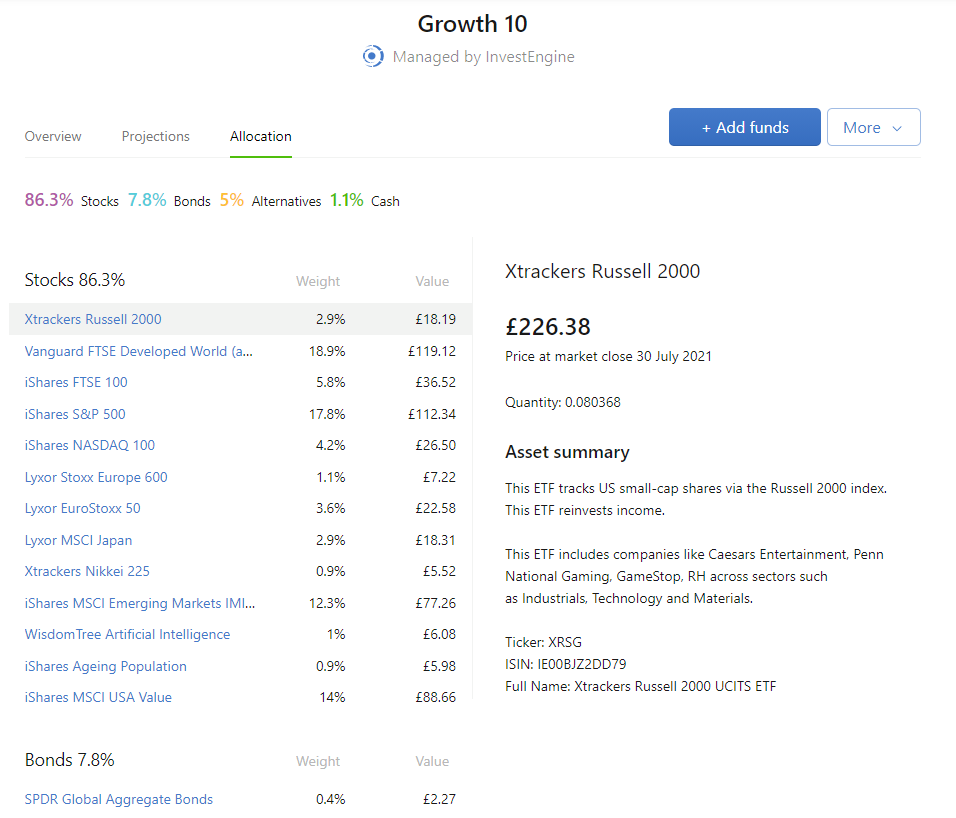

So I created myself a growth portfolio too and the process was just about the same, the questions were very similar to the income portfolio questions but this time the portfolio put together was almost entirely stocks with a small percentage allocated to bonds and only a couple of percent to gold and silver. So it was nice to see that the responses do matter and there are very different portfolios being put together depending on how you answer those questions.

Like the Income portfolio you can see the allocation and the stocks bought might well be some you recognise from other apps – things like S&P 500 and FTSE Developed World and so on. However in this projection tab we have a little calculator that aims to show how consistent investment and compounding might reward you over a particular period of time. So just playing with these sliders and the figures in the boxes you can see that investing as much as you can, for as long a period as you can could really send your portfolio parabolic in the final years. It’s all projections of course, nothing guaranteed at all, and I like they way they try to manage expectation with the colour-coded chart.

Fees?

So what about fees? How are IE paying for all this? Well, for a managed portfolio there is a 0.25% annual fee and the spread and costs of the ETFs that go into that portfolio. So on a £20,000 portfolio you’d expect to pay around £94/year. Peanuts really.

Of course, ETFs often carry their own variable charges and IE are up front about this where other platforms aren’t. Also there is a buy/sell spread to consider – again IE are very up front about this when others bury it and there are probably a lot of investors out there who don’t even consider it because it’s not front and centre. As a long term buy and hold type of guy in index funds and ETFs this doesn’t come into my thinking too much.

If you want to manage your own portfolio then there is no 0.25% annual fee.

No Other Fees!

There are no setup costs, no deposit fees, no withdrawal, or dealing fees and no extra charges for an ISA if you are so inclined. It remains to be seen if these prices or product offerings change over time, but all in all, a very very competitive package. Easy to use, well explained, and a superb FAQ section where you can read more about IE and have your questions answered make this one of the most user friendly platforms I’ve ever seen.

InvestEngine UK Limited is authorised and regulated by the Financial Conduct Authority FRN: 801128.

They take part in the FSCS scheme so investments are protected up up to £85k.

Couple this with an amazing sign up offer of £25 when you invest £100 and I really like what they are doing here. It’s easy to follow, no deposit and transaction fees make it easy to start investing with small amounts of money knowing your money won’t be eroded by fixed costs or crazy management fees.

Summary

I’m impressed. I’ll be watching their progress with interest, I’ll probably add some more money to play around with different portfolios and if there is anything else you’d like to see on Invest Engine or any questions you have leave a comment below. Don’t forget to leave a like if you got some value, don’t forget the link to get yourself £25 when you open an account and please consider subscribing to my YouTube channel if you found this useful.

Do you reckon further ETF’s will be added onto Invest Engine? I like the look of this app, but most of the ETF’s I currently invest in are not yet on IE, so am hesitant to make the switch over.

I can certainly try to find out for you.

I have a good relationship with the guys at InvestEngine – I’ll post back here with what they say.

Yes, indeed, they have plans to add more and more as time goes by.

What are you interested in, in particular?

Wow. Not sure how I missed this comment for so long.

Yes! After talking with the guys at InvestEngine, I understand that they will be adding more and more ETFs as time goes by.

About 60 new ETFs have been added to the InvestEngine list.

Pingback: InvestEngine vs Vanguard – Which is better value? - Pretty Penny